Q3 2025 Performance Summary

Welcome to this quarter's insights, where we will review our performance over the period and year-to-date. It has been an eventful year, markets are moving quickly and a lot has happened within the strategy. We intend to spend a bit of time explaining the changes and the opportunities we see unfolding as well as our customary Stock in Focus. Beginning next quarter we will cover the year-to-date drivers at a stock and theme level, offering a differentiated discussion on how your money is being invested.

The MSCI World Index delivered a strong quarter, returning 9.29% in GBP terms, as equities continued to grind higher through what is typically a quieter, less liquid period in markets. The Global Blue Chip strategy gained 9.93%, outperforming the benchmark by 0.64%.

The third quarter of 2025 saw markets defy expectations. Despite persistent anxiety over US trade policy and its implications for inflation, growth and interest rates, equities rallied as disbelief became the fuel. Traders and algorithms reacted to every economic and corporate release with choppy, often volatile, price action, while discretionary investors - frustrated by the lack of clear signals - found themselves underexposed and forced to chase performance. Meanwhile, commodity trading advisors (“CTAs”) and other rules-based momentum strategies were programmatically buying every dip, amplifying the upside.

This systematic flow has been a major driver of returns since Liberation Day. While the AI investment boom dominated headlines, the breadth of participation across sectors pointed to a more resilient and broad-based rally, underpinned by stronger-than-expected GDP data and robust corporate earnings. Through July and August, Global Blue Chip’s earnings scorecard had a look of respectability about it, with some 80% of holdings beating revenue estimates, >65% beating on earnings per share (“EPS”), and 70% receiving earnings upgrades from analysts. With that said, we still incurred some of that trademark volatility – see the period of underperformance in the chart during earnings season (from mid-July to the end of August) largely driven by a ‘sell the fact’ reaction to what were, on the whole, very good earnings results.

Q3 2025 Performance Breakdown

Last quarter we wrote:

“Despite the volatility that characterised Q2 and the turnover within the strategy as we repositioned the portfolio in readiness for the opportunities ahead, the Global Blue Chip strategy exits Q2 with strong momentum.”

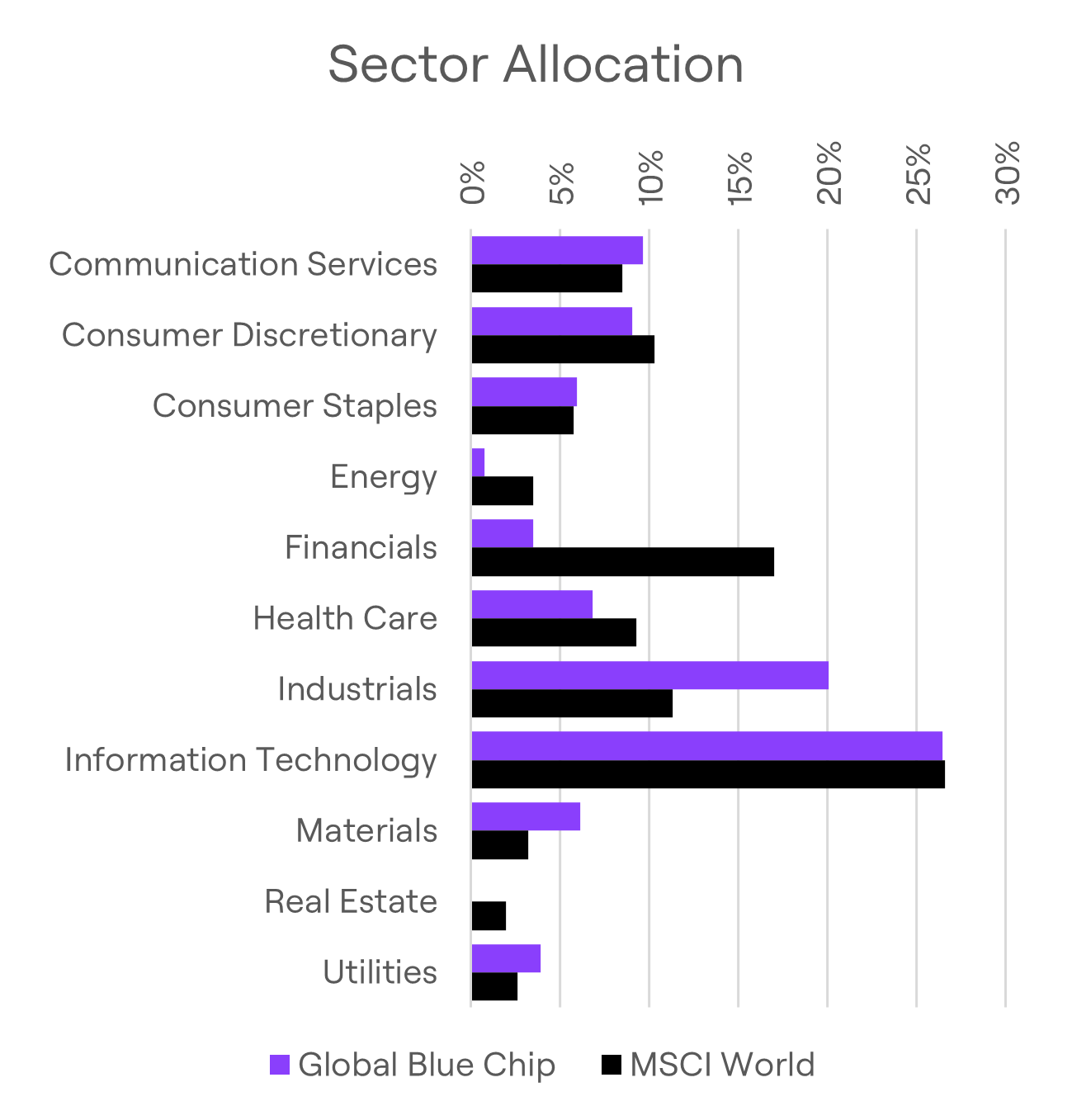

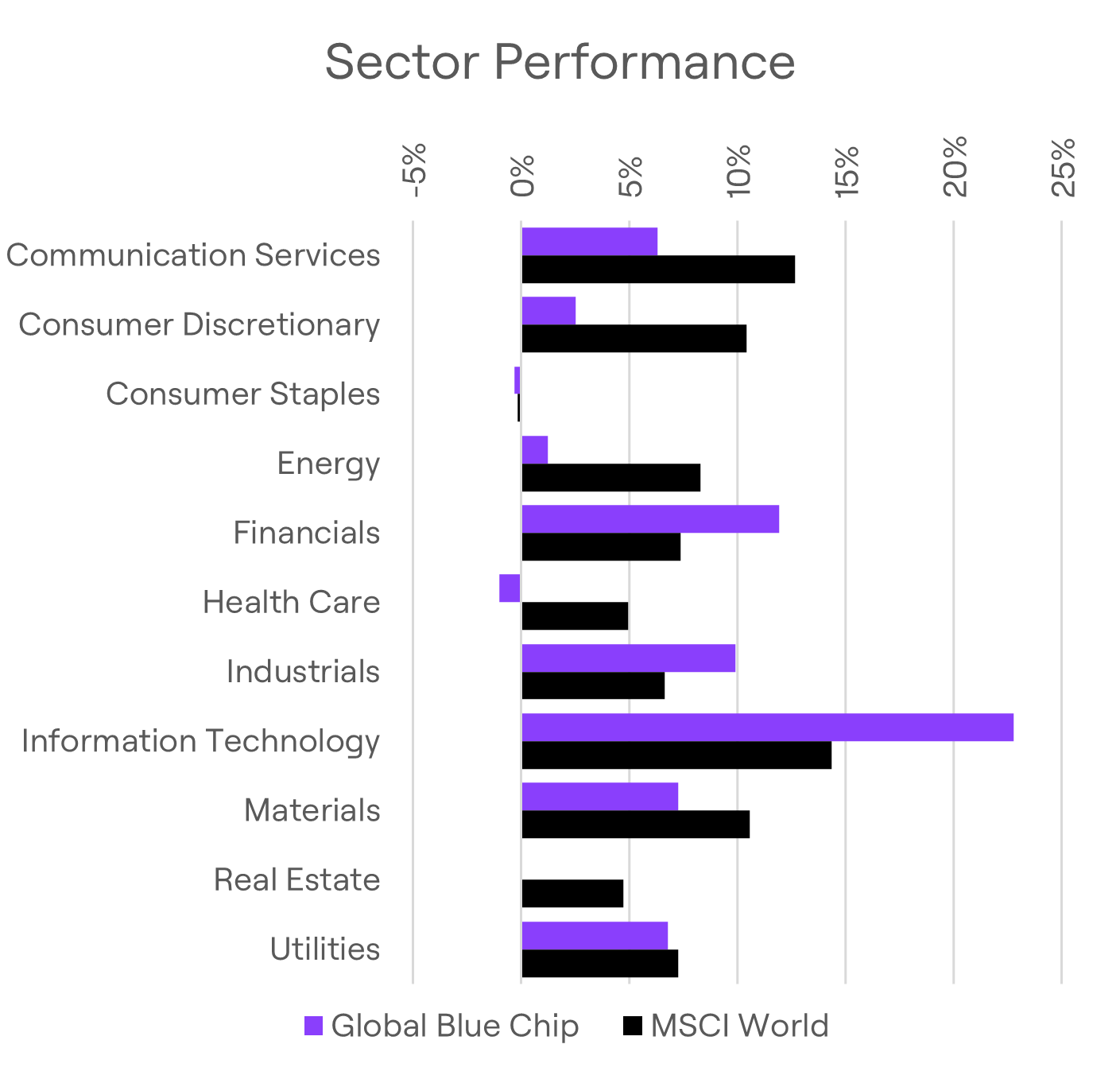

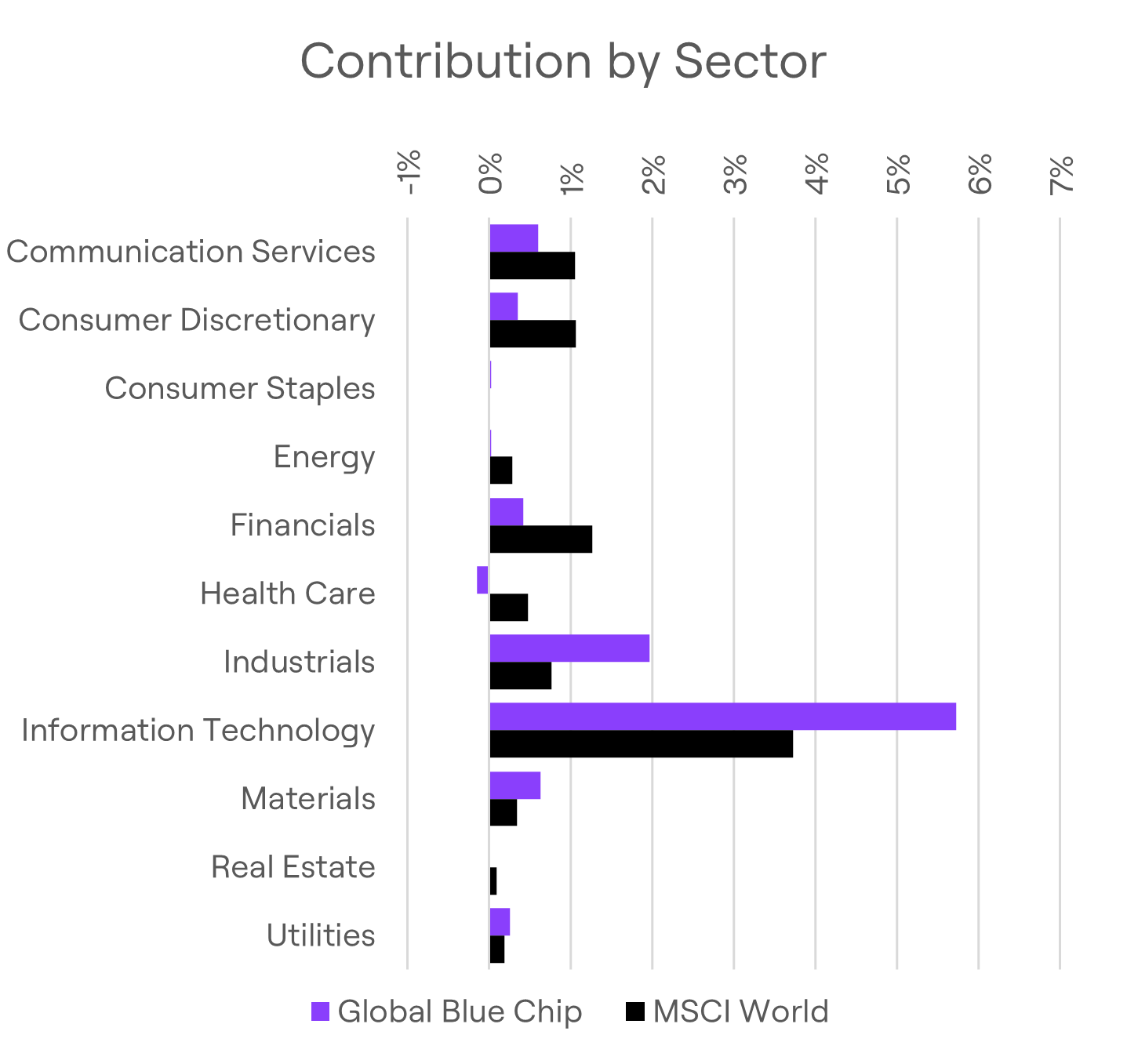

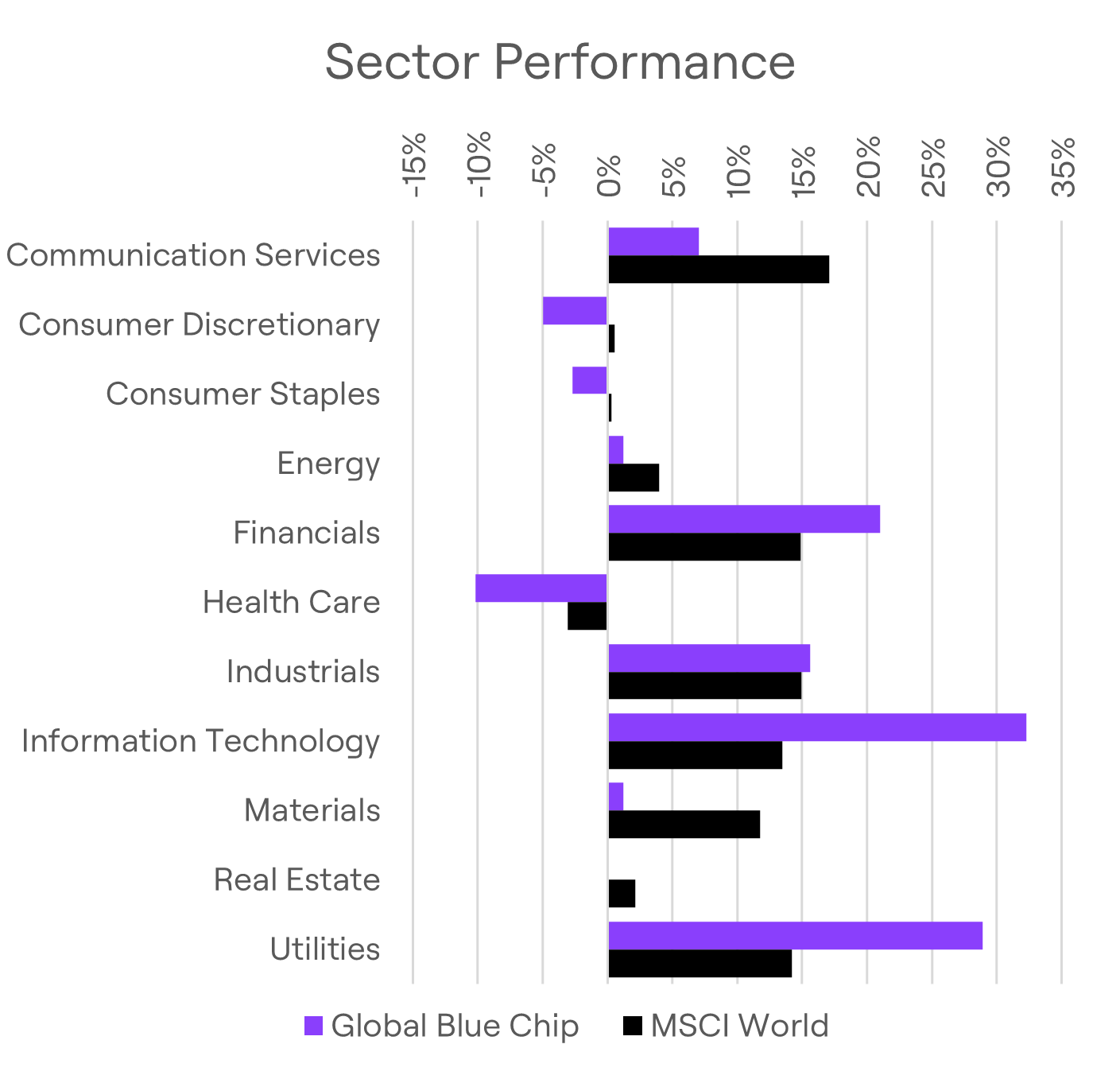

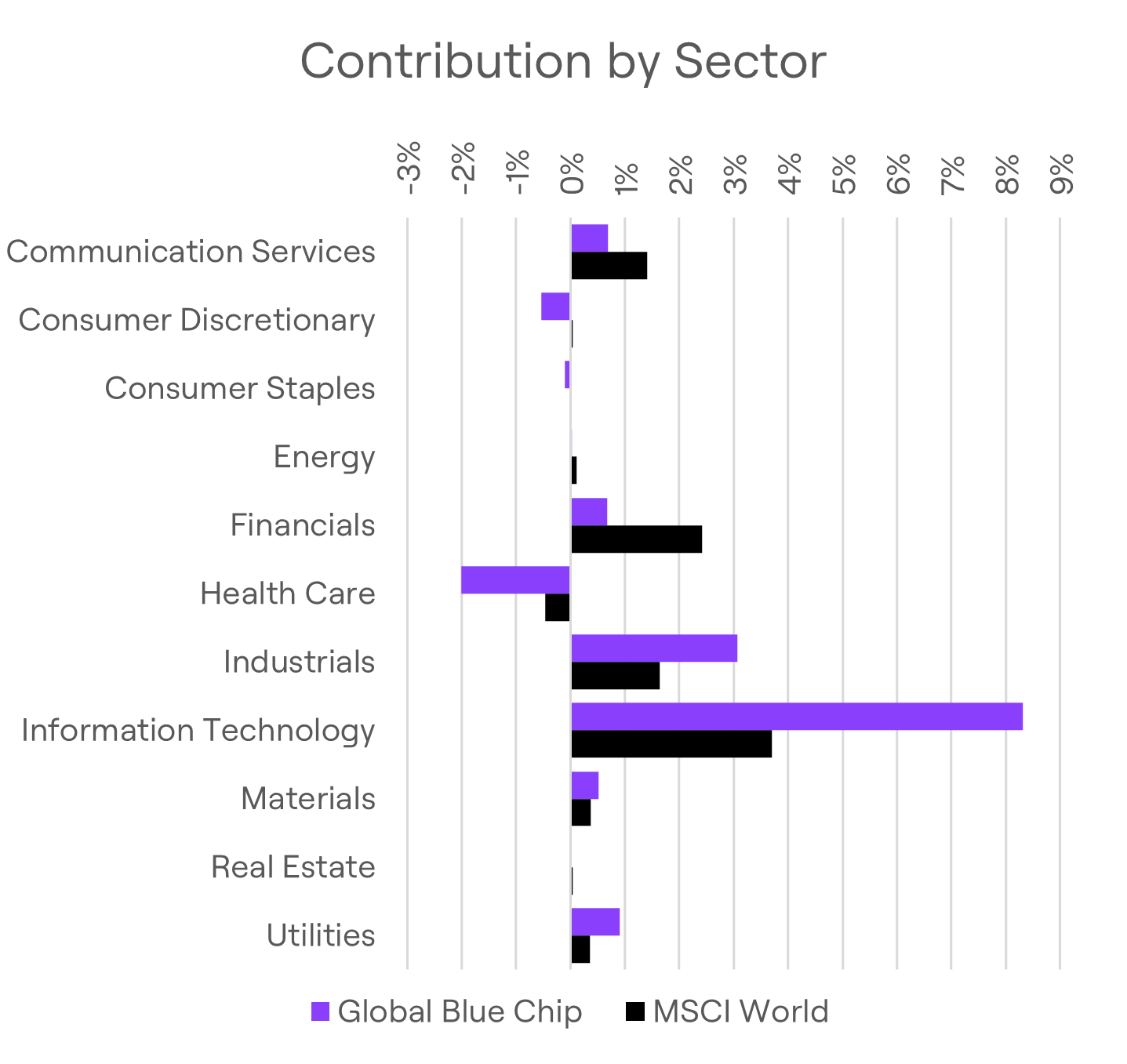

That momentum certainly continued into Q3 despite a ‘buy the rumour, sell the fact’ outcome for a number of holdings during earnings. The quarter’s gains were driven by investments in AI infrastructure, defence, and capital goods. Financials also performed strongly, led by JP Morgan and our new holding, Interactive Brokers. Sector allocation favouring Industrials, Materials, and Utilities added further value, while Healthcare continued to lag, as expected in a late-cycle bull market.

There are tentative signs of a recovery in healthcare as sentiment appears to be thawing following a steady drip of positive news flow on individual companies striking deals with the Trump administration on tariffs. A return to more normal market behaviour (i.e. offering a safe harbour during stormy conditions) would see us allocate more to this area of the market, as valuations also look very compelling.

Our AI-related holdings were the top contributors to performance. Oracle’s revelation of a $300bn order from OpenAI for 10GW of compute capacity over a five-year period starting in late 2026 surprised investors, propelling shares higher, adding 100bps to performance and turning Blue Chip’s relative performance fortunes around. Volatility, for once, worked in our favour! Nvidia followed with several major collaborations, including a $100bn investment in OpenAI to develop 10GW of compute infrastructure with the first GW expected to be delivered in H2 2026.

The number of deals OpenAI announced during the quarter for chips and compute certainly gave the AI complex a much-needed injection of enthusiasm after momentum had clearly stalled post earnings. The circular nature of the deal making – Nvidia invests in OpenAI who buys stuff off Nvidia, and the lack of detail on how such deals would be funded – kept the bears active despite the pain they must have been suffering if they were actively shorting AI infrastructure-related stocks. Markets can remain irrational longer than individuals can remain solvent, and when generous liquidity conditions meet a bullish narrative, the market is rarely ready to sniff out answers to such questions. When seeking exits and entries, timing is important but difficult and a strategy that enables you to scale in and scale out to protect profits and maximise returns is the most effective approach, especially when a party is in full swing. Given how good the party has been, now may be a good time to start executing a strategy that consolidates our AI exposure and reallocates capital towards ideas in other areas of the market. This is something we will do as Q4 unfolds.

Defence stocks rallied after it was reported Russian military aircraft violated NATO airspace, escalating regional security tensions and underscoring Europe’s need to strengthen its deterrence posture through credible military capabilities. Our defence investment case is based on a desire to ‘get in the way’ of sustained spending from durable sources and our trigger was NATO members’ promise to commit to an increase in defence spending up to 5% of GDP. There remains healthy scepticism over whether Europe’s members will actually follow through with this promise due to budgetary pressures. Peace agreements would, in our opinion, be bearish for sentiment towards the sector in the short-term and we may well revise our stance in the context of opportunities present within the broader portfolio.

However, we are learning that peace may be elusive. If Trump is so keen to broker peace in Europe and Gaza, why is he so happy to start new conflicts closer to home? Some speculate the build-up of military hardware and activity in and around Venezuela is more to do with regime change than it is about stopping the drug cartels and halting the flow of drugs entering the US. The nature of the situation is complicated and not always what it is portrayed to be. Opportunities for peace in Gaza and Ukraine have come and gone, and may well come back, but it wouldn’t surprise us to hear that it links with events in Venezuela and other areas around the world. There’s an ongoing struggle between the world’s superpowers and these conflicts are symptoms of it. During times of conflict the first casualty is the truth. Obtaining views on major events from all sides is a good exercise to get different perspectives. Every nation has its reasons for representing its version of events, especially on contentious matters. Through a lens clouded by the fog of war, we warily hold onto our defence positions knowing there is equal chance of extension and escalation, as there is of workable peace agreements and the prospect of ‘peak war’.

Financials also contributed meaningfully. Interactive Brokers, an online execution-only platform, introduced under our “Changing World” theme, offers a tech-native model that efficiently disintermediates traditional financial services. The company demonstrated good growth over the quarter although shares did rock a bit on the news that the firm was offering ‘free’ commission trading to capture market share in Singapore. JP Morgan, widely regarded as the best-run US bank, demonstrated growth across all divisions during its Q2 earnings. The bank, under the stewardship of Jamie Dimon is investing in AI and blockchain initiatives to enhance margins and capture new growth opportunities, including a potential client-facing crypto-collateral lending programme and the upcoming JPMD – a deposit token built on Coinbase’s Base network that the bank’s clients can use to send money around the world instantly.

Q3 2025 Top Contributors & Detractors to Performance

| Contributors | |

| Top 5 | Contribution to Return (%) |

| Alphabet Inc-CL C | 0.92% |

| Oracle Corp | 0.90% |

| AngloGold Ashanti PLC | 0.69% |

| Nvidia Corp | 0.68% |

| L3Harris Technologies Inc | 0.65% |

| Bottom 5 | Contribution to Return (%) |

| Haleon | -0.29% |

| Netflix Inc | -0.24% |

| Givaudan-Reg | -0.23% |

| Mercado Libre Inc | -0.23% |

| Honeywell International Inc | -0.22% |

Table 1. Top and bottom 5 contributing holdings to performance between the period 30/06/2025-30/09/2025. Source: Bloomberg LP and Titan Wealth CI. Compiled by Titan Wealth CI 01/10/2025. All return in GBP terms.

Unsurprisingly, three of the top five quarterly contributors were AI-related: Alphabet, Nvidia and Oracle. Alphabet led the pack after the US Supreme Court allowed it to retain its Chrome browser and continue its lucrative default search deals with companies like Apple, which the Department of Justice had sought to break up. The company is also expected to possess the top performing Large Language Model by year-end 2025, according to Polymarket – an online marketplace where customers can wager on real-world outcomes. At the time of writing, the odds stood at 72%.

Among the detractors, Haleon continued to struggle with inventory issues in its North American business unit as customers down traded to white labelled goods, incurring a number of broker downgrades. Givaudan and Honeywell saw margin pressure, and Netflix paused after a strong Q2 run, while Mercado Libre weakened amid Argentina’s financial turmoil. Nonetheless, we remain constructive on Netflix (advertising upside) and Mercado Libre, which remains the dominant e-commerce and fintech platform in Latin America. These platforms are rapidly becoming our preferred way to access the consumer growth opportunities within developing markets.

Q3 2025 Trades & Portfolio Reshaping

We continued to refine the portfolio through Q3, building exposure to our “Changing World” theme while trimming underperformers and managing position concentration.

In Technology, we added Arista Networks and Synopsys to deepen exposure to AI infrastructure and semiconductor design software, funded by trimming winners back to weight and exiting PTC after valuation risk rose on the back of takeover speculation.

In Global Consumer, we exited weaker performing holdings Haleon, Heineken, Givaudan and Airbnb, reallocating capital to high-growth e-commerce platforms Mercado Libre (Latin America) and Sea Limited (ASEAN). These businesses continue to expand their ecosystems through logistics and fintech, effectively building the “Amazon” of their regions and unlocking enormous long-term potential.

In Healthcare, we added AbbVie – a high-quality pharma business possessing a robust portfolio of drugs with minimal loss-of-exclusivity risk through the rest of this decade - and UnitedHealth Group, a high-quality franchise with improving fundamentals that we consider considerably undervalued. We exited GSK following FDA setbacks.

To strengthen our position in Natural Resources, we initiated positions in AngloGold Ashanti, Glencore and ExxonMobil, adding exposure to gold, industrial metals, oil and natural gas. These holdings align with our broader view that fiscal expansion and infrastructure investment will fuel the next phase of global growth. To fund these, we exited Rockwell Automation and Atlas Copco.

Finally, we introduced the KraneShares CSI China Internet ETF to capture renewed opportunity in China’s technology sector - a decision we explore in depth below.

Year-to-Date Performance Summary

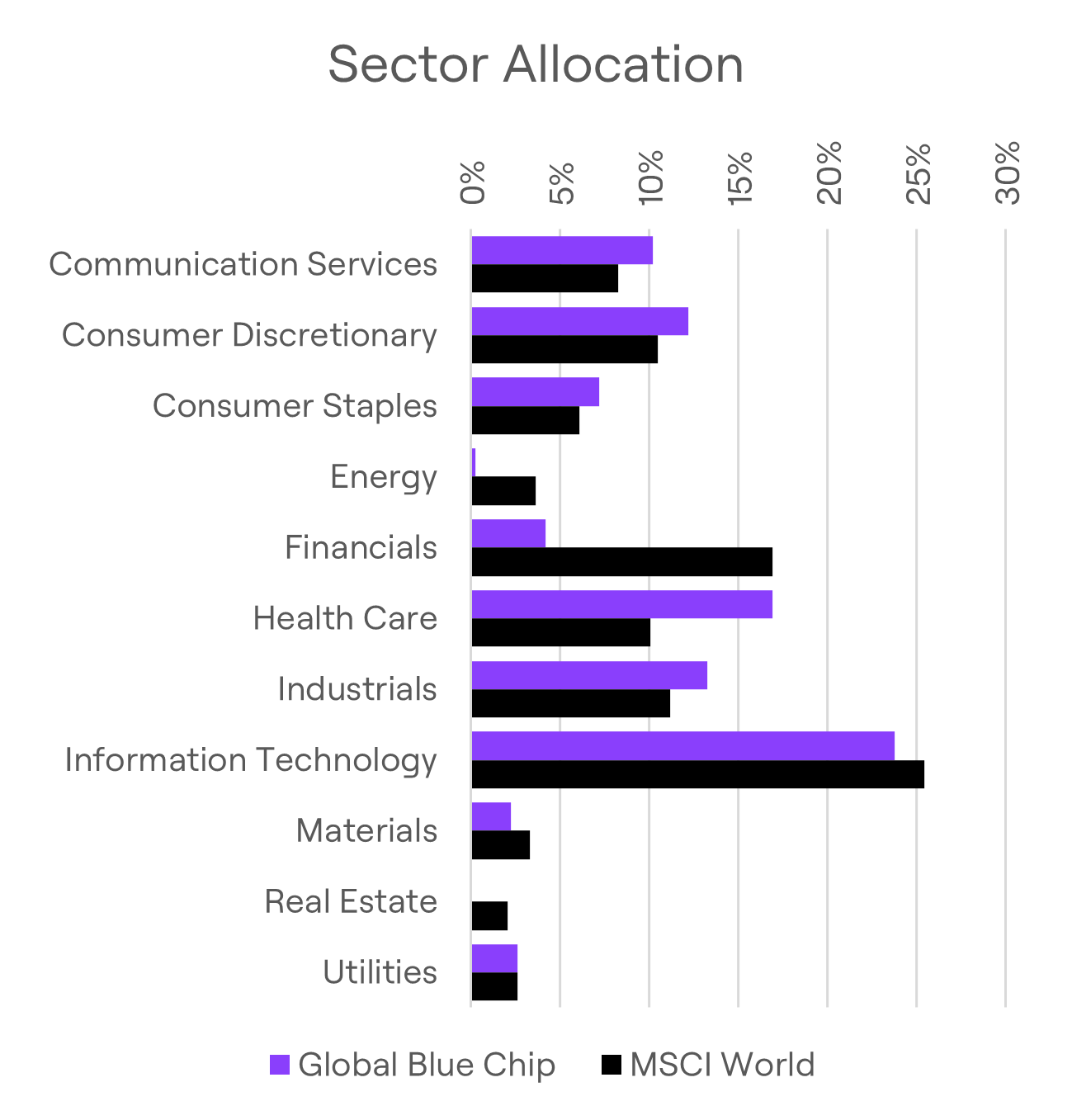

Year-to-date, the MSCI World Index has returned 9.61%, while Global Blue Chip has gained 11.62%, outperforming by 2%. This turnaround - from a 1.75% deficit in Q1 - reflects both decisive stock selection and our willingness to adapt. We’ve rotated away from laggards and concentrated exposure in higher-conviction themes, such as AI infrastructure, e-commerce, basic materials and capital goods.

Year-to-Date Performance Breakdown

2025 Year-to-Date Top Contributors & Detractors to Performance

| Contributors | |

| Top 5 | Contribution to Return (%) |

| Oracle Corp | 1.56% |

| Advanced Micro Devices | 1.44% |

| Nvidia Corp | 1.42% |

| Broadcom Inc | 1.31% |

| KLA Corp | 1.01% |

| Bottom 5 | Contribution to Return (%) |

| Bruker Corp | -1.07% |

| WPP Plc | -0.71% |

| LVMH Moet Hennessy Louis Vui | -0.69% |

| Regeneron Pharmaceuticals | -0.64% |

| Apple Inc | -0.62% |

Table 2. Top and bottom 5 contributing holdings to performance between the period 31/12/2024-30/09/2025. Source: Bloomberg LP and Titan Wealth CI. Compiled by Titan Wealth CI 01/10/2025. All returns in GBP terms.

There has been a considerable amount of change to the strategy over the past nine months. As we look back, we are pleased with how the transition has been executed, the performance outcome, and how the portfolio is currently positioned. We thought it would be helpful to our investors if we explained what changes to exposure/policy have been made, our current thoughts on them and what investors can expect going forward.

I have written and spoken about the challenges the strategy faced in 2024 and how we sought to address them through appropriate policy changes. These changes centred on portfolio construction and risk mitigation rather than a wholesale change on the type of investments we intended to make.

To address heightened single stock volatility, especially around times of new information flow such as earnings, we lowered the average position size. In order to be fully invested, we increased the number of stocks to 40-45 from 30-35 previously. Following this transition, and having gone through one set of earnings announcements, we are pleased with the outcome as no one stock had a meaningful, negative impact on the overall performance. Only in exceptional circumstances would this be the case, and, fortunately, one such case was to the upside with Oracle.

To mitigate the impact of momentum on relative performance, we have devised tools to better flag underperforming holdings, processes to review in the context of the original investment thesis and a framework on how we will address them. The result of this has been to cut losers early, even if the investment was made recently. We expect turnover to increase as a result of being more willing to act sooner, but we believe this will ultimately improve performance.

In terms of investment orientation, we have re-positioned parts of the portfolio towards some of the most compelling trends that are shaping the world we live in. The AI build out has been one of them and we have been confident that companies related to the AI infrastructure complex (such as chips, fabs, tools, data centres, grid and power suppliers) will be where tangible value will accrue. The momentum has been strong, but recent investment and collaboration announcements (as explained previously) have started to polarise the investment community, with many highlighting dot-com similarities where network enablers captured the real economics but overinvestment and vendor financing risks accelerated the collapse.

Whilst we acknowledge the lesson from history we note there are notable differences. Demand for accelerated compute far exceeds current capacity. The problem we see is one where companies fail to meet ever higher expectations in their ability to execute due to real world issues surrounding constraints on fab processing times, power capacity, delays in construction etc. For now, bar a recession or exogenous shock, this cycle likely has further to run in our opinion but we are watching developments closely.

Nevertheless, constraints provide opportunities and the lack of available power is one area we intend to investigate further - although we do own RWE and E.On for this very reason.

Beyond the AI infrastructure theme, there are a number of supply-demand imbalances that will require investment to address or government cash flows that are likely to grow in a sustained way that we would like to 'get in the way' of. Examples include commodities, defence, infrastructure and energy.

Two areas where we are seeing value and the beginnings of a potential decade – if not multi-decade – bull market are China and natural resources. The two are no longer inseparable, as they were twenty years ago, but the relationship - and opportunity - is just as powerful in our opinion.

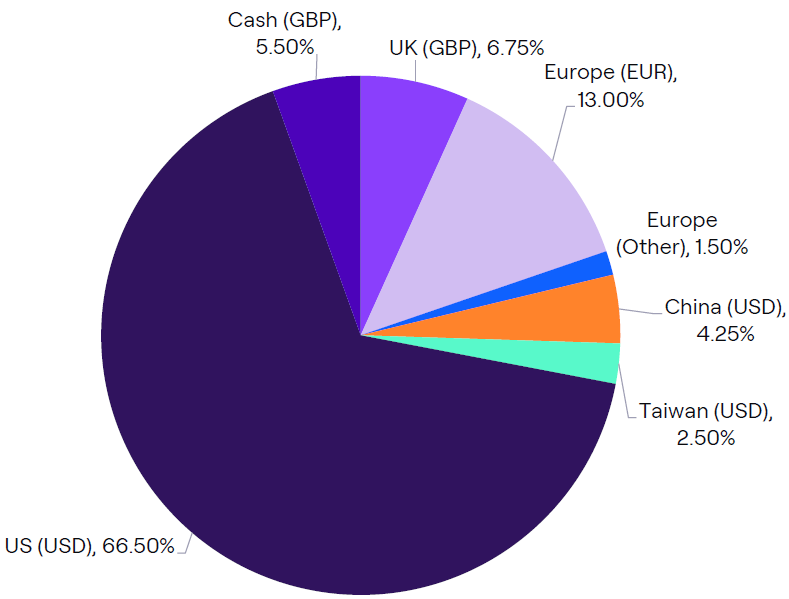

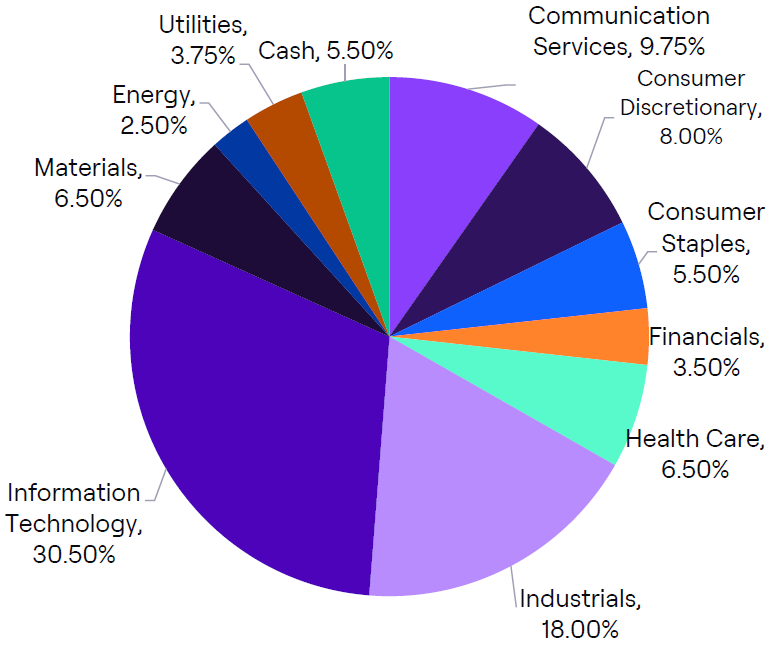

Current Portfolio

| Global Consumer | 17.50% |

| Amazon | 3.00% |

| eBay | 1.80% |

| L’Oreal | 2.80% |

| Mercado Libre | 2.50% |

| Netflix Inc. | 1.80% |

| Unilever | 2.80% |

| Walt Disney | 2.30% |

| Sea Limited Sponsored ADR Class A | 0.80% |

| Changing World | 32.25% |

| Anglogold Ashanti | 2.50% |

| Interactive Brokers Group, Inc. Class A | 2.00% |

| BAE Systems plc | 1.50% |

| Caterpillar | 2.00% |

| E. ON | 1.80% |

| Exxon Mobil | 2.50% |

| Glencore plc | 2.50% |

| Honeywell | 2.50% |

| JP Morgan | 1.50% |

| Kongsberg Gruppen ASA | 1.50% |

| L3 Harris | 2.50% |

| Mosaic Company | 1.50% |

| RTX Corporation | 2.00% |

| RWE | 2.00% |

| Schneider Electric | 2.00% |

| Siemens | 2.00% |

| Healthcare | 6.50% |

| AbbVie | 1.50% |

| Edwards Lifesciences | 1.50% |

| United Healthcare | 2.00% |

| Eli Lilly | 1.50% |

| Technology & Innovation | 38.30% |

| Advanced Micro Devices | 2.5% |

| Alphabet | 3.3% |

| Arista Networks, Inc. | 2.5% |

| ASML | 2.5% |

| Broadcom | 2.8% |

| CrowdStrike Holdings, Inc. Class A | 2.3% |

| KLA | 2.0% |

| Meta Platforms | 2.5% |

| Microsoft | 2.5% |

| Nvidia | 3.0% |

| Oracle | 1.8% |

| Taiwan Semiconductor | 2.5% |

| Uber Technologies | 2.0% |

| Synopsys Inc | 2.0% |

| KraneShares China Internet ETF | 4.3% |

| Cash | 5.5% |

Table 3. Global Blue Chip Model Portfolio holdings and weightings as at 30/09/2025. Source: Titan Wealth CI. Any difference between weightings displayed here and in data elsewhere is due to that data being representative of average weight over the period in question.

| Mkt Cap ($Bn) | Gross margin | Net income margin | ROCE | Net debt to direct equity | FCF Yield | P/E | |

| GBC | 521 | 25% | 8% | 12% | 34% | 5.3% | 22.8 |

| MSCI | 733 | 35% | 10% | 7% | 41% | 3.3% | 20.1 |

Table 4. Aggregate portfolio holding characteristics of certain financial ratios and valuations as at 30/09/2025. Source: Bloomberg LP and Titan Wealth CI. Compiled by Titan Wealth CI 01/10/2025.

Investment Insights: The Next Opportunity

Adopting an abundance mindset is important when it comes to investing. Understanding when an idea has run its course is difficult – trends run on for longer than anticipated, quality businesses develop new opportunities and take growth to the next level etc. Often the decision to exit is driven by the need to find room and capital to fund the next idea that has a greater return potential. We believe there are two arenas offering investors with exceptionally compelling entry points today.

Natural Resources

The similarities to the early-2000s commodity supercycle are unmistakable, in our opinion. Then, markets were pivoting away from an ageing tech boom, underinvestment had hollowed out the commodity complex and China’s industrial ascent triggered an explosion in global demand. Today, the AI revolution, electrification, defence rearmament and fiscal-driven infrastructure programmes are colliding with a decade-long investment drought in supply. The setup is familiar, but with the added edge of unfolding within a multi-polar world where urgency and strategic alignment are now considered critical to national security.

Our natural resources exposure provides tangible leverage to these same structural shifts. Glencore provides industrial metals exposure in copper, nickel and cobalt, all of which are essential to AI and electrification. AngloGold Ashanti offers leveraged exposure to gold, which is increasingly seen as a store of value and a hedge against debt debasement. ExxonMobil provides exposure to energy security and the gas-fired generation capacity that will become a crucial piece in AI’s future success.

The previous cycle was driven by structural scarcity and policy inertia, and similar circumstances will sit at the nexus of today’s supply shortages. The West is now scrambling to secure assets after a decade and more of neglect which allowed China to build a network of strategic partnerships, with its Belt and Road Initiative (“BRI”) at its heart. This neglect and active discouragement means current supply will fall short and won’t be able to come online fast enough to keep up with demand. It’s ironic that our sophisticated future, and the pace of its deployment, will be dictated by the availability of the most basic of materials. Scarcity will once again sit at the centre of this investment opportunity.

China

China’s ascent to become the second largest economy is unnerving the dominant partner. Trade tensions and post-Covid supply chain realignments are accelerating as the two biggest economic forces in the global economy rub shoulders. China’s post Great Financial Crisis pivot toward ASEAN and the developing world, combined with Russia’s discounted energy exports and India’s labour advantage, creates the foundation for what Gavekal calls a “Ricardian growth boom” in their note ‘Which Megatrend Will Reshape Global Markets’. These realignments mark the reconfiguration of global trade flows - paid for in a Yuan-based, gold-backed, monetary system that sits outside of the US dollar payment rails – and we believe long-term orientated investors need to be on the right side of this shift.

Gavekal notes the current environment for China mirrors post-2008 America – an undervalued currency, cheap and abundant power, deflationary macro conditions and policymakers with ample room to stimulate. The Chinese Communist Party’s renewed focus on stability and economic growth, centred around advanced manufacturing, technology and stimulating the consumer, should rebuild confidence and wealth effects among a domestic consumer base that has been knocked back by high youth unemployment and a property market correction that has crushed optimism.

Our preferred play is the KraneShares China Internet ETF ($KWEB) whose holdings are diversified across technology and e-commerce related investments which position us in-line with a number of key themes as set by the CCP in their latest five-year plan (2026-2030) for the economy and its governance. President Xi’s tone towards the tech sector has also turned more constructive of late as the AI race intensifies against the US. China’s leading AI businesses are also dominant within the country’s e-commerce industry and are now growing rapidly across ASEAN, Africa and LATAM, piggy backing off the centrally planned BRI, strengthening trade ties beyond the borders of increasingly sceptical western markets and policy makers.

In other words, we believe $KWEB is where China’s policy, trade, and technological strategies converge, offering investors an attractively priced 'get in the way' opportunity and an alternative to investing in very sensitive-to-execution-risk American tech. It is still worth noting this carries its own set of risks as tensions between the US and China oscillate over trade and other geopolitical matters.

Together, China’s stabilisation, Asia’s integration and a global re-rating of real assets underpin what could become the next great capital rotation: out of increasingly favoured and expensive US mega tech and into tangible, policy-backed growth. It has the hallmarks of the early 2000s, but this time driven by the build out of AI, expanding existing infrastructure to support growth and industrial output, and bring online cheap abundant sources of energy to power the next chapter. History rarely repeats, but it often rhymes - and like a contemporary beat that reminds its listener of an older tune, we find ourselves nodding our head to the rhythm of some of the most extraordinary trends of their time.

The pivot in our strategy is more than just increasing stock counts and reacting quicker to poor performing holdings. It’s recognising that the world around us is changing rapidly. Currencies are being debased, debt burdens are ballooning and monetary systems are changing. The old playbook may not work so well in this environment and approaches will have to adapt in order to keep up. There is a saying that capital ends up in the hands of those that treat it best. Raw materials, energy and China have been incredibly harsh environments for capital over the past decade, but the cold winds are shifting, and it’s at these inflection points where the biggest returns are made and we are adding selectively in order to be part of it.

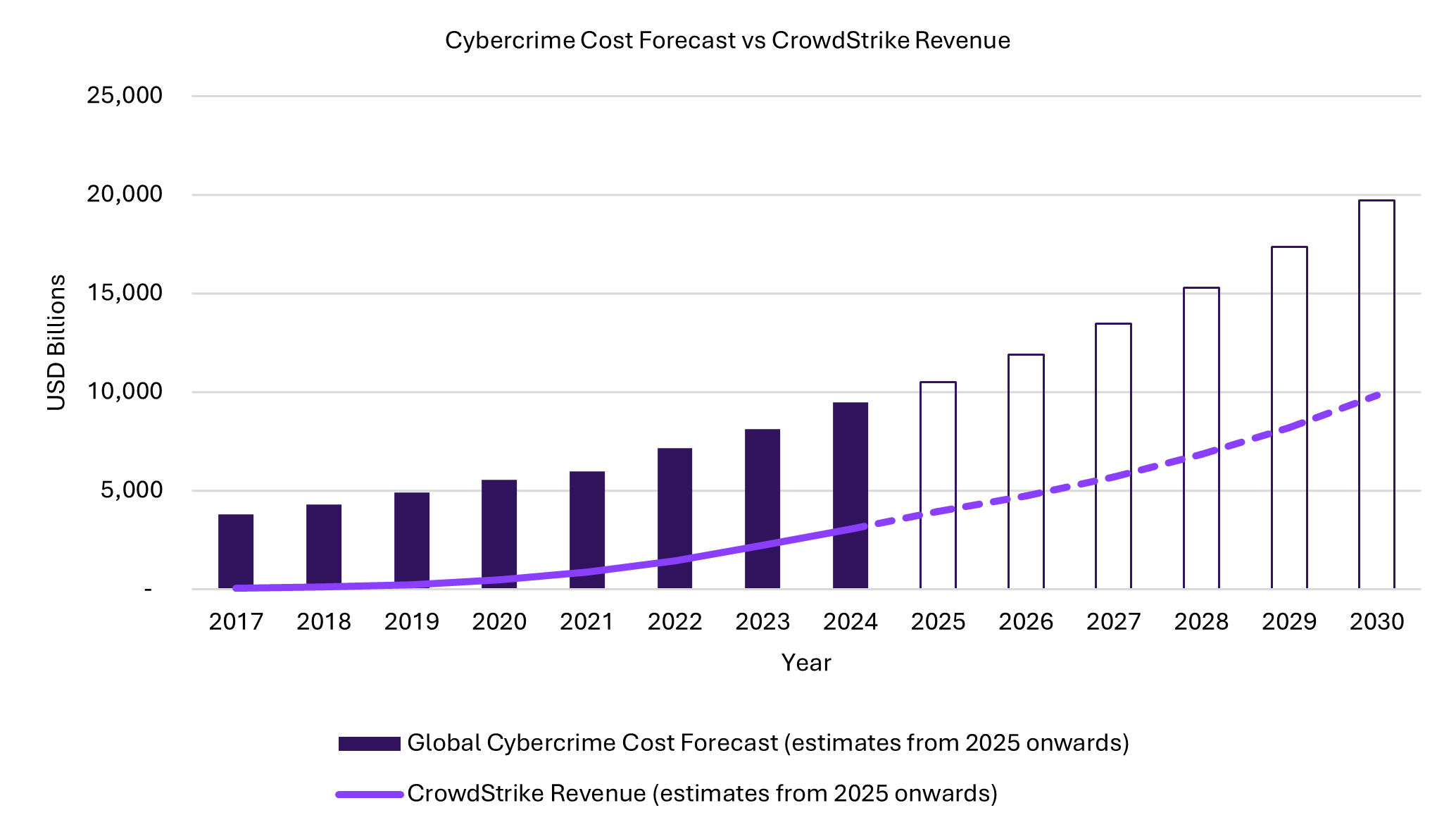

Stock in Focus: CrowdStrike

Cybersecurity is no longer a nice-to-have line item on IT budgets, but a foundational requirement for modern economies given the changing world we are in and the evolving nature of cyber-attacks as part of a rapidly evolving theatre of war between nation states.

As demonstrated above, global cybersecurity spending is forecast to rise steadily in the high single to double digits annually as enterprises recognise the stakes as existential. Be it purely reputational damage and regulatory liability from downtime, to a business being unable to operate at all. In short, cybersecurity is now a structural growth market from an investment perspective, because it’s something that people, businesses and governments cannot live without.

Enter CrowdStrike. CrowdStrike emerged in 2011 as an offshoot from McAfee, founded by George Kurtz and Dmitri Alperovitch, with the simple - but radical - idea that endpoint protection should be cloud-native from day one. Instead of layering bulky software onto each device, they created Falcon – a single platform that supplies users, direct from the cloud, with multiple security modules that run off the same data. It was elegant, scalable and, most importantly, effective. High-profile wins in attributing the Sony Pictures hack to North Korea and the DNC breach to Russia cemented its credibility.

Since then, CrowdStrike has become the leader in modern endpoint security, with ~18% market share ahead of Microsoft. Its Falcon platform has expanded into over 20 modules covering identity protection, cloud workload defence, vulnerability management, log management and managed threat hunting.

The firm’s Flex licensing model now underpins customer adoption by removing procurement friction, deepening module penetration, and producing higher-value, longer-term deals. On average, Flex customers use nine modules, with contract values rising sharply after renewal – largely due to initial discounts burning off as customers remain sticky at renewal time, as well as customers generally seeking more modules to improve their level of protection. For a company built on subscriptions-as-a-service (SaaS), that is exactly the kind of ratchet investors like to see.

Organic growth has been supplemented by targeted acquisitions, such as Humio for log management, Preempt Security for identity threat protection, and most recently Pangea to extend AI detection and response capabilities. Execution has been matched financially with the company transitioning into GAAP profitability while retaining enviable gross margins north of 80% on subscriptions.

The pièce de resistance, though, is CrowdStrike’s agentic AI, Charlotte AI. It is designed to act as a co-pilot for security teams: automating triage, threat hunting and response in natural language. Its effectiveness stems not just from model architecture, but from the trillion-plus proprietary data points CrowdStrike collects daily. The crucial differentiator in AI’s effectiveness is the amount and quality of data. Data, in the realm of AI, is a genuine moat, and no competitor has a comparable telemetry set spanning endpoints, identities and cloud workloads.

CrowdStrike sits at the nexus of a structurally expanding market, with secular demand tailwinds and a business model that monetises breadth as well as depth. Financially, management guides towards >20% net new annual recurring revenue growth, 24%+ operating margins, and 30%+ free cash flow margins in FY27 – highlighting the operational leverage we seek in well-managed businesses. Risks are not absent though; these include Microsoft’s monopolistic bundling power which remains formidable, new upstarts lurking as ambitious challengers to specific modules, and cybersecurity companies being prone to negative headlines if they make just one mistake. But CrowdStrike has consistently demonstrated both innovation and execution to so far overcome these disruptions.

Cyber security is no longer optional, and CrowdStrike provides critical infrastructure in a world where a single breach can cripple economies, throw hospitals into chaos and result in no food on your shelves. This is a potential crisis for which the likelihood will only grow, meaning the likes of CrowdStrike will only become more necessary – and hence a company we see as a core structural piece of our portfolio.