Six months ago, serious talk of peace in Ukraine by Christmas would have felt wildly optimistic. And yet, here we are. Nothing is signed, sealed or delivered, but the wheels of diplomacy are starting to squeak into motion.

The latest development is a 28-point peace framework quietly proposed by the United States. After nearly four years of war, it seems the political will may finally exist to shift from stalemate to settlement. The core idea is this: neither Russia nor Ukraine can win outright, and both sides now face greater risks from continuing than from compromising.

Geopolitical George Friedman, whose strategic analysis has been particularly sharp throughout the conflict, puts it bluntly. Russia can’t occupy all of Ukraine. Ukraine can’t push Russia fully out. So, you get negotiation. And that negotiation, in this case, has a distinctly American flavour.

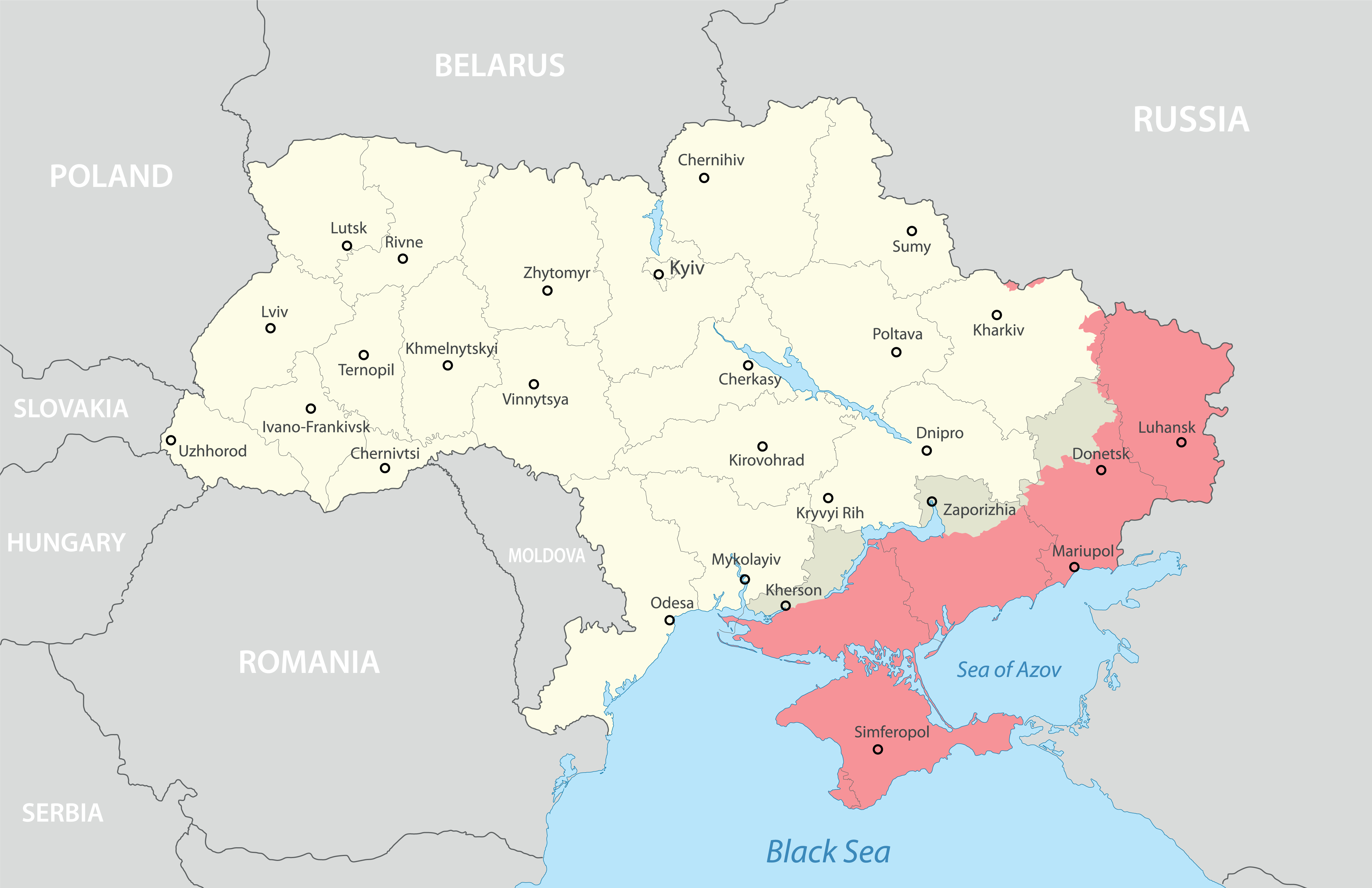

According to the initial proposal, Russia would retain control of Donetsk and Luhansk, the two eastern provinces it’s occupied since early in the war, while Ukraine would regain some minor territories. More critically, point five of the plan offers Ukraine a kind of shadow NATO membership and therefore any future Russian aggression would be considered an attack on the West as a whole.

It’s not formal NATO membership, which remains a red line for Moscow, but it’s no toothless pledge either. The US would provide a security guarantee that “mirrors Article Five,” backed by the potential for allied military deployments in peacetime on a rotational basis. NATO jets, for example, would be stationed in Poland.

Ukraine’s military would be capped at around 800,000 soldiers, which is close to current levels, and not disarmed. The goal here is to create a neutralised, buffer-style Ukraine - armed, sovereign, but not provocative. Not a NATO springboard, but not a defenceless grey zone either.

There’s also a fail-safe clause. If Russia restarts the war, any sanctions relief or de facto recognition of occupied territory would be reversed, and it would risk a direct military response from the US. If Ukraine violates the agreement by launching attacks into Russia, it forfeits the Western security guarantee. Neither side gets a blank cheque.

Friedman points out that buffer zones, historically, are not economic wastelands. Quite the opposite. Switzerland thrived as one. Finland’s Cold War neutrality didn’t stop it from becoming prosperous. Ukraine could, in time, emerge as a connective hub between East and West, provided, of course, that Russia’s own economic reintegration proceeds in good faith.

This brings us to another interesting wrinkle. Point 13 of the original plan outlines gradual reintegration of Russia into the global economy and eventual US-Russia cooperation on economic matters. Controversial? Undoubtedly. But also strategically pragmatic as an isolated, humiliated Russia is unlikely to sit quietly.

Importantly, the 28-point plan is not fixed. Reports say Ukraine and European allies have already pared it down to 19 points, possibly 18, as some clauses were deleted or revised to address sovereignty concerns. The details remain fluid. The important thing is that we now have a credible framework for moving toward peace, even if the route is still winding.

It’s also clear that Europe is pushing hard to ensure the deal isn’t seen as a gift to Moscow. Keeping control of key fortress towns like Sloviansk and Kramatorsk is vital for Ukraine’s defence posture. A frozen conflict is possible, yes, but not one that allows Russia to regroup and try again later.

What does all this mean for investors? Quite a bit, actually. If a settlement, even a shaky one, materialises, markets will begin recalibrating fast.

In the short term at least, energy markets could stabilise further as the risk premium on oil and gas should ease, especially if sanctions on Russian exports begin to unwind. Defence stocks, which have enjoyed a multi-year run, could also pause for breath and the same goes with commodities. However, longer term both energy security, huge infrastructure projects globally including fresh demand linked to Ukrainian and Russian rebuilding, and defence in general will remain in huge demand. Any pullback could also be looked at as a possible buying opportunity. Finally, and more broadly risk appetite might return to markets that have priced in prolonged conflict, especially in emerging markets.

For our part, it reinforces the value of staying thematically focused. Peace and recovery are investable themes. So is the next phase of global rebalancing – the one where diplomacy, not drones, sets the tone.

The war is not over. This plan may well falter. But it’s the first time in a long time that something resembling an endpoint is on the table.

“All we are saying is give peace a chance.”