As we move into September – back to school for many and back to work after summer holidays for others – it feels like the opportune moment to recap and review a couple of key topics following a mixed summer for markets.

The summer months are historically some of the most volatile, and whilst this year was no exception, at least from a headlines perspective, markets have remained relatively resilient throughout; the S&P 500 even reached a new all-time high last Thursday (28th August).

Over the last few months we’ve seen some key influences, most notably the continued dominance of AI and ongoing geopolitical and trade tensions. Increasingly, these tensions now include rising legal uncertainty around the legitimacy of some US tariffs, a development many will be watching closely.

Continued dominance of Artificial Intelligence

AI has been a major market driver, particularly in the US, leading performance not only in the technology sector but also driving a recovery in markets overall since lows in April. As ever, Nvidia has been the one to watch, with the chipmaker managing to set a new sales record in Q2.

Despite high expectations from analysts, overall, the numbers slightly missed the mark, leading to a few weaker trading days. This reflects investor caution around valuations as well as uncertainty over the repercussions of the US–China trade war - with chips at the forefront. Nvidia has looked to manage the impact, and expectations, in this respect. In August, the company agreed to give the US government a 15% cut of its H20 chip sales to China in return for export licences, while also preparing for the worst-case scenario of no shipments in its future earnings guidance.

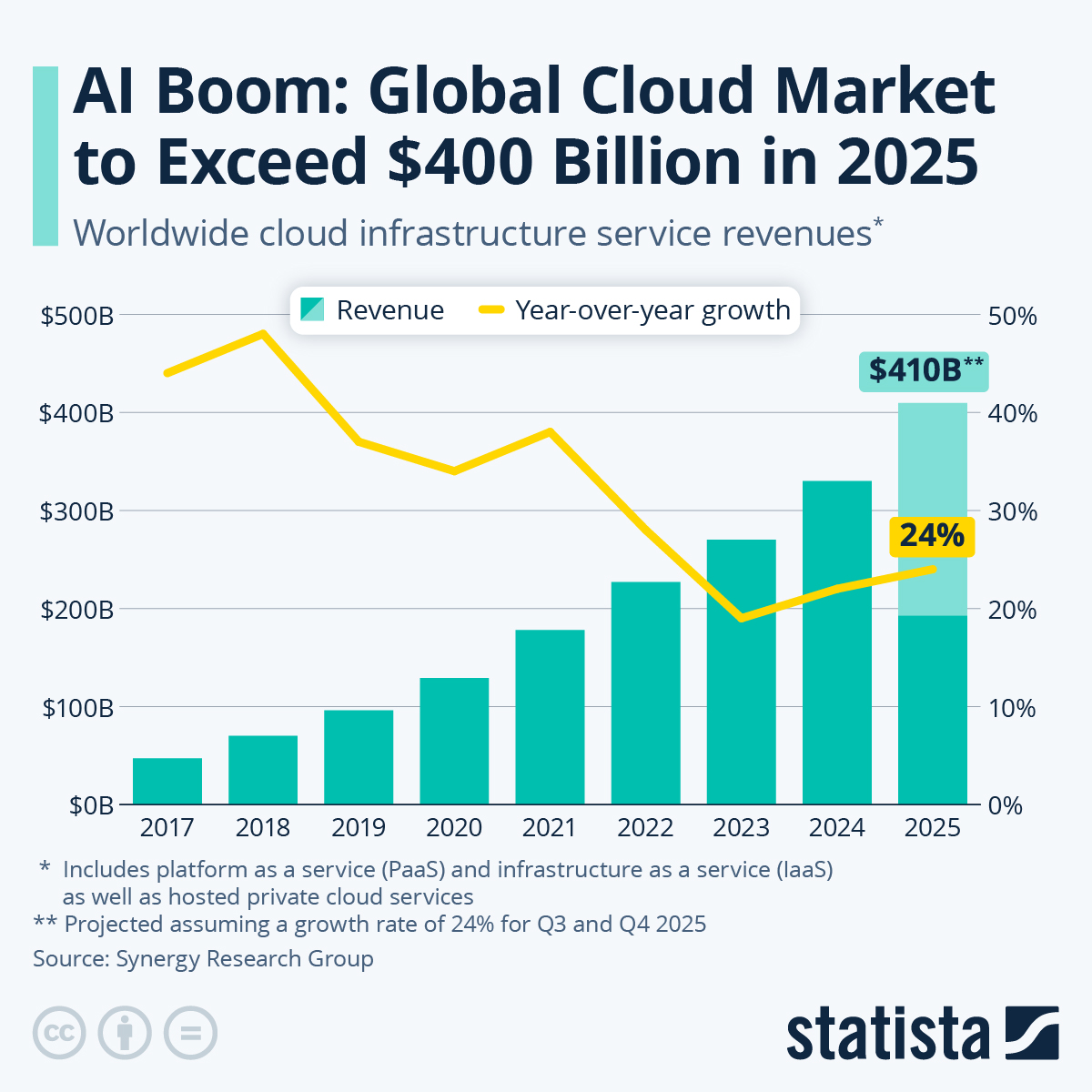

Reviewing actions of other major technology companies such as Meta, Microsoft, Amazon and Alphabet, the optimism isn’t over, as reflected in their continued investment in AI infrastructure. They continue to build and expand data centres, acquire high-performance GPUs and custom chips, and enhance cloud networks to power advanced AI models. Many have doubled their AI capital expenditure spend this year relative to last year, with total sums in the region of $150bn being quoted and expectations that this will hit $400bn by year-end – suggesting the trend is certainly not over yet.

Ongoing geopolitical and trade tensions

Trade disputes and proposed tariff policies, with new tariffs on more than 90 countries, have impacted investor sentiment and influenced trade flows. Some of the more notable tariffs include:

- India: Tariffs stand at 50%, with a 25% penalty for transactions with Russia (predominately oil) – this being a key source of funds for its war in Ukraine. Until recently, the US was India’s largest trading partner, but Prime Minister Modi shows no signs of cutting links with Russia, focusing on obtaining the best deal for its 1.4bn population. Instead, to combat the tariff impact, tax cuts for both individuals and businesses have been promised alongside a drive to become self-reliant, with the slogan “make and spend in India”.

- South America: Mexico is currently in a tariff pause but has increasingly showed alliance with the US, raising its own set of duties on Chinese goods targeting cars, textiles and plastics in order to protect local industries. Brazil on the other hand, is facing 50% tariffs, citing unfair trade practices, and has officially initiated dispute consultations at the World Trade Organization and is considering introducing a reciprocity law.

- Europe: A deal was struck to cap tariffs at 15% on many industrial exports to the US, including cars, which is in fact a reduction that took effect on 1st August. Many specific products are also exempt (from today), including aircraft, aircraft parts and generic pharmaceuticals. As you would expect, there has been two sides to these deals with many citing that favourable terms have been given to the US. Not only has Europe eliminated tariffs on all US industrial goods, but they have also provided preferential market access for certain US agricultural products and committed to significant to investment in US energy products, AI chips and defence.

Looking ahead, while trade tensions remain a headwind, now compounded over the legal uncertainties, the ongoing momentum in AI shows there is still plenty of opportunity for growth, and balance will therefore be key.