Alex Finer, who is part of our discretionary investment team in Guernsey, writes this week’s update.

This week was particularly eventful in global affairs, with several major developments coinciding in quick succession. The US President’s second state visit to the UK took place from 16th to 18th September, setting the political and economic tone. Midway through his visit, the Federal Reserve delivered its first rate cut of the year, trimming rates by 25bps.

The week then closed with the Bank of England’s decision on 18th September to hold the Bank Rate steady at 4.0% - choosing caution over the latest inflation prints remaining at 3.8%, which means the prospect for further interest rate cuts this year very much hang in the balance.

The spotlight was firmly on the unprecedented second state visit of President Donald Trump to the UK, with an increased costing estimated at £15 million. Far from a purely ceremonial affair, the visit was designed around deepening economic ties. The state banquet at Windsor underscored this, bringing together leaders of politics, business and technology, including Tim Cook (Apple), Jensen Huang (Nvidia), Sam Altman (OpenAI), Stephen Schwarzman (Blackstone) and Rupert Murdoch.

The outcome was striking: a record £150 billion of inward investment commitments from US firms – the largest commercial package ever secured during a state visit. To put this in perspective, it dwarfs the £40 billion of deals struck during Xi Jinping’s UK visit in 2015 and exceeds the expected £25.5 billion annual trade boost from the newly signed India–UK FTA.

It also delivers on the government’s “Plan for Change” strategy. For Prime Minister Keir Starmer, it provided a much-needed positive backdrop amid domestic economic challenges such as rising inflation, sluggish GDP growth and mounting fiscal pressure – challenges our CIO, Kevin Boscher, discussed in his recent macro update “Is the UK headed for an economic crisis?”

However, despite the listed benefits, broader debt concerns persisted. At the time of the investment release, government borrowing came in significantly higher than forecast, with the deficit after just five months of the fiscal year reaching £83.8 billion – £11.4 billion above the OBR’s expectations and the second highest since records began in 1993, behind only the pandemic year of 2020. Thirty-year gilt yields remain elevated at 5.5%, reflecting ongoing investor unease.

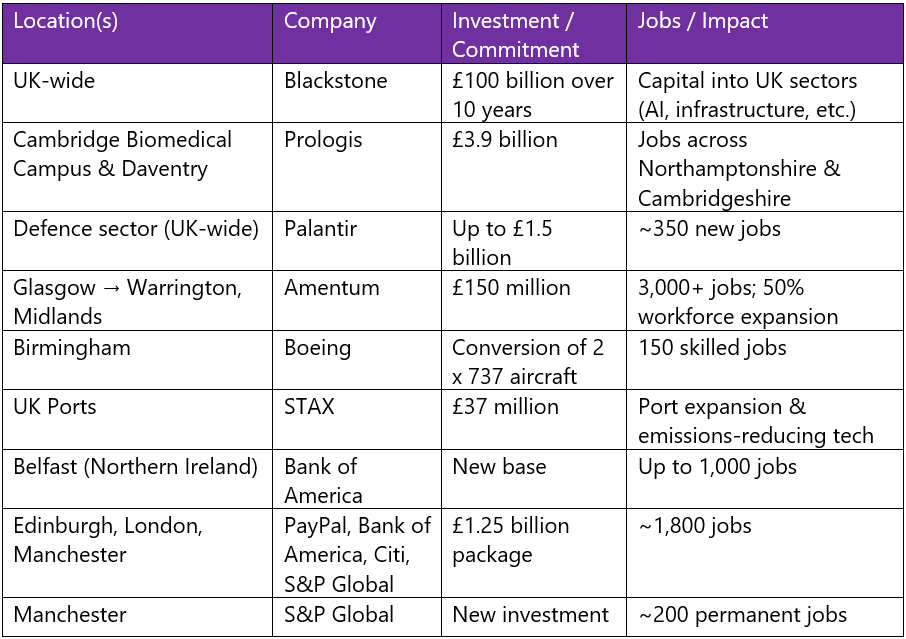

Importantly, the £150 billion will not be concentrated in one region or sector. More than 7,600 jobs are set to be created across the UK, with funds flowing into clean energy, life sciences, and advanced manufacturing – all central pillars of the UK’s Modern Industrial Strategy. Technology will also see a strong lift, with Microsoft, Google, and others pledging major cloud and AI infrastructure investments, including an AI supercomputer project.

“When we back British brilliance, champion our world-class industries, and forge deeper global alliances — especially with friends like the US — we help shape the future for generations to come and make people across the country better off.” - Prime Minister Keir Starmer

The below showcases the expected investment in the UK:

Portfolio Implications

The investment package also reinforces the strong momentum we have seen in AI and broader growth technology stocks, which continue to drive the bullish trend that has been in place since the spring.

Within our multi-manager range, both the BlueBox and Sanlam allocations have delivered strong results, advancing 5.4% and 5.7% so far in September alone (as at 18th September), with each now showing double-digit gains from the April lows. Meanwhile, our Titan Global Blue Chip Fund, with direct holdings in global leaders such as Apple, Nvidia, Broadcom, Oracle, TSMC and Microsoft, has been particularly well positioned to capture this upside, with year-to-date performance of 7.5%.

Importantly, our Blue Chip strategy does not rely solely on technology. The portfolio is structured as a barbell: on one side, exposure to the transformative long-term growth of cloud computing, semiconductors, and AI infrastructure; on the other, our changing world theme, which allocates to wider industrials, defence companies and materials suppliers addressing the immediate needs of governments and consumers in an evolving geopolitical and economic landscape. This complementary positioning allows the Blue Chip fund to participate fully in the innovation wave while also capturing the benefits of increased trans-Atlantic investment flows into energy security, defence, and advanced manufacturing.