Last week brought some unusual political theatre, with Chancellor Rachel Reeves delivering an unannounced pre-Budget address from the Downing Street briefing room, just over two weeks before the full details are due to be published on 26th November. This sort of ‘scene-setter’ is a rarity for a UK Chancellor. The briefing lasted roughly 45 minutes and was packaged with bold red signage reading “Strong Foundation, Secure Future” – a clear attempt to frame the mood before markets react to anything concrete.

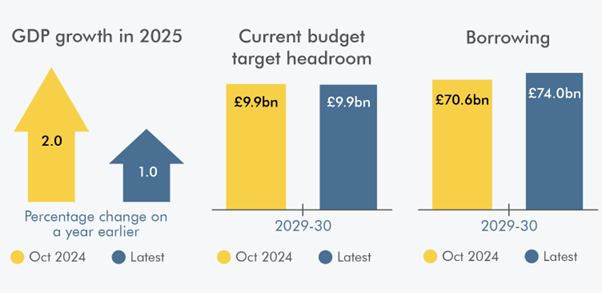

No actual policy measures were released, however, Reeves declined to rule out tax rises across the board to plug what is estimated to be a £30 billion fiscal hole required to meet the government’s rules. This comes against a backdrop of lower economic forecasts (GDP of ~1.9 percent in 2026 and ~1.8 percent in 2027), slower-than-expected rate-cut expectations and more modest wage growth.

What makes this announcement interesting for investors isn’t just the novelty, it’s the intent. After the turmoil triggered by Liz Truss’ mini-Budget in 2022, which saw big unfunded tax cuts delivered at a time of high inflation, policymakers are acutely aware that unexpected fiscal announcements can unleash volatility in bond and equity markets. More recently, the Trump “Liberation Day” tariff announcement demonstrates how even known policies can still catch markets off guard and blindside investors if not well communicated.

Budget expectations

So, what can investors reasonably expect from the full Budget? Nothing is certain until the Chancellor next steps up to the dispatch box, however, recent Office for Budget Responsibility (“OBR”) figures and the direction of existing tax policy at least give us a framework.

Last year’s Autumn Budget fell heavily on businesses, with over half of the additional revenue coming from employers via a single percentage-point rise in employer National Insurance contributions from April 2025. This, alongside reductions to business-relief and capital-allowance schemes, makes it unlikely that Reeves will lean on this group in the same way again, given how much businesses have already absorbed.

At the same time, the government remains bound by its manifesto pledge not to raise income tax, employee national insurance or VAT for working people, narrowing the available tax levers. That being said, there are certain targeted VAT moves already underway, such as removing exemption for private education, although any broader increase in the standard VAT rate looks off the table. More plausible changes could be brought into niche areas such as healthcare VAT exemptions as well as betting and gambling activities.

Focus on wealth?

More striking is the narrative shift toward higher earners and wealth holders. The Treasury’s own press release titled “Budget to address an economy that’s not working well enough for working people”, hints strongly that “working people” will again be protected, suggesting the burden may fall elsewhere.

- That points to the growing likelihood of wealth-focused taxation, with possibilities including:

Tighter rules on inheritance tax, especially around lifetime gifts - Further changes to capital gains tax (“CGT”) and pension taxation

- “Exit taxes” on unrealised gains when individuals leave the UK

A recent report from the think tank Onward had the government consider an annual levy, equivalent to 0.54% for properties between £500,000 and £1 million and 0.81% for properties valued above that. Although annual in structure, the tax would only crystallise on sale. Separately, The Times has reported that the Chancellor is also considering imposing CGT on sales of primary residences worth £1.5 million or more, effectively restricting private residence relief for high-value homes.

These sit alongside broader proposals for wealth tax, such as a levy on total personal assets above a certain threshold. Other related campaign groups have floated a 2% tax on individuals with wealth over £10 million. However, while such measures have public appeal, the OBR’s Fiscal Risks and Sustainability Report (July 2025) warned of the dangers of relying too heavily on a small mobile group of high earners, who already account for a disproportionate share of tax revenues.

Final thoughts

Against that backdrop, Reeves’ early intervention feels like a deliberate attempt to soften the ground ahead of some potentially uncomfortable decisions. Nothing is confirmed, and at this stage much of the discussion remains speculation, but the signals are hard to ignore. We already have a sense of where tax policy may land – not through explicit announcements, but through the themes the Treasury keeps emphasising: protection of “working people”, greater focus on wealth and a narrowing set of fiscal levers.

For investors, the final message is straightforward: when governments feel the need to guide markets this explicitly, it’s a sign that meaningful moves are coming – and it’s worth taking stock.