This week’s update, which is written by Bob Tannahill, is adapted from our ‘Higher Income Fund First Anniversary Letter’ article.

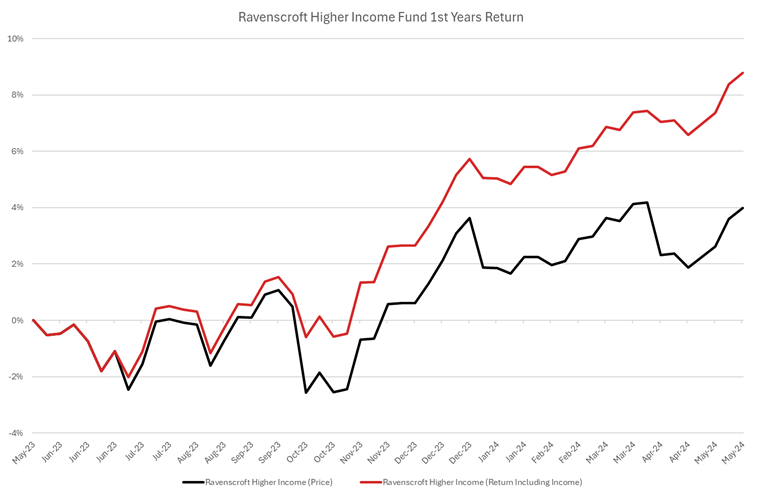

Last May we launched the Ravenscroft Higher Income Fund to allow investors to benefit from the significant value we saw in income assets following the turmoil in bond markets during 2022. We designed the Fund to capitalise on more than a decade’s worth of experience running the Ravenscroft Global Income Fund, combined with a broader mandate to help investors access the best income streams from the widest range of assets. As we arrive at the fund’s first birthday, we wanted to thank everyone who has entrusted us with their money and to report back on how the first year has gone. As you can see in the chart below the fund has returned 8.8% (including income and capital gains1) which we are very pleased with.

Source: Ravenscroft

This reflects what we had hoped to see when we launched the fund; that the higher levels of income on offer, as well as many bonds trading under their face value and hence offering capital gains, would combine to provide both income and growth. We are on track to have delivered our goal of around £6.002 of income by the end of June however this will have taken us a little longer than we had originally hoped, 14 months as opposed to 12. The reason for this is that the fund grew in size rapidly towards the end of last year and due to a quirk of the fund’s accounting this had the effect of converting some income into a capital gain. This therefore reduced the 2023 Q4 dividend to £1.10 from the fund’s average of around £1.50 per quarter. For the avoidance of doubt, there was no negative effect to the overall return received by investors. It was purely a change to how returns were delivered. Clearly meeting or surpassing the income target is our goal and we have therefore taken the proactive step of implementing additional processes to manage future flows. The good news is that this shortfall in income has pleasingly been more than offset by £3.99 of capital growth leading to the fund’s strong overall return in the first 12 months.

Within the fund, we only made one change during the year as most of the underlying assets behaved as we had expected. This change was to introduce an interesting new fund, Royal London’s Sterling Extra Yield Bond Fund, in exchange for a reduction in the two more volatile investment trust positions: The Renewables Infrastructure Group (“TRIG”) and Sequioa Economic Infrastructure Income (“SEQI”). This new addition increases the diversity in the portfolio and reduces the influence of the short-term volatility that these trusts can display on the fund overall. We have one more idea that is currently in the due diligence stages that might allow us to increase diversification within the equity component of the fund as well.

Looking forward, we remain positive regarding the outlook for the fund and its underlying investments. Equity valuations look reasonable with pockets of good value and on the bond side we still have attractive bond yields with the chance of gains. Given pricing today therefore, we should be able to again produce an income of around 6%, give or take, with the chance of some modest capital growth over the next few years if market conditions are steady.

So, once again we would like to say thank you to our investors for their support and if anyone is interested in finding out more about the fund please feel free to contact us.

To read the full Higher Income Fund First Anniversary Letter to Investors, click here.

- All returns are quoted in Sterling total return terms (including income and capital gains/losses) and run for the period 19/05/2023 to 19/05/2024 unless otherwise stated.

- Dividends and capital value changes are quoted for the O distribution class. The £5.60 figure includes an estimate of the 2024 Q2 dividend, £1.50, which is yet to be confirmed. Quoted share price is as at 19/05/2024. (GG00BM8NFK98)