As one of the most asked questions from our investors this year, “Are we living in an AI bubble” has got me thinking about why bubbles burst or pop.

To answer this, I thought why not go straight to the source, and so the following answer is from my favourite AI search engine.

“Bubbles burst primarily because their thin film of liquid (usually water and soap) loses its integrity, which can happen in several ways. The main reasons are:

- Evaporation – when the water in the bubbles film evaporates, especially in dry or warm air, the film becomes thinner and weaker, eventually breaking and causing the bubble to pop.

- Puncturing or disturbance – if the bubble is touched or poked, or hit by a gust of wind, the surface tension is disrupted, creating a hole that rapidly expands and causes the bubble to collapse.

- Surface tension and pressure – the bubble is held together by surface tension, which keeps the liquid firm and stable. When a hole forms, the pressure inside the bubbles equalises with the outside, and the surface tension pulls the film apart, causing the bubble to burst.”

Next, I asked whether some bubbles could never burst. In short, while all bubbles eventually burst under “normal” conditions, there have been environments (normally created) whereby bubbles can last for extremely long periods. But even then, they eventually burst.

Whilst this may relate more to the bubbles that sit in our bath, or the kind blown at children’s birthday parties, the same reasons for bursting can hold true for equity market bubbles.

Equity market bubbles are caused by rapid price increases that far exceed an asset's fundamental value, often driven by speculative demand, herd behaviour and a cycle of euphoria.

Key factors include:

- A disconnect from earnings – whereby the price of a company is extended well beyond the expected growth from said company. In our world this is known as extreme overvaluation.

- The widespread use of leverage - the use of borrowed money to invest amplifies both gains and losses, increasing risk and fuelling the rapid price increases during the boom phase.

- Excessive optimism - prices are driven more by speculation and a belief that they will continue to rise, rather than by actual earnings or productivity. This can be fuelled by "herd behaviour," where investors follow the crowd, also connected to extreme overvaluation.

- Transformative innovations - bubbles often arise around a new technology or innovation that attracts a lot of excitement, causing a surge in investor enthusiasm and corporate investment.

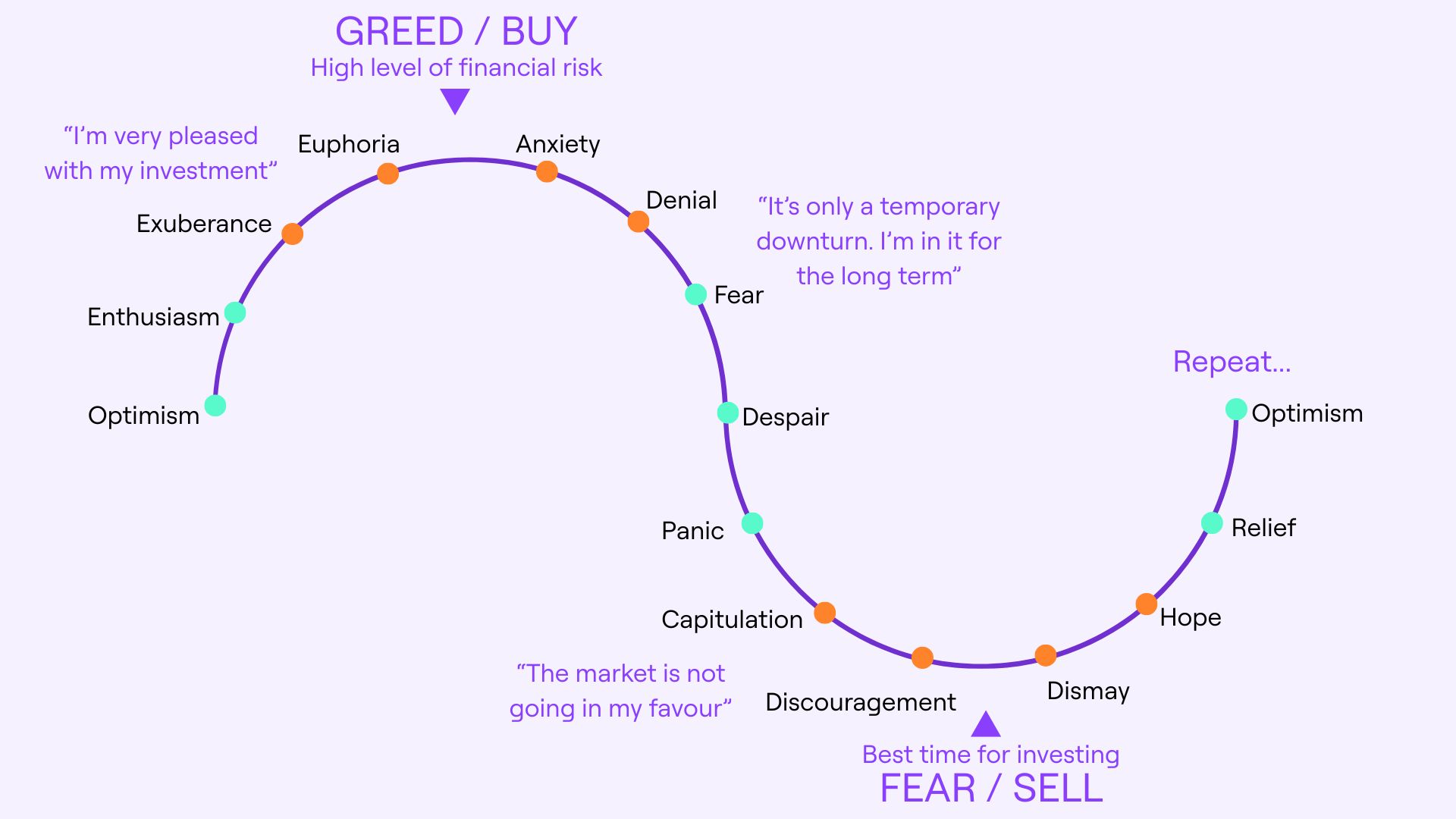

The diagram below shows our normal behavioural biases and “feeling” when investing.

How market bubbles burst is comparable to physical bubbles. The equity market bubble can be broken when investors start taking profits, leading to a "profit-taking" and eventually "panic" phase where selling intensifies, and prices collapse back to more realistic levels. Essentially, they suffer from either evaporation or disturbance.

Given all of the information above, we still haven’t answered the question or whether we are in an AI bubble.

A disconnect from earnings – there are definitely some companies out there that are trading at elevated prices based on potential versus actual growth. These tend to be the disruptors that everyone is obsessed about, but whether they make money is another matter. Generative AI could be an example here; the technology has potential to fundamentally reshape industries by creating new capabilities. As to whether this generates tangible profits or cost savings has yet to be seen.

The widespread use of leverage – this has become less of an issue given the higher interest rates seen over the last few years, and which really shook out the “disruptor” market in 2022. For example, Meta platforms fell nearly 65% in 2022 but have since powered up over 425%. Maybe that also covers the excessive optimism as well?!

Excessive optimism – Over the last three years, there are several companies that have seen returns in excess of 500%, which is a whopping 85% per annum. Investors often tend to look at several metrics, such as the CNN Fear and Greed Index and other indicators like momentum, but the market and many of its investors suffer from “Fear of Missing out” (or FOMO), so optimism can last a very long time.

Transformative innovations – AI is definitely that. We have heard all about how it will transform the way we live and work, with some going as far as to say it will have the same transformative effect steel, electricity and the internet once did.

AI exposures

We have two exposures in our multi-manager funds that have exposure to the AI theme and technology: Landseer Global Artificial Intelligence and BlueBox Global Technology.

At the start of November, we had our quarterly call with the fund managers for the BlueBox Technology Fund, of which we have a 5% weighting in our Balanced strategy and 7% in Growth. As you can imagine, the “bubble” question was quite high on the list of talking points.

From fund manager William de Gales’ point of view, he cannot see that we are currently in a bubble, because we remain in the long-term growth trend in the technology industry of 15% per annum. For him, we are within the bounds of rationality, as there are of course times when one gets ahead or falls behind.

Personally, in answer to this question, I think the answer is not quite yet, although there are certain companies out there that could be ready to “pop”. On the upside, the fund managers from BlueBox are all over that and steering well clear of the overpriced disruptors that many people get excited about!

As your investment managers, while the bubble debate is ongoing, we continue to monitor things closely. Should the market environment start to “thin” or show signs of strain, we will of course be ready to take proactive steps to protect portfolios and endeavour to steer clear of any potential pop.