Key highlights:

- Global growth looks relatively stable, but is slowing modestly in the US.

- Inflation is mixed, remaining above target in the US and UK, although stable. It is less of an issue in Europe and many emerging markets, whilst China is struggling with deflation.

- Led by the Federal Reserve (“Fed”), central banks will continue to cut rates but maybe not as much as expected, as growth accelerates and fiscal policy becomes increasingly expansive.

- Our fixed income strategy remains focused on credit quality, shorter maturity issues and attractive yields.

- Equities should continue to “climb the wall of worry”, but market leadership is changing.

- The dollar is likely in a bear market long-term and sterling is also at risk.

- The “changing world” and “fracturing global economy” themes will be powerful influences on the economy, financial markets and policy makers for years to come.

- The macro background is changeable, uncertain and provides both risks and opportunities. Therefore, a different investment strategy is required.

As we approach the final quarter of the year, the global economy appears to be weathering the challenging macroeconomic backdrop relatively well. It’s true that we remain in a period of significant change and policy uncertainty, so nobody really knows where we are headed, but at this juncture, global growth looks relatively stable. The US is key here, and although there are some signs that the economy may be softening, especially the labour market, the risk of a serious slowdown or recession seems low at this point. The consumer remains strong, businesses are investing heavily in AI and new technologies, and although fiscal policy is acting as a modest drag largely due to Trumps tariffs, the “One Big Beautiful Bill” is expansionary and should soon counter the impact from tariffs.

Importantly, China, as the world’s second biggest economy, is also embarking on targeted monetary and fiscal easing to improve its growth prospects. It is also encouraging to see Germany abandon its fiscal restraint and target higher growth, which should benefit the rest of Europe as well. Looking forward to next year, the combination of expansionary fiscal policy in many G7 economies, lower interest rates, cheaper energy prices and an easing of the uncertainty around tariffs should see a modest acceleration in global economic activity.

Tariffs, trade and the economic impact

It’s still early days, but so far tariffs are slowing global trade slightly and likely having a negative impact on US growth, but not as significantly as expected. It appears that some foreign exporters are absorbing part of the impact through the weaker dollar, whilst many US companies are not fully passing on the increased costs and are happy to take a margin hit. We are yet to see the real impact on US inflation, but, again, it will probably be less than expected, especially as the outcome can still change. In addition, tariffs are a one-off increase, similar to a tax hike. Importantly, as the new tariff levels settle down, this will become less of an issue for business and consumers.

Inflation trends

The outlook for inflation is mixed. Although it remains uncomfortably above target in the US and UK, it has stabilised. Meanwhile, China continues to be mired in deflation while in Europe and many emerging economies, inflation is less of an issue. I’ve previously talked about the longer-term outlook for inflation in terms of fire vs ice, and the jury is still out on this one. In many of the world’s biggest economies, it’s likely, in my view, that inflation will remain above the central bank targets for some time due to several factors. These include ageing populations, shrinking work forces putting upward pressure on wage growth, expansionary fiscal policies, relatively easy monetary policies (central banks will find it very difficult to increase rates and will need to keep bond yields from rising too high given all of the debt in the system), the fracturing world and other government challenges such as income and wealth inequality and climate change. We are likely in a world where 2% is the new floor for inflation in the major economies and central banks will tolerate inflation in a 2-4% band as policy makers target higher nominal growth. One caveat here is that the US is currently enjoying an investment boom as companies look to boost productivity through investment in AI, Cloud computing, biosciences etc.

Central bank policy divergence

The Fed is cutting rates in light of a softening employment market, inflation is stable and the risks to growth have switched to the downside in the short term. Clearly, there is a lot of political pressure on the Fed and Trump will keep trying to influence policy over the coming months, which could be negatively interpreted by the markets. The expectation is that the Fed will cut rates twice more this year and two or three times next year. I broadly agree with this, although I think it is likely that rates may fall less than expected next year as both US and global growth accelerate and as inflation starts to rise again.

Elsewhere, I think the Bank of England (“BoE”) will keep rates on hold for this year and maybe next due to high inflation and rising inflationary expectations. Having said that, I think the UK may be headed for an economic or financial crisis, due to faltering growth, stagflation, rising public sector deficits and debt and unsustainable fiscal policies. If this occurs, we would likely see a recession, a significant fall in sterling and higher Gilt yields, which would force the BoE to step in with quantitative easing (“QE”) and maybe rate cuts. Meanwhile, the Bank of Japan (“BoJ”) will keep raising rates as inflation takes hold for the first time in three decades, whilst China and many other emerging economies should be able to gradually reduce rates. European rates are likely on hold for a while, especially as Germany and other countries pursue a more expansionary growth strategy.

Fixed income and equity strategies

Given this macro environment, we have been advocating a relatively defensive fixed income strategy for the past year or so, which has focused on investing in shorter-dated maturities and attractive quality yield where available. This strategy remains appropriate. Sovereign bonds, and especially US Treasuries, are under pressure from rising fiscal deficits, the risk of higher long-term inflation, international investors choosing to hold less US assets due to Trump’s policies and the weaponisation of the dollar and an ageing demographic (less savers and more drawing down on borrowings). This will result in higher risk premiums for long-duration bonds. Credit markets have performed strongly and as long as global growth holds up well, which we expect, the sector is still attractive from a yield perspective, especially high-quality investment grade issues. Care is also required regarding UK credit, should a crisis emerge. In addition, there are some interesting opportunities in specialist debt, such as cat bonds, EM debt and hybrid bonds, all of which are offering very attractive yields.

Equities have recovered strongly from their April lows, despite a background of continued uncertainty and negative media headlines. The key drivers of the rally have been decent earnings growth, thanks to a resilient US and global economy, the anticipation of expansionary fiscal policies and interest rate cuts, plentiful cash/liquidity in the system, which is looking for attractive long-term returns, continued excitement around AI, the weaker dollar; and a gradual easing of concerns around the tariff war. Given the macro backdrop which I have described, I think that equities can continue to make progress over the next year or so, although sentiment does look a little extended in some areas and markets may pause for breath at some point soon. However, any pullback in markets would likely be a buying opportunity unless the US economic outlook deteriorates significantly or we get some unexpected geopolitical shock.

The recovery in many of the US mega-cap growth stocks has been very impressive and is based on the strong earnings and revenue outlook as well as the excitement around AI. Valuations are starting to look stretched in some stocks, and a period of consolidation should be expected, particularly as concerns are emerging about the potential return on the billions being poured into AI investment (as discussed by my colleague Ben Byrom in a recent update). Longer-term, though, these stocks are likely to continue to trade at a premium and move higher due to the strong fundamental backing and a more favourable economic picture.

Outside of the US, stocks are generally rising for similar reasons to above, but also because investors are anticipating stronger global growth as Europe, China and Japan all follow expansionary policies, which should be positive for earnings. Valuations also look reasonable in these markets, especially in sectors such as cyclicals and value. It is probable that small- and mid-cap stocks may also join the rally if economic activity accelerates as expected over the next few months. In addition, emerging market equities are likely in the early stages of a bull market thanks to the combination of stronger global growth, a weaker dollar, attractive valuations, shifting global trade patterns, the likelihood of appreciating currencies and falling interest rates.

Currency market dynamics

We have been negative on the US dollar for a while – a call that has proved correct. We remain bearish on the long-term outlook for the currency due to rising deficits, growing levels of public sector debt, the fracturing world theme, international investors’ diminishing desire to support US policies and assets, and a Fed that seems content to easy policy into a resilient economy. Having said that, I also think sterling is likely to depreciate sharply should the UK suffer a crisis, as I expect. The risks are definitely rising, and it makes sense to retain a significant exposure to non-Sterling assets for sterling-based investors. I am also positive on the outlook for many Asian currencies, including the Yuan and the Japanese Yen, where the BoJ is gradually returning rates to a multi-decade high as growth and inflation prospects improve.

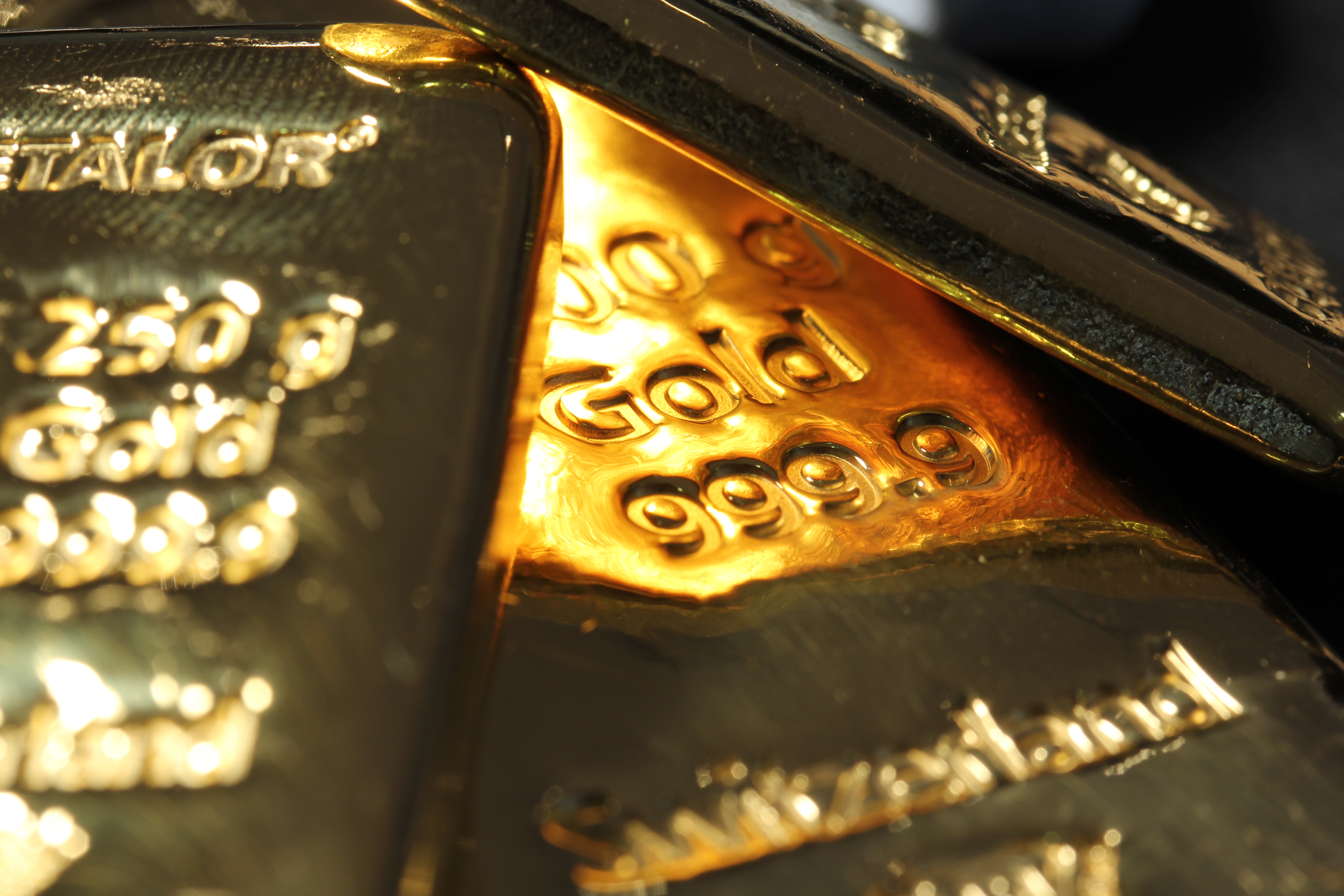

Gold & commodities

Gold has risen to all-time highs over recent months and remains in a bull market given the macro environment that I have described. Central banks are big buyers of gold as they diversify their reserves away from US Treasuries and other dollar assets. It is also likely that China and its allies will start to trade with each other in a currency other than the dollar and are actively considering backing this with gold. At the same time, retail investors are attracted to gold due to rising deficits and debts, the devaluation of fiat currencies, the likelihood of higher long-term inflation and an increasingly uncertain geopolitical world. Other commodities could also be in the early stages of a bull market if global growth accelerates as expected and given the impact of the changing world order and fracturing global economy.

The strategy for the future

I have previously explained how the “changing world” and “fracturing global economy” will be powerful influences on financial markets and policy makers for years to come. As the US and its allies line up against the China-led bloc, it’s clear that this is having a huge impact on the global economy, trade, capital flows, government and central bank policies, investment decisions, financial markets and politics (reflected in a change in many incumbent governments and a move to populism and extreme politics on both sides). Whilst there are many reasons for concern here, there are also going to be plenty of opportunities for savvy investors to take advantage of this. In addition, whilst many of these changes are potentially negative for economic activity and inflation, there are some positives as well, provided that policy makers and businesses respond decisively and in the right manner, i.e. expansionary fiscal policies, productivity-led investment boom etc.

I remain optimistic on the economic and market outlook despite the gloomy headlines and fast-changing macro environment. Markets, and equities in particular, are likely to continue to climb a “wall of worry” over the next year or so. The key risks for markets are a worse-than-expected slowdown in the US, a China deflationary bust, escalating tensions in Middle East/Europe resulting in higher energy prices, a UK economic or financial crisis and a spike in US Treasury yields.

I am still firmly of the view that a different investment strategy will be required for the next five to 10 years compared to what proved successful over the period from 2008 to 2020. We are in a very different world from that which prevailed back then. For all of the reasons already discussed, and including a gradual decline in US exceptionalism, investors will need to be more flexible and adaptable in their approach, deploy different hedging/diversifier strategies, manage currency exposure more actively, understand that equity leadership is changing and manage risks very carefully. The good news is that the outlook is positive with lots of great opportunities for those investors that do adapt as needed, which, of course, is our aim as we strive to deliver good returns for you, our valued clients.