“…Don’t stop thinking about tomorrow

Don’t stop, it’ll soon be here

It’ll be better than before

Yesterday’s gone, yesterday’s gone”

Don’t Stop, Fleetwood Mac, 1977.

Amongst a sea of miserable political headlines, I thought I’d provide some positivity because, in fact, from an investor’s perspective both bond and equity markets have performed very well of late and, moreover, there are reasons to be positive for the future as well.

If the start of 2025 felt a little uncertain to you, you weren’t alone. Markets stumbled out of the gate, distracted by the usual cast of economic worries, geopolitical drama, and AI-fuelled existential dread. But, just like Oasis on tour, they’ve made a monumental comeback.

The MSCI World Index, which had dipped earlier in the year, has recovered impressively and as at the end of September was up in sterling terms by 9% (1). Not only that, but our own Global Blue Chip Fund has outpaced the market, rising by 11%(2) over the same period. It’s always gratifying to say that we’ve not only kept up, but got a little ahead of the game. Long may that continue.

So, what’s been driving the recovery? The big themes haven’t really changed, but the world seems to have remembered that not all risks come with red warning lights.

Technology, as ever, has been at the centre of the action. AI continues to dominate headlines and balance sheets alike, helping boost the broader tech sector. The phrase “AI-driven” might be getting overused, but the impact is real. From productivity gains to entirely new business models, the sector has grown faster than a toddler in a sweet shop.

And it’s not just the mega-cap tech names making noise. Semiconductors, infrastructure, cloud computing - all have ridden this wave.

Emerging markets have also shown some swagger in recent months. While they still face headwinds, such as currency volatility and political risk, the long-term narrative is hard to ignore. Particularly in Asia, where infrastructure spending is quietly becoming a major global economic engine.

You may have heard of the Valeriepieris circle (which we have highlighted in the past) - a curious geographical fact that shows more than half the world’s population lives within a relatively tight circle drawn over Asia. That’s a lot of people building, moving, trading and consuming. And with governments in the region pouring money into infrastructure, energy and connectivity, this is no longer just a local growth story - it’s a global one.

Naturally, that kind of spend will have ripple effects. One of the big ones being commodities. The demand for copper, lithium, steel and other raw materials needed for roads, rails, data centres and EVs could begin to reshape market dynamics. And of course, infrastructure spending isn’t limited to this region. Germany for instance has committed to an infrastructure spend of €500 billion over the next 12 years and this will be reflected across the globe.

As thematic investors, we’re watching this closely. While we haven’t invested dramatically yet, the signs are there that commodity exposure may become a more prominent theme in the portfolios in the future.

Now, a quick inward glance. It’s hard to believe, but we’re already 10 months into life as Titan. We’ve spent this time working closely with the wider team to ensure our investment approach not only stays true to what’s made it successful, but evolves to meet the needs of a growing and dynamic client base.

That doesn’t mean change for the sake of it. Our core philosophy remains firmly in place: we build portfolios that are liquid, understandable, global in scope and, above all, are aligned with our clients’ investment goals and objectives. We’re not trying to time markets or chase headlines. We’re aiming for sustainable, long-term returns by identifying the structural themes that are reshaping the global economy.

As we enter the final stretch of the year, there’s plenty to be optimistic about. Inflation appears to be behaving (mostly), rate rises may finally be behind us (famous last words), and the global economy is proving more resilient than many predicted. Of course, there will always be twists and turns. But with portfolios that are thematically driven, globally diversified, and built with clarity and conviction, we feel well-placed to navigate what’s next.

As Fleetwood Mac sang “Don’t stop thinking about tomorrow”.

Market & Asset Update

by Alex Finer

“The only constant is the changing world we are living in, and our ‘Changing World’ theme is playing a larger and pivotal role in our portfolios, as we are actively listening and ready to respond”

The third quarter of 2025 extended the rally in risk assets, with most asset classes benefitting from the subsiding US trade tensions, resilient corporate earnings and near-term rate expectations.

Out of global equities, emerging markets led the pack - the MSCI EM index gained 12.6% (3), versus world equities 9.2% (4). This was driven by a sharp rebound in China, which advanced 22.9% (4) in sterling terms, whilst India lagged; this marked a welcome narrative shift from the sole focus on US-centric markets that has dominated previous years.

The rotation into once-unloved regions proved positive for our strategies, particularly after several years in which emerging markets had been held back by regulatory tightening, property-sector weakness and wavering investor confidence.

Elsewhere, the bullish narrative continued with equity markets pushing to new all-time highs and with few downturns. The S&P 500, Nasdaq Composite and FTSE 100 each closed the quarter at record levels, while gold enjoyed its strongest year since 1979 in dollar terms, rising beyond USD 3,800 an ounce (hitting an historic high of $4,000 at the start of Q4). Performance across risk assets was driven by a few key elements; resilient earnings from technology ‘hyperscalers’ riding the AI wave, better-than-expected recovery in some previously discounted consumer stocks and continued bullish sentiment.

However, the broader macroeconomic backdrop presented a more nuanced picture. On one hand, policy developments remained broadly supportive of markets. The Fed delivered its first rate cut of the cycle in September, lowering its benchmark rate by 25 basis points and reinforcing expectations of a soft landing. Tariff-related inflation pressures also eased modestly, while a series of new trade accords — many branded as “tech prosperity” partnerships — signalled improving global cooperation and the gradual normalisation of supply chains. Yet these positives were tempered by structural and regional concerns. In July, the US revealed slower job growth, while a sharp sell-off in US Treasuries in September reignited debate over fiscal sustainability. Across Europe, sentiment weakened as France grappled with a ballooning debt burden and growing political instability, heightening worries over cohesion within the euro area.

For the UK, inflation ticked back up to 3.8%, challenging the government’s “plan for change” aimed at lowering household and energy costs. Bond markets reflected these pressures: government bonds underperformed as yields rose on fiscal concerns, while investment-grade corporates fared better, with spreads tightening on the back of strong demand and relatively healthy balance sheets.

Looking ahead, questions remain over how long AI-driven momentum can sustain equity market leadership. While some investor scepticism is warranted, governments appear committed to structural transformation, with corporates expected to play a pivotal role in that evolution. As diversification re-emerges as a core investment theme, opportunities are developing in under-allocated regions and value-oriented sectors where long-term growth potential persists, even if the timing of such rotation remains uncertain.

Multi-Manager Update

by Bob Tannahill

The third quarter was a very strong one for markets and a good one for our portfolios. After a tricky first half of the year, with UK equities being the star of Q1 and healthcare coming under pressure in Q2, it was nice to see the portfolios firing on all cylinders again in Q3. This helped the Balanced and Growth portfolios post strong absolute and relative numbers and at the quarter end all the three core multi-manager strategies are sat on solid return numbers on a year-to-date basis.

While this is a decent place to be, our goal is of course to always try and do better. In that vein, over the last few years there has been a lot of work going on behind the scenes as it became clear that the post-Covid world was different from a market perspective to the previous environment. While we have made several incremental changes over that time, which have helped the portfolios navigate these new choppier waters, there is a more structural change that we started rolling out earlier this year, which we believe is needed to get the best out of the portfolios. That is the introduction of two new features:

- Index “anchors”

- Dedicated regional allocations

Active quality global equity managers, who have long formed the core of our portfolios, have found themselves in a tricky place in recent years. Their (sensible) tendency towards broad diversification has prevented them from capturing the strong run from the focused group of US tech stock stocks that has driven huge returns from indices like the S&P 500 (although the strength of indices has been a trend beyond the US to be fair). At the same time, when markets have rotated away from the US market darlings, it has been stock markets outside the US that have benefitted most. This is not an easy environment for global equity managers whose benchmarks contain more than 70% US stocks. They have found themselves owning the wrong bits of the US in the US upswings and not enough of the rest of the world in the counter rotations. To help mitigate this, in Q1 this year we started to introduce a new “barbell” global equity allocation, combining passives with regional allocations. This has a few positive effects:

- It helps our core global equity positions keep up in periods when flow is driving either US tech or US counter rotations strongly

- It reduces our overall US weight, which feels appropriate when the US weight in global indices is running at an historic high and geopolitics is heating up

As we go into the fourth quarter, we are looking to take another step in this direction with the introduction of a low-cost US tracker paired with an active European equity fund (although we may start with a European tracker, while we identify the right active fund). As we look forward, we are looking to further build out this allocation to better equip your portfolios to navigate a world of changing market dynamics and rising geopolitical tensions.

*Peer groups are the Asset Risk Consultant, Private Client Indices (“PCI”). These are the Cautious, Balanced and Growth PCIs for our Income, Balanced and Growth strategies respectively.

Please find performance commentary on our core multi-manager strategies below, followed by our direct equity approach, Global Blue Chip. Each strategy is available via a segregated investment portfolio or via our Titan Global Fund range. To discuss any of our investment solutions further, please don’t hesitate to get in touch.

Cautious Portfolios

Lower Risk

For the third quarter of 2025 our Cautious portfolios returned 2.7% (6) falling between the UK and International peer groups, which returned 2.8% (7) and 2.6% (8) respectively.

As was the case over the previous quarter, equities were the strongest performers in the portfolio, in a period where all underlying positions made positive gains, led by our emerging market positions. Pacific North of South Emerging Market Equity Income Opportunities and Prusik topped the performance table, returning +12.7% and +11.5% respectively. It’s worth reiterating our positive outlook for the emerging world, where we believe we’re in the early innings of a pronounced period of outperformance of selective emerging market equities relative to broad global indices.

Yields generally fell across global yield curves, while credit spreads tightened, resulting in a broad appreciation of fixed income markets. Against this backdrop our preferred Fixed Income managers all contributed positively to the portfolio over the period under review with Fermat Cat Bond +5.0% and Titan Hybrid Capital Bond +3.2% again leading the performance charts.

From a diversifier perspective, Ruffer Total Return performed as we’d expect, appreciating +3% over the quarter, continuing an impressive year for the fund after a difficult 2024. The fund has now returned +9.9% over the first nine months of the year, demonstrating a valuable source of differentiated risk-adjusted returns.

One change was made to the fund in the final week of the quarter, switching exposures within our corporate credit allocation, exiting the Rathbone Ethical Bond position, preferring an allocation to the Titan Core Credit Fund. Titan Core Credit, a Sterling corporate bond fund, offers exposure to high quality, investment grade corporates across a broad range of industries and geographic regions. The allocation will allow a number of key benefits utilising in-house expertise and products; including excellent access to the investment team and daily transparency of the fund’s underlying holdings. We expect portfolio performance to be enhanced as the new fund should deliver similar performance but benefit from a lower total cost.

Higher Income Portfolios

Medium Risk

Our Higher Income portfolios returned 3.2% for the third quarter (9), taking the year-to-date return to 8.4% (10), with the income component on track to hit the target yield of 6%.

Reviewing the third quarter, overall equities were the strongest performers in the portfolio, in a period where all underlying positions made positive gains, led by our emerging market position, Pacific North of South Emerging Market Equity Income Opportunities, which topped the performance table. It’s worth reiterating our positive outlook for the emerging world, where infrastructure spending is quietly becoming a major global economic engine with governments in the region pouring money into infrastructure, energy, and connectivity. This was followed by Schroder Global Dividend Maximiser, which experienced positive share price movements from some of its top holdings. For example, luxury goods business Kering, was the largest contributor as investors showed confidence in the new CEO’s ability to steer the luxury conglomerate in the right direction following a number of years of lagging returns. In addition, miner Anglo American announced M&A activity that was also well-received by investors.

On the fixed income side, yields generally fell across global yield curves, while credit spreads tightened, resulting in a broad appreciation of fixed income markets. Against this backdrop our preferred fixed income managers all contributed positively to the portfolio over the period under review, with Fermat Cat Bond and Schroder Strategic Credit leading the performance charts.

From a diversifier perspective, investment trust Sequoia Economic Infrastructure struggled in this environment, but post-quarter end has been aided by a Net Asset Value (NAV) uplift. The vehicle provides exposure to key growth areas longer-term such as data centres, transport and shipping infrastructure alongside environment solutions areas within solar and wind.

We made no changes this quarter.

Looking towards to the latter half of the year, markets seem to have stabilised and adjusted well to U.S. tariffs and the Federal Reserve has restarted its rate cutting cycle; supporting global bond markets into 2026.

Balanced Portfolios

Medium Risk

For the third quarter of 2025, our Balanced portfolios returned +4.5% (11), which compares to the UK and international peer group returns of +3.8% (12) and +4.0% (13) respectively. This brings the year-to-date return to +6.1% (14), which is comfortably ahead of cash rates and inflation.

Our equity exposures continue to have a wide dispersion of returns. At the end of September, Pacific North of South Emerging Market Equity Income Opportunities fund led the performance pack delivering a stellar year-to-date return of +20.6%. The fund has an income and value focus so has been a beneficiary of investment flows this year, but the fund manager has added significant value through their stock selection. In contrast, AB International Healthcare fund is at the bottom of the performance pack, delivering a return of -6.7%. Investment markets are trying to understand the profit and loss impact of America seeking favoured nation pricing status making the healthcare sector a difficult place for investors. However, we believe there is lots of value in the space and a solid thematic tailwind.

Understandably, our Fixed Income exposures have had a much narrower span of returns. At the end of September Titan Hybrid Capital Bond fund is leading the performance pack, delivering a year to date return of +7.9%. The team have added significant value through a mix of bond selection, their deep understanding of capital structures combined with their reading of credit spreads, interest rates and inflation. iShares Ultrashort Bond fund has delivered the lowest return of +3.6%. In fairness, the fund is performing exactly in line with our expectations. Due to the funds very short duration, we use it as a cash proxy and expect it to deliver returns slightly ahead of cash.

One change was made to the fund in the final week of the quarter, switching exposures within our corporate credit allocation, exiting the Rathbone Ethical Bond position, preferring an allocation to the Titan Core Credit Fund. Titan Core Credit, a Sterling corporate bond fund, offers exposure to high quality, investment grade corporates across a broad range of industries and geographic regions. The allocation will allow a number of key benefits utilising in-house expertise and products; including excellent access to the investment team and daily transparency of the fund’s underlying holdings. We expect portfolio performance to be enhanced as the new fund should deliver similar performance but benefit from a lower total cost.

Growth Portfolios

Higher Risk

Over Q3, our Growth portfolios returned +5.7% (15), which compares to the UK and international peer groups return of +5.3% (16) and +5.1% (17) respectively.

At the top level for the quarter the top three performers were Polar Asian Stars (+17.4%), Pacific North of South EM Equity Income Opportunities (+12.7%) and Landseer Global Artificial Intelligence (previously Sanlam) (+11.0%).

Most sectors ended the quarter on a positive note. Technology, materials and consumer discretionary were the top sectors over the quarter. Healthcare had a strong period, with most of the performance coming at the end of September on news of an agreement between Pfizer and the US administration. This provided a benign outcome for the company and, importantly, a template for the industry, helping to reduce policy uncertainty that had weighed on sentiment in recent months. This success is an important catalyst for the sector as a whole. Biotechnology showed notable strength, supported by lower rates following the Fed cut and expectations for two additional cuts this year, renewed M&A activity and solid clinical data. With technology at the top of the sector performance for the period, it is no surprise BlueBox Technology and Landseer Artificial Intelligence were the among the best performing funds. Emerging markets were very strong, with Polar Asian Stars and Pacific North of South EM Income Opportunities top contributors. Emerging markets have benefitted from a weaker dollar and more flows from the US.

The bottom performers over Q3 were Lazard Global Equity Franchise (-2%) and Fundsmith (-0.3%), which sit within our core equity allocation. We have been reviewing how this part of portfolios should work, as discussed in greater detail in the multi-manager update. Lazard Global Equity Franchise is a value tilted fund, which was out of favour in the risk in quarter. Fundsmith Equity is a quality growth fund, a style that has been challenging this year, as well as suffering from some stock-specific issues.

Global Solutions Portfolios

Higher Risk

For the third quarter of 2025, our Global Solutions portfolios returned +7.1% (18).

The top three performers were, Polar Smart Energy +23%, Impax Asian Environment +17% and Robeco Smart Materials 16%.

Most sectors ended the quarter on a positive note. Technology, materials and consumer discretionary were the top sectors over Q3. Healthcare had a strong period; most of the performance came at the end of September on news of an agreement between Pfizer and the US administration. This provided a benign outcome for the company and, importantly, a template for the industry, helping to reduce policy uncertainty that had weighed on sentiment in recent months. Biotechnology showed notable strength, supported by lower rates following the Fed rate cut and expectations of two additional cuts this year, renewed M&A activity and solid clinical data. Polar Healthcare Discovery and Candriam Oncology responded also positively to the news.

Emerging markets have been strong, which was reflected in Impax Asian Environment performance. Equally, Robeco Smart Materials has enjoyed strong performance this quarter. Advanced materials names delivered a solid return powered by a sharp rebound in transition metals. Stabilising lithium prices lifted Albemarle and SQM plus steady gains in energy storage contributed.

The bottom performers over Q3 were Pictet Nutrition (-5%) and Aikya Global Emerging Markets (-1%). Nutrition lagged global equities this quarter, mainly due to defensive exposure like consumer staples, which has been out of favour. Precision technologies underperformed over the period as well as the strategy’s inherent underweights to AI/communication services. Food ingredients companies IFF and Novonesis have been weaker on sector rotation and growing fears of slowing demand, despite continued strong volume growth. Food distribution lagged as Sprouts Farmers Market and Chefs’ Warehouse de-rated despite both companies raising their guidance for the year. Softer traffic at US restaurants also weighed on performance.

Aikya Global Emerging is a quality, defensive fund in the portfolio and has not kept up in a strong growth market as expected. The strategy is underweight IT services and semiconductors, which are enjoying continued excitement surrounding the potential for AI. While Asia is home to some of the world’s best semiconductor companies, they believe valuations have become increasingly difficult to justify in the short-term. Aikya’s purpose is to generate absolute returns with strong downside protection over the long-term.

Blue Chip Portfolios

Higher Risk

by Ben Byrom

The MSCI World Index had a very good quarter, returning 9% in GBP terms as the stock rally continued through the period. The Global Blue Chip strategy delivered 11%.

The third quarter of 2025 was characterised by professional investors and systematic traders alike chasing into markets, as, due to the low volatile conditions, the market continued to grind higher. Momentum around the AI investment boom attracted much of the attention but the participation across all sectors pointed to a broadening out of the equity rally, supported by better-than-expected headline GDP figures and robust corporate earnings. The market processed the bulk of corporate earnings through July and August and Global Blue Chip’s score card had a look of respectability about it with some 80% of holdings beating revenue estimates, >65% on earnings per share (“EPS”), and >70% receiving earnings upgrades from the analytical community. With that said we still incurred some of that trademark volatility, as seen by the period of underperformance in the chart during earnings season (from mid July to the end of August) where a number of stocks demonstrated “buy the rumour, sell the fact price action”.

Last quarter we wrote:

“Despite the volatility that characterised Q2 and the turnover within the strategy as we repositioned the portfolio in readiness for the opportunities ahead, the Global Blue Chip strategy exits Q2 with strong momentum.”

That momentum carried into Q3 despite earnings season headwinds. Much of it stemmed from AI-related infrastructure stocks, where our technology exposure remains focused. A surge of deal announcements captivated investors. Oracle stunned markets with news of a $300bn order from Stargate partner OpenAI for 10GW of compute capacity over five years, sending shares sharply higher — volatility, for once, working in our favour. Nvidia unveiled several major collaborations, the largest also with OpenAI, worth $100bn, as the AI leader seeks to build vast compute infrastructure using Nvidia’s Vera Rubin platform to power next-generation models.

Industrials, especially the portfolio’s defence stocks, advanced after reports of Russian military drones and aircraft violating NATO airspace over Poland, Sweden and Estonia. These incidents heightened regional security alerts and reinforced expectations of sustained European defence spending. Consequently, holdings across the aerospace and defence complex — particularly in missile systems, surveillance, and electronic warfare — rallied on expectations of expanded procurement and a structurally higher demand outlook.

Financials also contributed strongly. Interactive Brokers entered the portfolio this quarter under our Changing World theme, reflecting the ongoing disintermediation of financial services as technology-driven models streamline operations, expand margins and offer consumers a superior value proposition. Their tech-native platform provides seamless onboarding and frictionless user experience - an edge in a once-closed market ripe for disruption. JP Morgan remains widely regarded as the best-run US bank. CEO Jamie Dimon recently highlighted that benefits from the bank’s AI investments now match their spending, underscoring how technology is enhancing its margin profile and positioning it to exploit a shifting regulatory landscape.

Top Contributors & Detractors to Performance

Top 5 contributors:

- Alphabet Inc-CL C (0.92%)

- Oracle Corp (0.9%)

- Anglogold Ashanti PLC (0.69%)

- Nvidia Corp (0.68%)

- L3Harris Technologies Inc (0.65%)

Top 5 detractors:

- Haleon PLC (-0.29%)

- Netflix Inc (-0.24%)

- Givaudan-Reg (-0.23%)

- Mercadolibre Inc (-0.23%)

- Honeywell International Inc (-0.22%)

Unsurprisingly, three of the top five contributors were AI-related. While Nvidia and Oracle’s headlines drove enthusiasm, Alphabet produced the largest absolute return. Its shares surged following the Supreme Court’s ruling allowing it to retain its Chrome browser and continue lucrative default search deals with partners like Apple - a significant win given the Department of Justice’s breakup attempt. Additionally, prediction markets (Polymarket) now assign a 72% probability that Alphabet will hold the world’s top large language model by year-end 2025.

On the downside, Haleon remained under pressure after another broker downgrade tied to inventory issues in its North American unit, as consumers retrenched and traded down to white-labelled alternatives. Givaudan and Honeywell also showed margin pressure, with pricing and volumes hit by the current macro environment. Netflix, despite solid earnings, saw some profit-taking as its guidance failed to surprise on the upside.

A number of transactions were carried out in the portfolio as we finalised the re-positioning of Global Blue Chip to align it more with the strongest trends shaping the world around us. More details on these trades can be found in our quarterly insights newsletter.

Stock in Focus

CrowdStrike

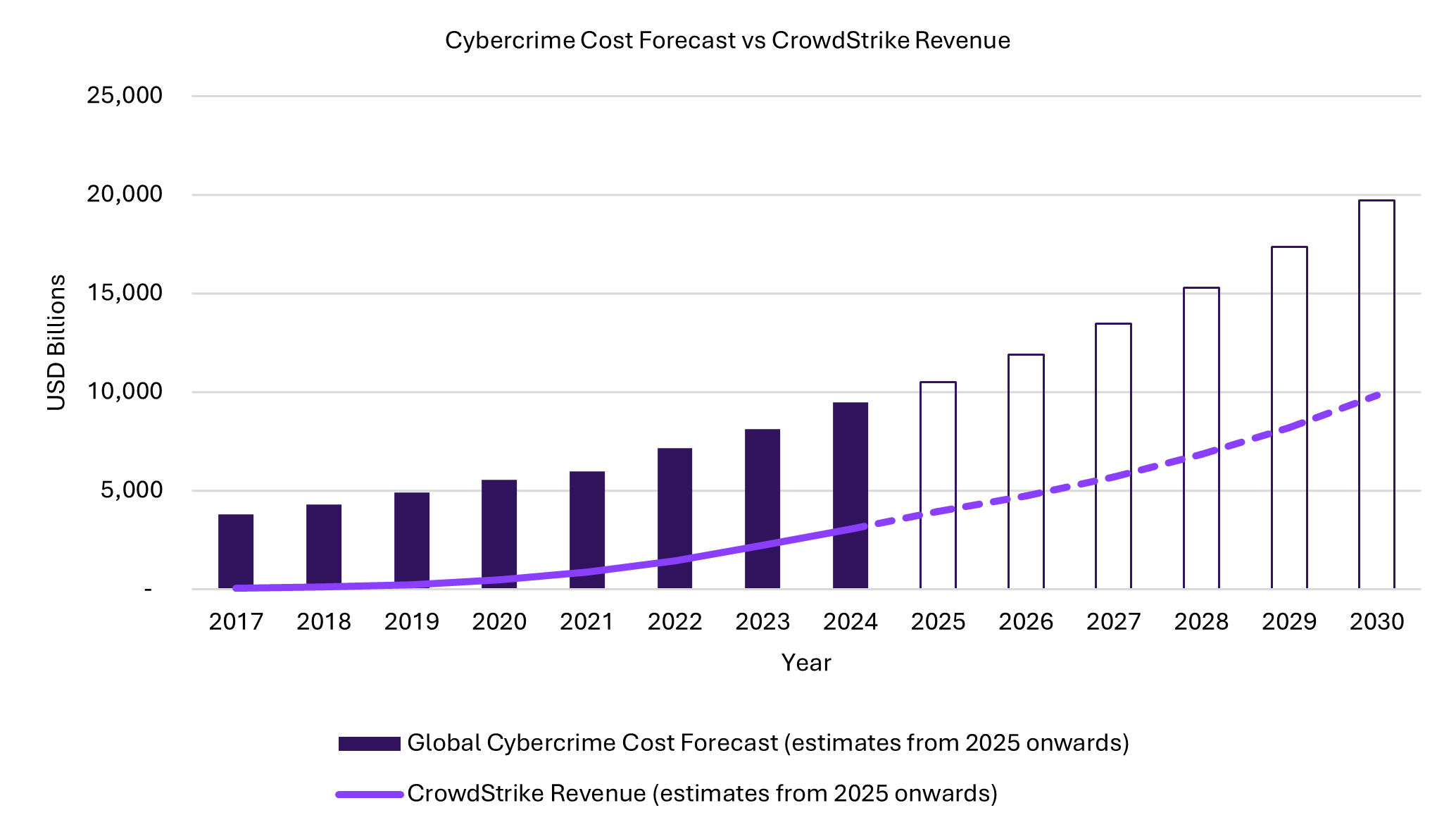

Cybersecurity is no longer a nice-to-have line item on IT budgets, but a foundational requirement for modern economies given the changing world we are in and the evolving nature of cyber-attacks as part of a rapidly evolving theatre of war between nation states.

As demonstrated above, global cybersecurity spending is forecast to rise steadily in the high single to double digits annually as enterprises recognise the stakes as existential. Be it purely reputational damage and regulatory liability from downtime, to a business being unable to operate at all. In short, cybersecurity is now a structural growth market from an investment perspective, because it’s something that people, businesses and governments cannot live without.

Enter CrowdStrike. CrowdStrike emerged in 2011 as an offshoot from McAfee, founded by George Kurtz and Dmitri Alperovitch, with the simple - but radical - idea that endpoint protection should be cloud-native from day one. Instead of layering bulky software onto each device, they created Falcon – a single platform that supplies users, direct from the cloud, with multiple security modules that run off the same data. It was elegant, scalable and, most importantly, effective. High-profile wins in attributing the Sony Pictures hack to North Korea and the DNC breach to Russia cemented its credibility.

Since then, CrowdStrike has become the leader in modern endpoint security, with ~18% market share ahead of Microsoft. Its Falcon platform has expanded into over 20 modules covering identity protection, cloud workload defence, vulnerability management, log management and managed threat hunting.

The firm’s Flex licensing model now underpins customer adoption by removing procurement friction, deepening module penetration, and producing higher-value, longer-term deals. On average, Flex customers use nine modules, with contract values rising sharply after renewal – largely due to initial discounts burning off as customers remain sticky at renewal time, as well as customers generally seeking more modules to improve their level of protection. For a company built on subscriptions-as-a-service (SaaS), that is exactly the kind of ratchet investors like to see.

Organic growth has been supplemented by targeted acquisitions, such as Humio for log management, Preempt Security for identity threat protection, and most recently Pangea to extend AI detection and response capabilities. Execution has been matched financially with the company transitioning into GAAP profitability while retaining enviable gross margins north of 80% on subscriptions.

The pièce de resistance, though, is CrowdStrike’s agentic AI, Charlotte AI. It is designed to act as a co-pilot for security teams: automating triage, threat hunting and response in natural language. Its effectiveness stems not just from model architecture, but from the trillion-plus proprietary data points CrowdStrike collects daily. The crucial differentiator in AI’s effectiveness is the amount and quality of data. Data, in the realm of AI, is a genuine moat, and no competitor has a comparable telemetry set spanning endpoints, identities and cloud workloads.

CrowdStrike sits at the nexus of a structurally expanding market, with secular demand tailwinds and a business model that monetises breadth as well as depth. Financially, management guides towards >20% net new annual recurring revenue growth, 24%+ operating margins, and 30%+ free cash flow margins in FY27 – highlighting the operational leverage we seek in well-managed businesses. Risks are not absent though; these include Microsoft’s monopolistic bundling power which remains formidable, new upstarts lurking as ambitious challengers to specific modules, and cybersecurity companies being prone to negative headlines if they make just one mistake. But CrowdStrike has consistently demonstrated both innovation and execution to so far overcome these disruptions.

Cyber security is no longer optional, and CrowdStrike provides critical infrastructure in a world where a single breach can cripple economies, throw hospitals into chaos and result in no food on your shelves. This is a potential crisis for which the likelihood will only grow, meaning the likes of CrowdStrike will only become more necessary – and hence a company we see as a core structural piece of our portfolio.

Data sources:

- MSCI World, GBP Total Return 30/06/2025 to 30/09/2025. Source: FEfundinfo.

- Titan Global Blue Chip, GBP Total Return 30/06/2025 to 30/09/2025. Source: FEfundinfo.

- MSCI EM, GBP Total Return 30/06/2025 to 30/09/2025. Source: FEfundinfo.

- MSCI World, GBP Total Return 30/06/2025 to 30/09/2025. Source: FEfundinfo.

- MSCI China, GBP Total Return 30/06/2025 to 30/09/2025. Source: FEfundinfo.

- GBP Titan Cautious Model Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: Titan Wealth (CI) Limited.

- Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- Asset Risk Consultants Sterling Cautious Private Client Index, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Higher Income Model Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Higher Income Model Performance Data, Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Balanced Model Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- Investment Association (“IA”) Mixed Investment 20-60% Shares Sector, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- Asset Risk Consultants Sterling Balanced Asset Private Client Index, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Balanced Model Performance Data, Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Growth Model Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: Titan Wealth (CI) Limited.

- Investment Association (“IA”) Mixed Investment 40-85% Shares Sector, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- Asset Risk Consultants Sterling Steady Growth Private Client Index, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Global Solutions Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: Titan Wealth (CI) Limited.

- MSCI World, GBP Total Return 30/06/2025 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Global Blue Chip Model Performance Data, Total Return 30/06/2025 to 30/09/2025. Source: Titan Wealth (CI) Limited.

All performance data above was collated on 16/10/2025.