Taking a leaf out of Mark Bousfield’s book, I thought I’d go down a musical avenue and title my article after the 1981 Clash hit ‘Should I Stay or Should I Go’ – a nod to the question many investors inevitably face: should I still be invested?

The difficulty of market timing

The old adage ‘time in the market beats timing the market’ has become relevant again amid this year’s heightened market volatility. Noisy headlines have become the norm with new narratives weekly – be it Trump’s tariffs and their potential implications for inflation, shifts in central bank policy, economic forecasts or rising geopolitical tensions. Against this backdrop, it’s natural for some investors to hesitate, waiting for the ‘perfect moment’ to invest. This often means attempting to maximise gains by buying at market lows and selling at market highs or perhaps even moving to cash in a bid to sidestep an anticipated downturn.

Whilst making adjustments to a portfolio can be prudent, consistently ‘timing the market’ – even for seasoned investment professionals – is exceedingly difficult and risky. Successful market timing hinges on getting two investment decisions exactly right: when to exit (before prices fall) and when to jump back in (before prices rise). Misjudging either can lead to significant and irreversible losses. Short-term market movements are unpredictable and driven as much by sentiment and headline risk as by the underlying fundamentals; it’s close to impossible to reliably forecast these movements. Counterintuitively, some of the best days in the market have historically happened during bear markets and missing out on those big days can have significant implications on portfolio growth.

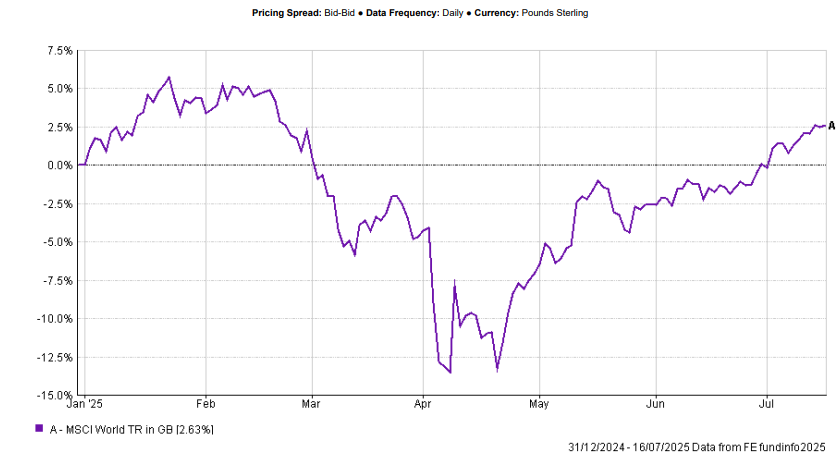

Consider what happened to the MSCI World Index in April, following Trump’s announcement of widespread tariffs on all countries not subject to other sanctions – the index tumbled 9.8% in just four days, down 13.5% (in GBP terms) for the year. Investors who left the market to avoid further losses or had perhaps been waiting on the sidelines for a better picture would have missed a sharp 6.5% rebound the very next day. Since that trough in April, the MSCI World Index has surged 18.7% at the time of writing, once again entering positive territory for the year (although this is still behind our Blue Chip strategy). This is a great example not only of how some of the best days in global markets can occur during market downturns, when sentiment is at its lowest, but also how challenging it can be to predict what markets are going to do over the short term and predict the best time to invest.

Sitting on your hands

Sometimes the best course of action is simply to do nothing at all; worry can cause investors to buy at market highs and sell at market lows, making successful long-term outcomes that much more challenging to achieve. After all, it’s human to want to invest into a rising market and sell out of a falling market. Whilst market volatility is both unnerving and distracting, it is important to remember it’s an inevitable part of the investment journey and can also create opportunities. History shows that patient investors, who remain committed throughout the market cycle, are rewarded as recovery in markets is not a question of ‘if’ but ‘when’.

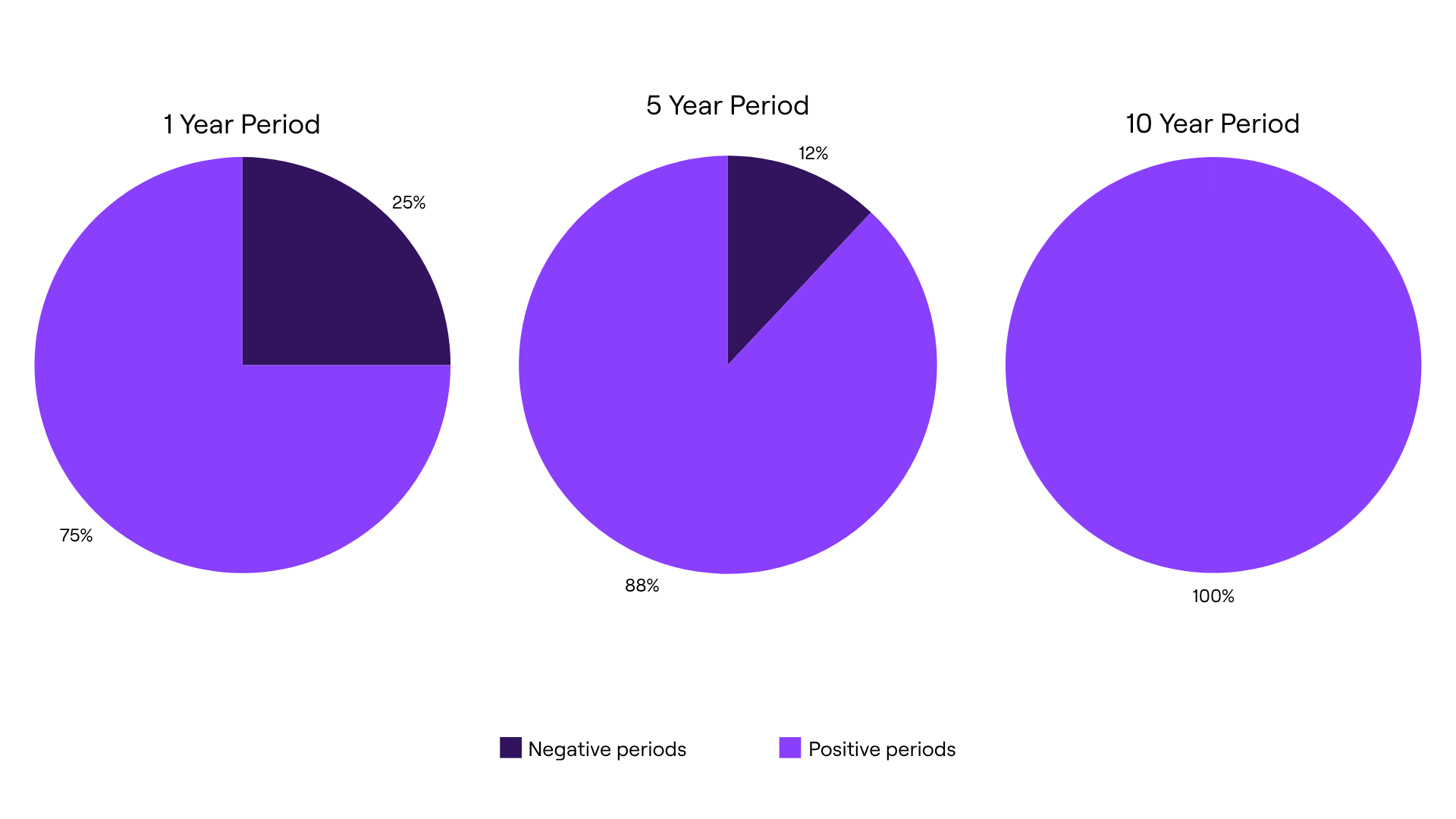

The historical performance of the MSCI World Index highlights the importance of being patient and maintaining perspective. Since its official launch in 1986, the index has delivered both positive and negative annual returns, with roughly a quarter of one-year periods ending in the red. While past performance does not guarantee future returns, the data reveals a compelling pattern. The longer investors hold their positions, the less likely they are to experience a negative return. Extending the investment horizon by another four years roughly halves the chances of incurring a loss, whilst every 10-year period – including major crises like the 2008 global financial crisis, the 2001 Dot-com bubble, and the 1997 Asian Financial Crisis – has delivered positive results. This underscores a crucial principle: staying invested is key to long-term investment success.

Investors who can ‘sit on their hands’ and resist reacting to the markets’ ups and downs are more likely to overcome short-term setbacks, as well as harness a benefit that goes hand in hand with longer investing: the power of compounding. This is the concept where the interest earned on an investment is reinvested, increasing the principal, so that future interest is calculated on the new, larger amount. The longer the investment period, the more significant this impact of compounding becomes as interest has more time to accumulate and generate additional returns. Investing early allows your money more time to grow and potentially lead to larger returns than starting later.

Successful investing isn’t about having a crystal ball; it’s about remaining focused on your long-term investment goals and having the patience to stick with it. By committing to a well-diversified, risk-aware portfolio and giving it the time it needs to grow, investors give themselves the best chance of long-term success — not through perfect timing, but through time itself.

If you would like to discuss any of our investment options, please do not hesitate to get in touch with a member of the team.