Market dynamics have noticeably shifted in the first half of 2025 compared to last year. In 2024, global markets were largely driven by US exceptionalism - led most notably by the performance of the “Magnificent Seven” tech giants. This year, however, investor attention has begun to diversify, with capital flows moving into other regions, including Europe and, significantly, the UK.

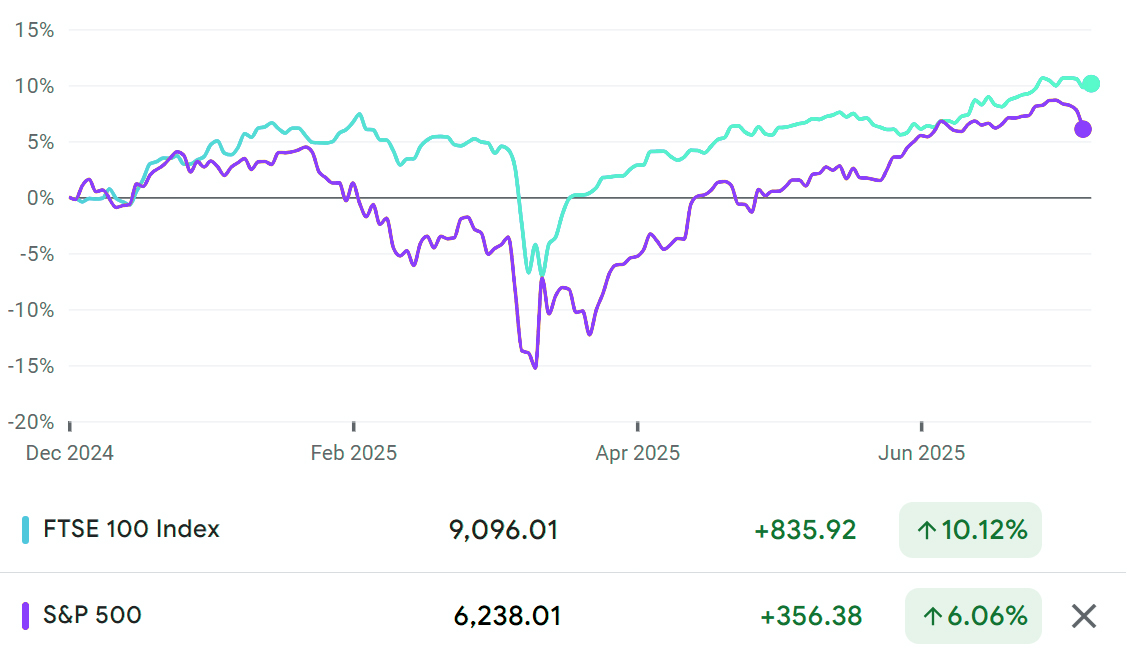

The UK market has stood out amid this changing landscape. The FTSE 100 reached all-time highs and delivered a 9.5% return in the first half of the year - its strongest start since 2021 and outperforming even the S&P 500 over the same period. It’s a remarkable turnaround for an index that, in recent years, has often been overlooked and struggled to keep pace with global peers in light of the lack of clarity in the domestic political arena and the UK’s standing post-Brexit.

It’s been a solid first half for the FTSE 100 in 2025, and to understand what’s driven this performance, it helps to look at the make-up of the index itself. The FTSE is heavily tilted towards value sectors like financials (~39%) and industrials (~17%), alongside energy and mining, which means it tends to behave more cyclically compared to the US market, where growth stocks, predominately technology (at 33%), dominate.

Over the year, this tilt has worked in the FTSE’s favour. With global markets facing uncertainty - thanks in no small part to President Trump’s new wave of tariffs - investors have been looking for stability and UK-listed companies have offered just that, with relatively cheap valuations and healthy dividend yields providing some much-needed reassurance. In our increasingly fractured world, being closer to home is an added benefit.

The UK’s position has also been strengthened by a series of supportive economic developments. Being one of the first countries to strike a trade deal with the US helped British companies avoid the brunt of new tariffs and gave the FTSE a competitive edge over other regions. On the interest rate front, the Bank of England made two cuts this year, bringing the base rate from 4.75% down to 4.25%. While rates are still high in historical terms, the move has supported banks, which continue to benefit from lending at elevated interest margins.

It hasn’t just been the UK macro environment leading to the rise, as there have been a number of stand-out stocks. Rolls-Royce, a FTSE100 stalwart first listed in 1987, was a standout performer, with profits jumping 50% thanks to strong demand for jet engines and AI data centre parts. Defence stocks also had a great run - helped along by Trump’s calls for allies to shoulder more of their own security. That shift has also benefited companies like BAE Systems, which is up an impressive 60% year-to-date, contributing an estimated 1.5 percentage points to the FTSE 100’s overall return.

In mid-March we made the decision to add the Vanguard FTSE 100 ETF at a 3% and 4% position respectively within our Balanced and Growth Funds as well as sterling and more capital growth-focused discretionary portfolios. Our primary reason for the inclusion was to increase overall portfolio diversification. Historically, our portfolios have had a bias towards the US, and an allocation to emerging markets, which was greater than that of the UK.

We view these changing dynamics – the general broadening of the market, heighted geopolitical tensions and growing preference for domestic investment – as a good opportunity to diversify both sectorially and geographically. Despite being a UK index, more than 80% of its revenues come from overseas, reflecting its composition of high-quality global businesses rather than UK-focused firms. The benefit of this global reach was evident throughout April and May, as even though the UK economy shrank slightly, the impact on the index was limited.