Q2 2025 Performance Summary

The second quarter of 2025 was anything but ordinary. It was largely defined by President Trump’s surprise Liberation Day tariff announcement on 2nd April, which reignited fears of deglobalisation and triggered a sharp selloff in sectors reliant on global trade - luxury goods, big pharma, and US tech giants among them. Yet markets rebounded strongly when Trump walked back some of his threat and investors rotated into companies seen as winners in a more inward-looking world - favouring AI and related industries, industrial automation, defence, and businesses with local or regional supply chains.

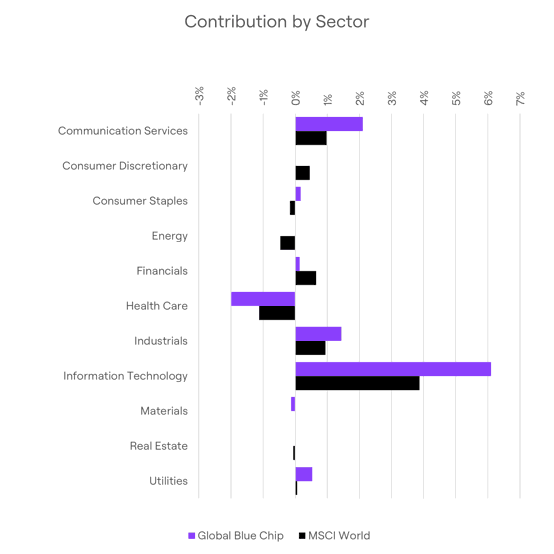

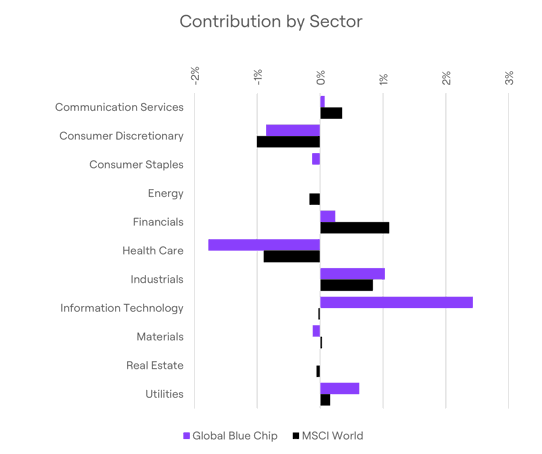

The MSCI World Index returned +4.6% in GBP terms, lifted by easing recession fears and a revival in risk appetite. Against this backdrop, the Global Blue Chip strategy delivered an impressive +8.8%. The outperformance was driven by strength in technology and industrial holdings, underpinned by portfolio repositioning that occurred towards the back half of Q1 and through much of April and May. The repositioning activity also removed laggards, especially in healthcare, which continue to lag because of political uncertainty. The lack of energy holdings also protected the portfolio against underperforming sectors.

On a year-to-date basis, the Global Blue Chip strategy settled the period a few basis points ahead of its benchmark thanks largely to the second quarter performance. Q2’s performance clawed back the slow start to the year and portfolio reorganising which took place during a negative market reaction following Nvidia’s impressive Q1 earnings beat and subsequent escalation as investors showed concern over the Trump administration’s ‘America First’ agenda in the lead up to Liberation Day. Reshuffling during the sell-off was painful, but ultimately the right decision, as we are now well positioned to take advantage of strong structural trends: fiscal loosening - as governments spend for growth, AI and AI related hardware and infrastructure;, rearmament – following NATO’s agreement to spend more on its capabilities reshoring – as businesses adjust to a fragmenting world, and e-commerce along with other cutting-edge trends shaping the world around us. It is unlikely the road ahead will be smooth, but the portfolio is full of quality businesses with a critical role to play across these investment themes. It feels right, and we’re pleased that most of the change is behind us with a positive outcome achieved.

Q2 2025 Performance Breakdown

Technology was the standout sector, with our holdings returning ~24.5% versus ~14.9% for the index’s tech component. Our concentrated positions in Nvidia, Broadcom, AMD, and Oracle drove nearly half of the strategy’s overall return. Nvidia maintained its market leadership in AI chips, while Broadcom surprised investors with 46% AI-related revenue growth. Oracle re-rated sharply after strong cloud infrastructure results. AMD, meanwhile, rallied into quarter-end following a positive investor day.

Industrials also contributed strongly. Newly added names like Siemens Atlas Copco, and Caterpillar, complemented existing holdings that continue to benefit from trends in infrastructure investment, factory automation, and geopolitical realignment. Communication services (notably Netflix) added value, as did a tactical position in a Eurozone ETF, which maintained market exposure, reducing cash drag, whilst certain non-US holdings were repositioned.

In contrast, the healthcare sector continued to drag on performance, and the strategy’s significant reduction over the period helped with relative returns. Other tailwinds included our zero exposure to energy – a laggard during the quarter – and low exposure to financials, which underperform due to macroeconomic and regulatory uncertainty.

Q2 2025 Top Contributors & Detractors to Performance

| Contributors | |

| Top 5 | Contribution to Return (%) |

| Broadcom Inc | 1.20% |

| Oracle Corp | 1.18% |

| Nvidia Corp | 1.08% |

| Netflix Inc | 0.85% |

| Advanced Micro Devices | 0.74% |

| Bottom 5 | Contribution to Return (%) |

| LVMH Moet Hennessy Louis Vui | -0.46% |

| Apple Inc | -0.39% |

| Johnson & Johnson | -0.34% |

| Sanofi | -0.28% |

| Regeneron Pharmaceuticals | -0.27% |

Table 1. Top and bottom 5 contributing holdings to performance between the period 31/03/2025-30/06/2025. Source: Bloomberg LP. Compiled by Titan Wealth CI 01/07/2025. All return in GBP terms.

Top Contributors:

- Broadcom (+1.2%): AI infrastructure and networking demand powered a sharp re-rating.

- Oracle (+1.2%): Strength in Oracle Cloud surprised the market and the stock reached multi-year highs.

- Nvidia (+1.08%): Earnings and guidance exceeded already-lofty expectations.

- Netflix (+0.85%): Strong execution and monetisation strategy reversed Q1 scepticism.

- AMD (+0.74%): Expectations building for credible AI alternatives to Nvidia.

Largest Detractors:

- LVMH (–0.46%): Sluggish Chinese luxury demand and trade friction prompted a full exit.

- Apple (–0.39%): The company’s presentation at the Worldwide Developers Conference (WWDC) underwhelmed; we sold the position over strategic concerns.

- Johnson & Johnson (–0.34%): Sector rotation and political risk pushed us to exit.

- Sanofi (–0.28%): A costly acquisition and trial miss undermined confidence.

- Regeneron (–0.27%): Exited following a poor run in drug trial performances.

2025 Year-to-Date Performance Breakdown

Our technology positions have had the greatest impact on returns during the year largely due to the timing of our increase in exposure and the focus on AI-related hardware and infrastructure. Industrial positions have also been strong contributors driven by a leaning towards automation. Utilities, where we executed a specific trade with the aim of benefiting from Germany’s fiscal pivot, proved very successful. The timing was fortunate as it coincided with a general gush of interest in Eurozone stocks as capital fled the US in response to Trump’s agenda. The intention, however, is to benefit from government-driven spending aimed at growth through rearmament and reindustrialisation-related infrastructure initiatives.

Discretionary holdings and healthcare were the clear laggards, continuing a trend from last year. We have spent much of the period reevaluating this area of the portfolio as we reposition into more compelling opportunities.

2025 Year-to-Date Top Contributors & Detractors to Performance

| Contributors | |

| Top 5 | Contribution to Return (%) |

| Netflix Inc | 0.86% |

| Advanced Micro Devices | 0.79% |

| Broadcom Inc | 0.72% |

| Nvidia Corp | 0.70% |

| Oracle Corp | 0.62% |

| Bottom 5 | Contribution to Return (%) |

| Bruker Corp | -1.02% |

| WPP Plc | -0.68% |

| LVMH Moet Hennessy Louis Vui | -0.66% |

| Regeneron Pharmaceuticals | -0.61% |

Table 2. Top and bottom 5 contributing holdings to performance between the period 31/12/2024-30/06/2025. Source: Bloomberg LP. Compiled by Titan Wealth CI 01/07/2025. All returns in GBP terms.

It is pleasing to see a handful of new additions during the period contribute meaningfully to the overall performance. We discussed what drove these stocks in the previous section. The laggards have all been cut as we removed the weaker-performing holdings during the period.

Whilst history rarely repeats, it often rhymes and despite the volatility we are seeing very similar trends unfold with technology and AI-related investments continuing their relentless charge higher as healthcare and consumer stocks continue their decline. One of our key takeaways from last year was to listen to the market as well as make decisions based on fundamentals. Being too early or too late can be a painful experience, irrespective of the quality and value proposition. As we always seek to improve what we do, we intend to listen more to what the market has to say, keeping a watchful eye on momentum will help and we discuss this more later in the investment insights section.

Q2 2025 Trades & Portfolio Reshaping

The quarter was defined by significant repositioning. We reduced healthcare sharply – from 18.8% at the start of the quarter to 11.4% at the end (please note, these are period averages and not exact end-to-end final weights). Adjusting for Haleon, which can be considered a consumer staple in some respects, we now have an underweight versus the index. Capital was put to work to fund investment across other themes.

Key Purchases:

Atlas Copco, Caterpillar, and Siemens added diversified exposure to industrial automation, and infrastructure spending.

MercadoLibre offers access to high-growth e-commerce and fintech trends in Latin America, an area that is currently underserved, combining scale with first mover advantage.

Unilever was reintroduced as a low-beta consumer staple to help increase defensiveness following our adjustments in healthcare. The company is well-positioned for growth in ASEAN (Association of Southeast Asian Nations), an area we are especially interested in.

Mosaic was bought as a targeted cyclical play on firming agricultural fundamentals and bottoming fertiliser prices. Management rebuilt the balance sheet and improved operating capability and efficiency during the last fertiliser boom, demonstrating prudent allocation of capital. Should agriculture prices firm further we would expect Mosaic’s cash flows to grow meaningfully.

HSBC Euro STOXX 50 ETF was introduced to maintain Eurozone exposure and FX balance while scouting stock-specific opportunities.

Thematic Additions – Defence & Cybersecurity:

We initiated positions in Raytheon, BAE Systems, Kongsberg Gruppen, and CrowdStrike to reflect our belief that global defence and cybersecurity spending is undergoing a secular shift. We discuss this in more detail in our Stock in Focus section of these insights.

Exits:

We exited several healthcare and tech names that either faced deteriorating fundamentals or offered limited upside.

Apple, as previously mentioned, was sold following an underwhelming WWDC and signs of strategic drift in AI.

Adobe was sold due to uncertainty surrounding its AI monetisation roadmap and the erosion of its moat in the creative software space.

LVMH was exited due to deteriorating sentiment in China and among middle-income consumers globally.

Sanofi, Regeneron, Alnylam, and Johnson & Johnson were sold to reduce healthcare exposure in light of drug pricing politics, poor M&A execution, or pipeline concerns.

Current Portfolio

Despite the volatility that characterised Q2 and the turnover with the strategy as we repositioned the portfolio in readiness for the opportunities ahead, the Global Blue Chip strategy exits Q2 with strong momentum. A portfolio breakdown of the model we operate from follows:

| Global Consumer | 28.00% | Ageing Demographics | 6.00% |

| eBay Inc. | 2.00% | Edwards Lifesciences Corporation | 2.00% |

| Amazon.com, Inc. | 3.00% | GSK plc | 2.50% |

| Mercado Libre | 2.25% | Eli Lilly and Company | 1.50% |

| Walt Disney Company | 2.25% | Technology & Innovation | 32.50% |

| Netflix, Inc. | 2.75% | Uber Technologies, Inc. | 2.00% |

| Airbnb, Inc. Class A | 2.50% | Meta Platforms Inc Class A | 3.00% |

| Heineken Holding N.V. | 2.50% | Alphabet Inc. Class C | 2.25% |

| Unilever PLC | 2.50% | PTC Inc. | 2.00% |

| Givaudan | 2.00% | Advanced Micro Devices, Inc. | 3.50% |

| Haleon PLC | 3.25% | ASML Holding NV | 2.00% |

| L'Oreal S.A. | 1.50% | Broadcom Inc. | 2.50% |

| Visa Inc. Class A | 1.50% | KLA Corporation | 2.50% |

| Changing World | 27.00% | NVIDIA Corporation | 3.50% |

| Rockwell Automation, Inc. | 2.00% | Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR | 2.75% |

| Honeywell International Inc. | 3.00% | Oracle Corporation | 3.00% |

| Siemans A.G. | 2.00% | Microsoft Corporation | 2.75% |

| BAE Systems Plc | 0.75% | CrowdStrike | 0.75% |

| Kongsberg Gruppen | 0.75% | EURO STOXX 50 ETF | 2.25% |

| L3Harris Technologies Inc | 3.00% | Cash | 4.25% |

| RTX Corp | 2.00% | ||

| JPMorgan Chase & Co. | 2.50% | ||

| Atlas CopCo SE | 1.50% | ||

| Caterpillar Inc. | 2.00% | ||

| Schneider Electric SE | 2.00% | ||

| E.ON SE | 2.00% | ||

| RWE AG | 2.00% | ||

| Mosaic | 1.50% |

Table 3. Global Blue Chip Model Portfolio holdings and weightings as at 30/06/2025. Source: Titan Wealth CI. Any difference between weightings displayed here and in data elsewhere is due to that data being representative of average weight over the period in question.

| Mkt Cap ($Bn) | Gross margin | Net income margin | ROCE | Net debt to direct equity | FCF Yield | P/E | |

| GBC | 487 | 49% | 12% | 19% | 46% | 3.5% | 21.4 |

| MSCI | 594 | 35% | 10% | 15% | 63% | 3.6% | 19.4 |

Table 4. Aggregate portfolio holding characteristics of certain financial ratios and valuations as at 30/06/2025. Source: Bloomberg LP. Compiled by Titan Wealth CI 01/07/2025.

With the raft of recent changes, we believe the portfolio is well positioned for the challenges or opportunities the second half of the year may bring.

Stock(s) in Focus: Defence

Deterrence in the 21st century is no longer confined to the size of one’s army, navy or nuclear strike capability. It is defined by the ability to see, sense and strike across vast domains, over land, sea and into space. Hostilities in Ukraine and the Middle East have highlighted the importance of effective surveillance, command and control (“C2”), and response capabilities, all under the umbrella of C5ISR[1]. Having the ability to achieve basic defence goals in the modern era requires persistent awareness, precision deterrence and technological superiority.

Rising geopolitical tension, especially between major powers like the US and China, is prompting a structural shift in defence priorities. NATO’s recent commitment to increase defence spending to 5% of GDP by 2035 (as discussed in a previous article ‘Pax Europaea’) reflects the urgent need to modernise military capabilities amid a rapidly changing threat landscape.

As such, we have chosen to invest across four companies – Raytheon, BAE Systems, Kongsberg Gruppen, and L3Harris Technologies – with concentrated exposure to the technologies central to modern deterrence: missile defence, C2 systems, cyber resilience, and space infrastructure. These firms were not selected because they are the only ones with relevant capabilities; there are other formidable defence contractors across both the public and private markets. Anduril (private), Lockheed Martin, Northrop Grumman, Thales, Leonardo, are but a few competent contractors with highly capable solutions. Our chosen focus companies stand out for their concentrated exposure to missile defence, C2 systems, cyber resilience, and space infrastructure – four important pillars to modern deterrence.

Raytheon, now under the RTX corporate umbrella, continues to be the nerve centre of the Western missile defence architecture. Its AMRAAM and Patriot systems have defined medium and high-altitude engagement standards for decades. But it is Raytheon’s deep integration into networked defence that truly sets it apart. Its role in the Integrated Battle Command System (IBCS) and the development of GhostEye radars are critical in enabling seamless detection and tracking of fast-moving, low-signature threats.

In Ukraine, Patriot batteries have proven essential in neutralising high-speed ballistic and cruise missile attacks. When Iran launched a retaliatory strike following the US bombing, its Fordow and Natanz nuclear facilities (Operation Midnight Hammer), it was Raytheon’s Patriot systems that intercepted the Iranian response defending the US Al Udeid air base in what is believed to be the single largest US missile defence engagement in history.

Yet Raytheon is not only a ground-based player. Its involvement in satellite sensors, missile-warning systems, and space-based ISR ensures that it is embedded at every layer of the kill chain (the term used to describe the sequence of events required to accurately detect, identify, track and eliminate a target). Whether enabling early warning of a missile strike in the Middle East, over Europe, or supporting US and NATO satellite constellations, Raytheon’s value is entrenched in both the terrestrial and orbital layers of the modern battlespace.

BAE Systems, Europe’s largest defence contractor, brings breadth and depth. Its C2 systems, radar platforms and electronic warfare solutions form the backbone of many NATO-aligned national defence capabilities. Its acquisition of Ball Aerospace has deepened its exposure to the rapidly expanding space domain, where it now supports missile warning satellites, electro-optical systems, and advanced antenna arrays. As militaries increasingly move toward space-based data fusion and C5ISR dominance, BAE sits at the fulcrum of this transition. Its cyber operations, while a smaller percentage of revenue, complement this by ensuring hardened networks and infrastructure – a necessary counterpart to any space-based asset. The company also holds a 37.5% stake in MBDA, the pan-European missile consortium it jointly owns with Airbus and Leonardo, which plays a vital role in supplying the European Sky Shield Initiative (“ESSI”) with relevant missile systems – such as the CAMM/IRIS‑T family.

Kongsberg Gruppen, a Norwegian defence contractor that punches above its weight. Its NASAMS system, co-developed with Raytheon, is becoming the preferred short-to-medium-range air defence system across NATO and ESSI participants. It is modular, interoperable, and affordable – a trinity that few air defence systems achieve. But Kongsberg is not merely a missile house. Its C2 capabilities, maritime strike systems (like the Naval Strike Missile), and space-related operations make it a critical node in Europe’s integrated deterrence structure. Through KSAT[2] and its other subsidiaries, Kongsberg manages satellite ground stations that support both civilian and military constellations. These assets are essential not only for communication but for maintaining the continuity of operations in a battlefield reliant on real-time geospatial intelligence.

L3Harris, an incumbent portfolio holding, may be less visible to the public, but among defence insiders it is widely recognised as a ‘force multiplier’ by improving communication, coordination, targeting and response time. After acquiring Aerojet Rocketdyne, L3Harris controls key propulsion technologies critical for both tactical missiles and strategic deterrents. But its main edge lies in its integrated mission systems, C2 frameworks and satellite payload technologies. L3Harris sensors sit aboard both military and civilian satellites. Its tactical communication systems link battlefield units to command centres. In modern swarm engagements or rapid-theatre deployments, these links can mean the difference between chaos and coordinated response. As the electromagnetic spectrum becomes a more contested domain, L3Harris’ edge in electronic warfare and spectrum dominance stands a good chance of growing in relevance.

Strategically, we also view our allocation through a geographic lens. Raytheon and L3Harris are US-based; BAE Systems and Kongsberg are European. This provides balance. Our broader thesis rests on reducing over-reliance on US suppliers, especially as Europe re-arms and demands domestic capability. NATO may be unified in mission, but procurement remains political with national bias. By tilting exposure toward European contractors that can scale into ESSI and other EU-led initiatives, we align with future budget flows.

Nowhere is this more urgent than in Europe, where the ESSI seeks to construct a continent-wide air and missile defence shield for willing participants to protect civilians and critical infrastructure. In this context, the need for NASAMS batteries, integrated C2, and radar systems that can filter saturation attacks is not optional. It is existential. Our chosen companies provide a great deal of the backbone of this architecture.

Simultaneously, the lessons from Ukraine’s innovative use of drones – from Operation Spiderweb to Ukraine’s fast evolving front line strategy – demonstrate that warfare is moving quickly. The ability to destroy massed infantry with loitering munitions or autonomous swarms is no longer science fiction. It is doctrine. Repelling these threats requires more than just steel; it demands a digital nervous system capable of instant feedback loops, electronic jamming, and kinetic response. All four companies provide components or entire systems that enable this new form of network-centric warfare.

Space, too, is a contested arena. Satellites are now targets, and their loss could cripple both military operations and civilian life. Navigation, communication, weather forecasting, even the stock markets – all depend on space-based infrastructure. L3Harris and BAE Systems are already designing and building resilient satellite networks, sensors capable of detecting anti-satellite launches and hardened ground stations. Kongsberg, through KSAT, controls key high-latitude ground assets vital for near-polar orbits, used extensively in both surveillance and weather monitoring. RTX, with its legacy of spaceborne sensor development, rounds out the orbital capabilities within the portfolio.

NATO member states recently agreed on what capabilities they will need to defend successfully against tomorrow’s threats. Whilst details are secret, we believe a sensible wager would be to own assets that vastly improve a military’s kill chain which naturally leads to greater drone and missile capabilities as well as technologies and software that bridge multiple domains. We expect these businesses to win their fair share of contracts and benefit. We do not believe this to be a cyclical upswing but a structural rearmament.

However, our thesis is not bulletproof. We recognise NATO commitments are just, well, commitments, and delivery can lag. Political shifts in Europe or the US could deprioritise defence or seek détente with adversaries. Populist movements may attack the legitimacy of defence spending. And defence tech is notoriously difficult to execute: cost overruns, programme cancellations and geopolitical upsets can derail even well-founded investments. We may also see disruptive entrants or classified breakthroughs that erode existing advantage.

Even with these risks, the strategic trajectory is clear. Preparing for confrontation in all domains: air, land, sea, cyber, and space, is forever evolving and in today’s world of AI the evolution is frighteningly quick. As doctrine evolves, defence budgets and procurement need to adjust accordingly.

Cybersecurity too is now a frontline issue in both military and civilian domains. For armed forces, it’s not just about protecting sensitive data - it’s about ensuring that missile systems, drones, radar, and satellite communications cannot be jammed, spoofed, or shut down in the middle of a conflict. A single breach can have devastating consequences. While our defence holdings are building cyber resilience into the platforms they sell to governments, a parallel industry is growing fast on the civilian side. Cyberattacks are all too common in the civilian domain: infrastructure, logistics, and even hospitals are high-value targets. Yet it is businesses that bear the brunt of a burgeoning cybercrime industry estimated to be worth in excess of $15 trillion by 2030. Whilst businesses respond to the fear of financial and reputational losses associated with a successful attack, there is a growing list of other considerations including mounting regulatory needs and insurance costs. Cyber defence is a high-growth industry.

CrowdStrike stands out in this space. Its Falcon platform is built for scale and speed, offering unified protection across endpoints, identities, cloud workloads and data. The company’s AI-native architecture enables real-time detection and rapid response, delivering automated containment before threats can spread. Importantly, CrowdStrike is not just reactive - it operates one of the most sophisticated adversary-tracking and threat-hunting programmes in the market, serving both enterprise and public sector clients. As regulatory scrutiny intensifies and corporate boards are forced to treat cybersecurity as a strategic risk, CrowdStrike’s role as a critical enabler of operational continuity is only expanding. This is a business positioned at the intersection of rising threat velocity, regulatory tailwinds, and enterprise dependency on digital infrastructure - a compelling long-term exposure to the digital defence economy.

In short, these companies aren’t cheap given recent news flow. Still, NATO commitments have staying power. Trump has pushed Europe to boost defence, and as long as Russia remains a threat, spending should rise substantially. We’ve allocated 0.75% to Kongsberg and BAE, and 2% to RTX, which trades at a discount to European peers. These sit alongside a 3% position in L3 Harris, taking defence exposure to 6.5%. If sentiment cools, we may trim L3 and increase European names. CrowdStrike enters at 0.75%, with plans to add on dips, but we intend to keep it a small position.

Investment Insights: Momentum

A momentum overlay

In our attempt to listen better to what the market is saying, we have recently added a momentum overlay to our investment process to potentially better time entries and exits with the aim of enhancing returns. To be clear, the core investment process (finding high-quality companies with solid balance sheets, growing global revenue streams and strong management teams at a reasonable price) is unchanged and remains at the foundation of everything we do. The momentum overlay is very much an additional process that occurs either once we have identified potential new investments that meet our core investment criteria, or as part of the ongoing monitoring of the portfolio. Essentially the role of the overlay is to help with the timing of purchases and exits, the weighting of individual positions and act as a trigger for further work.

Why momentum?

Momentum as an investment strategy usually focuses on buying stocks that are outperforming and selling or avoiding those that are underperforming.

The main idea behind the case for momentum is this:

When the market (or a stock) is moving up or down, it tends to keep going in that direction for a while – this is called the momentum phase. These uptrends (bull markets) or downtrends (bear markets) usually last longer than the short periods when the market is topping (called distribution) or bottoming (called accumulation). So, if you can spot a strong trend early, you can ride it for a long time and potentially make good returns before it reverses.

Momentum is usually compared to two other key investment styles, value and quality. Whilst each individual style (if applied consistently) will outperform the market over time, there is a wealth of academic and empirical evidence showing that a pure momentum strategy will significantly outperform either a pure value or a pure quality approach. This is both in terms of consistency (number of months or quarters of market outperformance) and actual returns, which should be hardly surprising, given that market uptrends and downtrends tend to be the most persistent market phases.

While it might be tempting to conclude that we should just focus on momentum, there are a number of other important considerations. First of all, momentum does not work all the time (e.g. market tops and market bottoms). Secondly, when momentum does change course, the reaction can be extremely volatile (think the dot-com crash in the early 2000s). Finally, and perhaps most importantly, is the fact that a combined momentum, quality and value approach has been shown to outperform any single style approach (including a pure momentum strategy) both in terms of consistency and the level of returns.

Keeping it simple

Our approach to momentum leverages the concept that a stock’s momentum phase will tend to last much longer than most investors expect, or as John Maynard Keynes famously said: "Markets can remain irrational longer than you can remain solvent”. In other words, our aim is to take advantage of market tailwinds to boost returns and avoid headwinds.

The simplest and most effective use of the momentum overlay is to avoid headwinds (AKA avoiding catching falling knives). In practice, this means that no matter how compelling our fundamental and valuation analysis is, we will not take a position in a stock if it is in a confirmed downtrend. When it comes to taking advantage of tailwinds, if after a period of sustained outperformance one of our stocks no longer meets our valuation criteria, we will not necessarily exit the position if it remains in a strong uptrend. That’s said, we may use the increasing valuation risk inherent in the position to reduce our weighting and take some profits.

Without trying to labour the point too much, it stands to reason that there will be many stocks with compelling momentum characteristics that we will not be invested in by virtue of the fact that they do not pass our fundamental quality and valuation hurdles.

It’s a relative game

Although we use the absolute price performance in assessing a stock’s momentum characteristics, we also look at the relative performance versus the market and the sector. Relative performance is an important indicator as stock trends are often much clearer on a relative chart. Also, to outperform the market our stocks, by definition, need to be in a relative uptrend.

Momentum in action

Broadcom is a good example of how we are using momentum. The company has been a serial value compounder, using acquisitions to drive revenue growth, margin expansion and free cash flow generation. Furthermore, Broadcom has become a key player in AI infrastructure, helping hyperscalers like Amazon develop in-house bespoke semiconductor chips for their AI servers.

From a momentum perspective despite being up eightfold over the last five years the shares remain in a long-term uptrend and above all the moving average levels both on an absolute basis and relative to the technology sector and the market (S&P 500). However, the extended nature of the charts relative to the moving averages could act as a catalyst for a review of the position size. Any Position size review would obviously take into account fundamental and valuation analysis.

Sources:

[1] C5ISR stands for Command, Control, Communications, Computers, Cyber, Intelligence, Surveillance, and Reconnaissance. It's a military term referring to the systems and processes used to gather, process, and disseminate information for effective decision-making and operations, particularly in modern warfare. Essentially, it's an evolution of C4ISR, adding "Cyber" to encompass the growing importance of cyber warfare and defense.

[2] Kongsberg Satellite Services specialises in satellite ground station services