“There’s a starman waiting in the sky,

He’d like to come and meet us,

But he thinks he’d blow our minds.”

David Bowie, “Starman” (1972)

As we moved from December into January, it marked not just the beginning of a new year but a full year and one month since we joined the Titan Wealth family. Reflecting on the past 12 months, it’s clear that the move has been one of the most positive developments in our firm’s history. The connection we have built with the broader Titan team, especially with the London-based asset management group, has been particularly fruitful. There has been a collaborative spirit between the teams and the combined experience and knowledge has genuinely enhanced the way we think about markets, portfolios and the opportunities in front of us.

One of the things I’ve appreciated most over this period is how much challenge is not only encouraged but welcomed. In a world where groupthink can be all too common, the ability to interrogate ideas, test assumptions and consider alternative views has been a real differentiator for us. Challenge doesn’t mean conflict for its own sake. It means honest dialogue that sharpens thinking, strengthens conviction and ultimately leads to better outcomes. That culture of open, constructive challenge has been central to how we’ve evolved this year. We’ve seen it in portfolio discussions, in strategy reviews and in the way we’ve adapted to changing market dynamics. Admittedly it’s not always easy, and it’s certainly not always comfortable, but it’s unquestionably valuable. It ensures that we don’t become anchored to yesterday’s thinking when tomorrow’s realities inevitably demand fresh perspectives.

In terms of performance, I’m pleased to report that this approach has translated into strong outcomes. The majority of our strategies finished the year ahead of their ARC peer group indices, a performance we view as a validation of both our philosophy and execution. In particular, the Global Blue Chip Fund delivered a +11.8% (1) return over the year, a reflection of its quality focused, resilient positioning across global markets. Likewise, our Higher Income Fund returned +11.0% (2), underscoring the strength of our income-oriented allocations even in a year marked by volatility and shifting macro dynamics. These aren’t numbers we take for granted, but they do reflect the outcome of disciplined investment processes and a willingness to challenge consensus where appropriate.

There’s no question that 2026 will bring its own set of challenges. Days into the new year, we already have geopolitical concerns, from Venezuela’s ongoing instability to broader global tensions, creating a wall of worry for markets to climb. Uncertainty around inflation, monetary policy moves and global trade dynamics sits squarely on investors’ radar. And yet, as much as challenges are part of the investment landscape, so too are reasons for optimism.

The world continues to innovate at an astonishing pace. From the rapid adoption and integration of artificial intelligence to breakthroughs in healthcare, energy and connectivity, the pace is relentless and, in many cases, quite literally mind blowing. Recent global technology forums and corporate outlooks have repeatedly highlighted that AI is not just a sector theme but a foundation for broad economic transformation that will reshape how businesses operate, how products are developed and how services are delivered.

This technological momentum is reflected in market behaviour too. Early 2026 has seen strong equity market gains, with major benchmarks reaching new highs on optimism about ongoing earnings growth and innovation driven expansion. While there are risks, including valuation pressures and inflationary concerns linked to heavy investment in technology, the underlying narrative is one of progress, not stagnation.

So, as we begin another quarter and another year, it’s worth remembering that optimism isn’t naivety. It’s a recognition that human ingenuity has repeatedly overcome barriers throughout history. Yes, there will be setbacks. Yes, there will be volatility. But if we maintain rigorous challenge, disciplined thinking and an eye on the long term, we are well placed to navigate whatever comes next and to capitalise on the transformative trends shaping the world ahead.

Here’s to a 2026 filled with opportunity and progress.

Market Update

by Blair Campbell

The last quarter of 2025 proved to be a positive one for risk assets, capping off a remarkable year, rewarding investors who stayed invested after the turmoil of April’s “Liberation Day” sell-off, ignited by Donald Trump’s tariff policies.

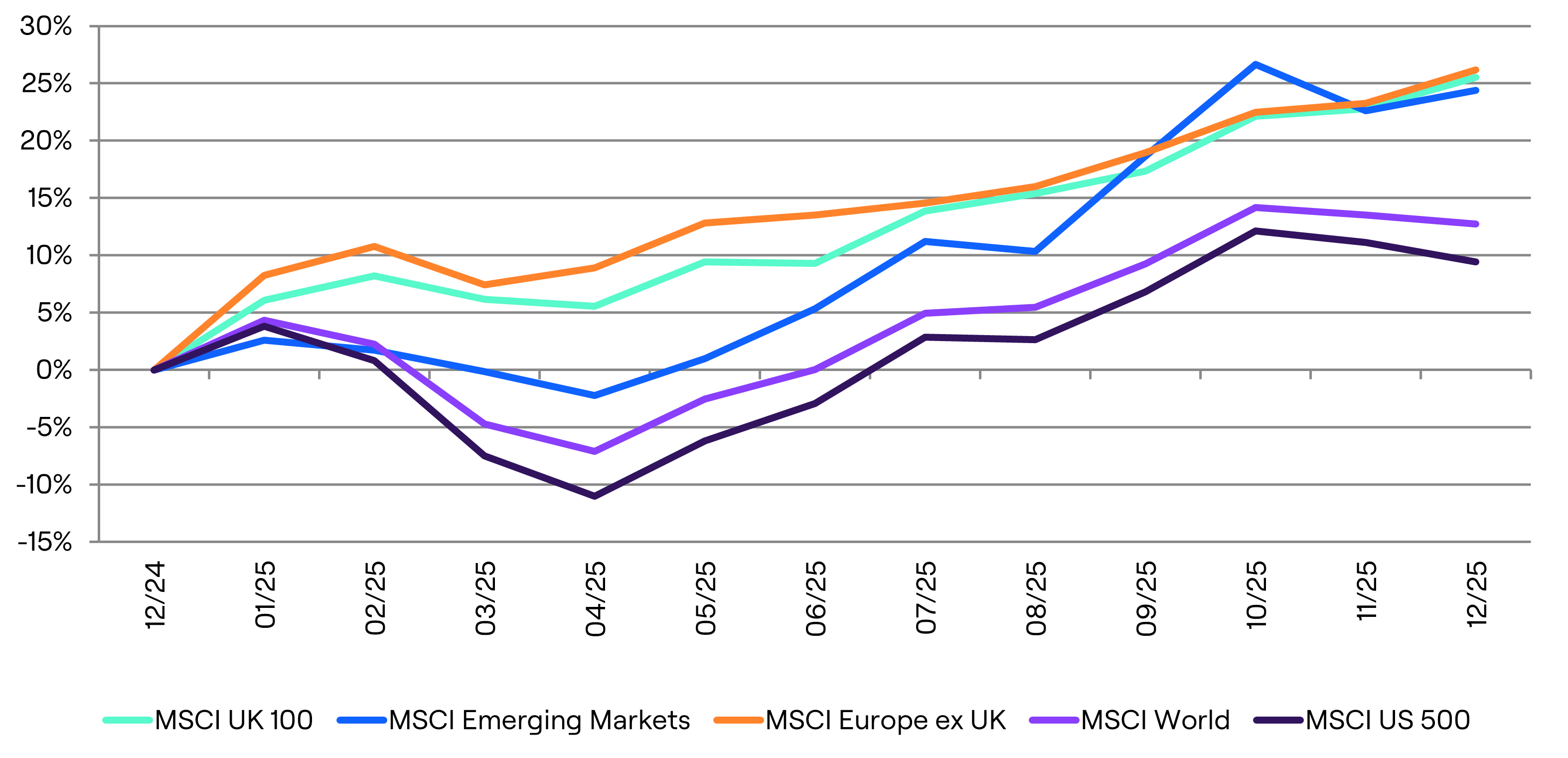

From an asset class perspective, commodities lead the way, particularly precious and industrial metals, while the healthcare (+10.7%) (3) and materials (+5.3%) (4) sectors outperformed from an equity standpoint. Emerging markets outpaced their developed counterparts, though there were wide disparities between underlying constituents. Fixed income markets were broadly positive, albeit Japanese bonds sold off in response to a continuing normalisation of interest rates and the potential of further stimulatory measures.

Emerging markets returned +4.8% (5) over the fourth quarter taking full year returns to +24.4% (6) and the first calendar year outperformance of developed market equities (MSCI World Index +12.8%) (7) since 2020. US equities underperformed their regional peers, where investor sentiment toward the AI trade cooled, following an announcement by Alphabet during the quarter that suggests Nvidia’s dominance in the industry could be challenged on account of Alphabet using its own chip infrastructure to build out its AI offering. Alphabet subsequently returned +28.8% (8) over the final three months of 2025 whereas Nvidia’s stock price remained flat. The news caused selling pressure in technology companies in the US, whose stock indices are heavily weighted to the sector, having been the beneficiaries of AI spending throughout 2025. As measured by the MSCI US, US equities returned +2.7% (9), on a total return basis.

Investors in European indices were far more buoyant, where indices are characterised by a higher weighting to companies in the mining and pharmaceutical industries, alongside companies that are concerned with the defence industry. On a constant currency basis, the UK returned +6.9% (10) over the quarter, marginally outstripping the European ex UK index return of +6.1% (11).

Japanese equities had a solid finish to the year appreciating +9.6% (12), in local currency terms, as investors weigh up the likelihood of a further loosening of fiscal policy.

As with equities, emerging economies outperformed in debt markets, owing to the relative depreciation of the US Dollar versus emerging currencies, stable economic fundamentals and a willingness of investors to accept risk. Broadly speaking developed sovereign debt markets were also positive, finishing the year off on a high. Whilst inflation hasn’t gone away, employment and growth data are such that the expectation is for rates to decrease rather than be raised. As per the Bloomberg benchmark government bond indices, the UK returned +3.3% (13) in sterling terms, while the US Treasury market returned +0.9% (14).

Multi-Manager/Asset Strategies

by Bob Tannahill

Looking back over 2025, politics dominated the headlines and, as reflected above over the quarter, geography had an unusually large impact on portfolio returns. While most regions and asset classes posted solid returns over the year, there were some clear leaders and laggards on the equity side geographically. The US gave up its crown as market leader and other parts of the world, emerging markets and Europe, posted the strongest gains.

Currency also had a impact; while a US-based investor may be pretty happy with US stocks posting 17.6% (15) in US dollar terms, thanks to a material dollar devaluation over the year, a UK-based investor may be less impressed with the same stocks returning a more modest 9.5% (16) in sterling terms.

Combining this strong equity market with a well-behaved bond market, and you have a year where most portfolios made good money in absolute terms. We are very pleased to see your portfolios repairing some of the damage that was done to their purchasing power by the 2022 inflation shock.

With such disparity between regional equity returns, however, even small differences between portfolios had an outsized impact. And with the world sadly looking to be in a period of geopolitical tension, we are conscious that this regional equity volatility could easily continue. On the back of this, across our core multi-manager portfolios, we focused on increasing the geographical diversification. We have been doing this by adding regional equity positions alongside our core global and thematic equities – both passive and actively managed approaches. We began this with a dedicated UK position in March, continued with European positions later in the year and are currently looking at Japan. The aim here is to reduce the natural US bias we get from our core global equity funds, ensure we have effective levers, and ultimately increase the robustness of your portfolios to this type of geopolitical uncertainty.

Looking forward, while the debate rages on over the sustainability of the amazing run we have seen out of large US tech stocks, global growth is holding up relatively well, inflation continues to grind lower and investment is rising (be that data centres in the US, defensive infrastructure in Europe or trade infrastructure in Asia). At the same time, we have reasonable equity valuations, outside of the hot spots and appealing corporate bond yields.

This together provides us with a decent base to deliver future returns from - we just need to navigate the geopolitical storms to get there.

Please find performance commentary on our core multi-manager strategies in the following pages; Cautious, Higher Income, Balanced, Growth and Global Solutions, followed by our direct equity approach, Global Blue Chip. Each strategy is available via a segregated investment portfolio or via our Titan Global Fund Range.

In respect to performance reporting, we are looking to harmonise both our client portfolio and fund level reporting. As part of this, we will report principally versus the international peer group (ARC Private Client Indices) in the future.

If you would like to discuss any of our investment solutions further, please don’t hesitate to contact a member of the team.

Cautious Portfolios

Lower Risk

Our Cautious portfolios had a solid 2025, finishing a choppy year up a healthy 8.2% (16) ahead of both the UK and international peer groups, which posted 7.8% (17) and 6.6% (18) respectively.

As above, 2025 proved to be a volatile but ultimately rewarding year for investors.

Within the portfolio, on the equity side the big winners were our emerging market positions Pacific and Prusik. These posted an impressive 28.2% and 19.0% respectively, reflective of the growth experienced across the region. In third place was our more European-biased global fund, Fidelity, which returned 15.7%. The one material laggard was Guinness, which posted a modest gain of 3.9%. This is in line with other US-biased/quality-focused managers we follow so we see this lag as stylistic as opposed to a fundamental cause for concern.

Bonds, meanwhile, had an excellent year with falling US government bond yields supporting prices, aided by well behaved corporate bond markets. These falling yields were driven by expectations of lower US interest rates on the back of a mixture of economics and politics. It feels strange to be linking US interest rates to politics, however this is a symptom of the wider shift we are seeing towards a more assertive style of politics globally - something which looks set to remain a feature of markets into 2026.

Against a benign backdrop, all our bond positions did well - although some stood out. The top performer was the Titan Hybrid Capital Bond Fund, which posted an impressive 9.6%. This fund has been a repeatedly strong performer for us and as such it is great to have Peter and his team now part of our wider group. The laggard was TwentyFour’s Asset Backed Securities Fund, however it posted 5.8%, which was broadly in line with its yield, so the lag was reflective of the defensive nature of the fund.

Our diversifying assets also had a strong year with Ruffer posting 11.6% on the back of heightened geopolitical uncertainty and its defensive positioning. The laggard was our near cash position iShares, which returned 4.8% in line with our expectations for the fund.

We made relatively few changes over the year as most of our positions behaved as we had expected.

Higher Income Portfolios

Medium Risk

Our Higher Income portfolios delivered a strong total return in 2025 of 11.0% (19). This breaks down into an income yield of ~6% complimented by capital growth. This is ahead of its objective of delivering an income yield above cash rates with a flat to rising capital value over both the year and since strategy launch in 2023.

As above, 2025 proved to be a volatile but ultimately rewarding year for investors. Most equity markets posted double-digit returns, although, noteably, the US gave up its crown as market leader and other parts of the world posted the strongest gains.

Within the portfolio, on the equity side, the key driver of returns was our emerging market position, Pacific, which posted an impressive +28.2%. This was reflective of strength across the region. Behind that, the natural European bias of our global dividend funds meant that Fidelity and Schroder Dividend Maximiser also returned strong numbers at +17.1% and +17.2% respectively.

Bonds meanwhile had an excellent year, with falling US government bond yields supporting prices, aided by well behaved corporate bond markets. These falling yields were driven by expectations of lower US interest rates on the back of a mixture of economics and politics. It feels strange to be linking US interest rates to politics, however, this is a symptom of the wider shift we are seeing towards a more assertive style of politics globally - something which looks set to remain a feature of markets into 2026.

On the bond side, we had a number of strong returns from funds such as; TwentyFour Income (+11.9%), Royal London (+10.6%) Fermat (+10.0%) and Titan Hybrid (+9.6%). The relative laggard was TwentyFour Asset Backed Securities at +5.8%, although this was in line with our expectations for what is quite a defensive fund.

We made no changes in the portfolio over the course of the year.

It is hard not to feel that 2025 was something of an alignment of stars for the portfolio, with EM- and European-focused equity positions supported by strong bond markets and a lack of any fund level issues. We believe the returns since the launch reflect an attractive starting point for income investors after the pain of 2022, aided by good performances from our underlying fund managers. However, it is important to bear in mind that bond markets have a tendency to glide along for periods before suffering short sharp reversals. We are of course always working to ensure portfolios can deliver returns over the medium term, it is worth bearing this pattern, of glide and shock in mind given the unpredictable nature of the world today. A nice feature of income portfolios, though, is that the dividends keep coming even if markets fall. This helps us look through the inevitable tough times for markets and reach our longer-term financial goals.

Balanced Portfolios

Medium Risk

Our Balanced portfolios posted a strong absolute return for 2025 of 8.5% (20), which is at the upper end of the strategy’s historic range, albeit fractionally behind the international peer group, which returned 8.7% (21). The year was a tricky one for us on a relative basis, with UK equities returning a punchy 25.8% (22) on the back of a strong rally out of the banking sector primarily. As we tend to be underweight the UK versus the peers structurally, this presented a cyclical headwind to our portfolios on a relative basis.

In respect to the underlying positions, across our equities, emerging markets (Pacific +28.2%) and technology (BlueBox +20.4%) were our top performers over the year and we remain happy holders of both funds. Lazard Global Equity Franchise came bottom (-3.4%). The fund outperformed strongly in Q1, however a series of stock-specific issues in October/November led to a challenging Q4. Due to the value bias of the fund, we do expect it to perform differently to other holdings and it is a lever within our core equity allocation. That said, we are currently reviewing with the manager. The other laggard was our healthcare position, notably the AB Fund (+2.7%). The healthcare sector looks well over sold to us, on the back of US politics, and as such we have held since the mid-year lows and pleasingly have seen a decent initial recovering in the second half of the year.

Amongst our bond and diversifying positions there were no laggards to report as all holdings posted positive returns and have performed, at least, in line our expectations. Ruffer, Fermat and Titan Hybrid Capital Bond all deserve special mentions as they delivered equity like returns (+11.8%, +9.9% and +9.6% respectively). Ruffer’s defensive mindset delivered attractive returns amid heightened geopolitical tensions. Fermat benefited from high embedded returns and a cautious approach to risk. And finally, for the third year in a row, Titan Hybrid Capital is nudging double digit returns aided by the teams reading of financial markets and capital structures. It has been a pleasure to have them as part of our wider Titan team over the year.

Growth Portfolios

Higher Risk

Our Growth portfolios posted a strong absolute return for 2025 of 9.8% (23), which places it between the UK and international peer groups, which returned 11.6% (24) and 9.1% (25) respectively. The year was a tricky one for us on a relative basis with UK equities returning a punchy 25.8% (26) on the back of a strong rally out of the banking sector primarily. As we tend to be underweight the UK versus the peers structurally, this presented a cyclical headwind to our portfolios on a relative basis.

Within our equities, Pacific (+28.2%) was our top performer, marking a good year for the fund in a period when emerging markets were generally strong. Pacific is our “value” exposure in emerging markets and was comfortably ahead of the emerging market equity index, highlighting the importance of diversification. Our second-best performer was Atlas (+24.9%) aided by its European focus. Atlas is our dedicated infrastructure holding and outperformed the world equity index by over 10% for the year, not bad for a defensive asset class!

Lazard Global Equity Franchise came bottom (-3.4%) and is under review. The fund outperformed strongly in Q1 however a series of stock specific issues in October/November led to a very poor Q4 for the fund. Due to the value bias of the fund, we do expect it to perform differently to other holdings and it is a lever within our core equity allocation. That said, we are currently reviewing with the manager.

Amongst our bond exposure, which is focused on higher yield, and diversifying position, Fermat, there were no laggards to report. All holdings have performed well and were all ahead of the index, reflecting positive fund selection from the bond side of things.

As we enter 2026, we will continue to assess the investment environment to ensure we take advantage of any investment opportunities we may see. Thank you for your continued support and here’s to a prosperous 2026.

Global Solutions Portfolios

Higher Risk

Over the quarter, our Global Solutions portfolio returned 4.2% (27), taking the full 2025 return to a pleasing +11.5% (28) ahead of the international peer group at 9.5%*.

As discussed, from a regional perspective, the US experienced relatively muted returns as momentum behind mega-cap technology stocks faded towards the end of the year and investors rotated into more cyclical sectors – this was despite a small interest rate cut by the Fed. Elsewhere, across non-US developed markets and emerging markets (“EM”), these were boosted by positive global economic data. From a sector perspective, with the focus on cyclical areas, financials and materials performed strongly. Whereas defensive sectors such as staples and healthcare lagged.

In this environment, the top three performers were, Polar Smart Energy +35.1%, Atlas Global Infrastructure +24.6% and UBAM Positive Impact Emerging Equity +23.3%. All holdings benefitted from increased global spending over the year focused on AI adoption, the subsequent surge in electricity demand and the global push for the energy transition. Under the bonnet of these funds, there is broad range of companies from those focused on tools associated with AI and semi-conductors, battery maker, lithium supplier and copper miner geared towards EV grids. All of these provide diversified exposure, and a cyclical element to the portfolio to help navigate varying market conditions.

In respect to the key detractors, these were Pictet Nutrition -8.6% and Pictet Global Environmental Opportunities -0.7%.

Pictet Nutrition’s focus on more defensive nutrition-related companies, from food producers, ingredient manufacturers and logistics, and it’s inherent underweight of large technology stocks, particularly those in AI and semiconductors, caused it to struggle as investors have favoured high-growth sectors.

In terms of the Environmental Opportunities Fund, which offers exposure to companies looking to solve a wide range of environmental issues such as climate change, resource management, and pollution prevention, interest rates continued to provide headwinds. Whilst interest rates are starting to fall, they have remained higher than expected, leading to persistently high cost of capital and project development costs, which has weighed on the share prices of many of the companies in the fund’s universe.

We would like to use this opportunity to thank our investors for their continued support and wish you a positive year ahead.

* ARC Sterling Equity Risk PCI

Global Blue Chip Portfolios

Equity Risk

by Ben Byrom

The fourth quarter of 2025 was more volatile than we were expecting. We delivered a positive 1.2% return but were behind the MSCI World Index by roughly two percentage points. The quarter began strongly as optimism around AI spending lifted parts of the infrastructure market, then turned in November as investors questioned how sustainable the current pace of AI deployment and financing will be.

In broad terms, technology was still our best-performing area, but weakness in consumer-exposed holdings and financials mitigated those gains. E-commerce shares softened as market data pointed to a slightly weaker consumer backdrop, and financial stocks were unsettled by shifting expectations for interest rates. Commodities and power markets were also important features of the quarter: precious metals remained strong and energy equities performed well even when the oil price was softer at times.

Contributors

Our largest contributor in the quarter was Advanced Micro Devices (AMD), which benefited from OpenAI’s series of major announcements for compute and chip commitments. OpenAI’s order created a major sentiment shift for the shares signalling there was credible, large-scale demand for the company’s accelerators and systems.

Alphabet (Google) also performed well, supported by resilient digital advertising and steady progress in cloud services. The launch of Gemini 3 and its benchmark leading capabilities implied there was a credible different path to large language model development bifurcating the AI market and adding to AI-related volatility later in the quarter.

Healthcare added meaningfully through Eli Lilly following a deal the company did with the US administration to reduce the price of its GLP-1 drugs in exchange for tariff relief.

Caterpillar benefited from the increasing demand for reciprocating engines to provide much-needed onsite power to data centres. Glencore also contributed as commodity markets remained firm. Our gold exposure, including AngloGold Ashanti, also added meaningfully to returns as stronger precious metal prices translated into higher cash generation for miners.

Detractors

Netflix was our largest detractor. We subsequently sold the position after Netflix agreed to acquire Warner Bros., as we viewed the deal as a greater financial and execution risk (more debt and higher uncertainty) without offering a sufficiently attractive return from the share price.

E-commerce was another drag. Sea Limited and MercadoLibre struggled as investors became more cautious on discretionary spending and less willing to pay up for growth. Interactive Brokers saw weakness amid interest-rate uncertainty, while Coinbase (a new position) experienced extended volatility as crypto currency prices softened into December.

Key transactions

Trading activity in Q4 had two objectives: reducing risk where we felt the balance of outcomes had deteriorated, and adding exposure to areas with improving long-term tailwinds.

Technology and AI positioning

Markets can change direction quickly, particularly around large themes such as AI. We took a position in Micron Technology early in the quarter to gain exposure to high-bandwidth memory, a clear bottleneck in chip development. The position was later sold for a solid gain, more than offsetting the small loss incurred on our Synopsys sale as part of a broader de-risking effort.

Later in the quarter we initiated Adobe, a stock we have held before, where we believe AI is more likely to enhance the product suite than disrupt it. In addition, we repurchased RELX following a sharp sell-off, viewing concerns around AI-driven competition as overdone. We exited Oracle after its blow-out OpenAI-related news, deciding to lock in the outsized gains the stock added during the market’s AI frenzy in October.

Consumer and e-commerce

We sold our long-term holding in Disney, reflecting our view that consumer discretionary spending could remain under pressure if cost-of-living conditions stay tight, especially at a time when the company is spending significantly on Parks and Resorts. We also exited Sea Limited due to significant adverse investor sentiment following a worse-than-expected earnings report where a capex announcements on logistic networks and fulfilment led to margin compression. Experience suggests that when companies go through capex cycles, sentiment can remain volatile until investors are satisfied that the expenditure will lead to a bigger and better business. We will continue to monitor Sea Limited and may re-enter should fundamentals and sentiment show signs of improving.

Changing world

Within the commodity sector - where we are positioning for sustained tensions around currency debasement, energy consumption and strategic asset security - we initiated Baker Hughes and Agnico Eagle Mines, and we sold Mosaic.

Baker Hughes gives us exposure to energy services, a sub-sector of the oil and gas industry that supplies equipment and expertise to upstream, midstream, and LNG operators across the project lifecycle – from drilling and production through to processing, compression, and maintenance. It is particularly well positioned within LNG infrastructure – an area where the long-term dynamics look very positive. Importantly, it also has meaningful industrial exposure through its turbomachinery, compression and services businesses, which supports diversification beyond pure oil price sensitivity.

We initiated Agnico Eagle Mines to diversify our gold miner exposure alongside AngloGold Ashanti. Given the operational complexity of mining, spreading exposure across high-quality operators helps mitigate single-company risk.

We sold Mosaic as agricultural pricing softened and reallocated the proceeds to better opportunities within the portfolio. With fertiliser products such as potash and phosphate now considered critical minerals, we may re-enter should fundamentals dynamics assert a sustained move higher in underlying potash and phosphate prices as Mosaic is very well positioned to benefit.

We also made a name swap within our defence and security sub-theme, funding the initiation of Lockheed Martin through the sale of Kongsberg Gruppen. We preferred Lockheed as a more direct play on defence, with meaningful exposure to missiles, air defence and space, supported by a large order backlog that provides strong long-term visibility. Incidentally, Kongsberg announced it would split out its civil marine business to focus on its defence business unit. We will keep an eye on these developments, but the reduced market capitalisation of the specialised defence business may be a stumbling block.

We continued to build exposure to our financial deregulation and disintermediation of financial services theme through the purchase of Coinbase, to gain exposure to the regulated infrastructure of cryptocurrencies - particularly stablecoins - following the passage of the GENIUS Act by Congress. We believe stablecoins are likely to become a preferred transfer mechanism over time, and Coinbase has established a strong reputation for regulatory compliance.

Changing demographics: an ageing population

Finally, we held XLV (the State Street healthcare ETF) for a period while we completed work on a new holding within our healthcare theme. We are always looking for attractively priced businesses with strong growth prospects, but past lessons warn of moving too soon. With a preference for device businesses over pharma companies - given the market’s fickleness around patent cliffs, regulatory uncertainty and political pressure on drug prices - we chose to capture some of the sector’s momentum through this ETF while we completed work on Koninklijke Philips N.V., a focused health technology company with a leading position in both professional medical equipment and personal health. ‘Philips’ is a business that has been through significant change and challenge and is now emerging with a more focused model and scope for margin expansion. We bought Philips this year, and we will discuss it in more detail in our next publication.

We start 2026 with the portfolio in good shape. We expect turnover to decline meaningfully now the portfolio has been repositioned to gain better exposure to the trends impacting the world around us, and we look forward to navigating whatever challenges and opportunities this year may bring. Thank you for your continued support.

Data sources:

- Titan Global Blue Chip O Acc, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- Titan Higher Income O Dist, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- MSCI World Healthcare, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI World Materials, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI Emerging Markets, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI Emerging Markets, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- MSCI World, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- Alphabet Share Price, USD Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI US, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- FTSE 100, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI Europe ex. UK, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI Japan, JPY Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- Bloomberg UK Government Bonds, GBP Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- US Treasuries, USD Total Return 30/09/2025 to 31/12/2025. Source: FEfundinfo.

- MSCI US, USD Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- MSCI US, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- GBP Titan Cautious Model Performance Data, Total Return 31/12/2024 to 31/12/2025. Source: Titan Wealth (CI) Limited.

- Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return 31/12/2024 to 31/12/2025. Source: FE fundinfo

- Asset Risk Consultants Sterling Cautious Private Client Index, GBP Total Return 31/12/2024 to 31/12/2025. Source: FE fundinfo.

- GBP Titan Higher Income Model Performance Data, Total Return 31/12/2024 to 31/12/2025. Source: Titan Wealth (CI) Limited.

- GBP Titan Higher Income Model Performance Data, Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- GBP Titan Balanced Model Performance Data, Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- Asset Risk Consultants Sterling Balanced Asset Private Client Index, GBP Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo

- FTSE 100, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- GBP Titan Growth Model Performance Data, Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- Investment Association (“IA”) Mixed Investment 40-85% Shares Sector, GBP Total Return 31/12/2024 to 31/12/2025. Source: FE fundinfo.

- Asset Risk Consultants Steady Growth Asset Private Client Index, GBP Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

- FTSE 100, GBP Total Return 31/12/2024 to 31/12/2025. Source: FEfundinfo.

- GBP Titan Global Solutions Performance Data, Total Return 31/12/2024 to 31/12/2025. Source: Titan Wealth (CI) Limited.

- Asset Risk Consultants Equity Risk Asset Private Client Index, GBP Total Return 31/12/2024 to 30/09/2025. Source: FE fundinfo.

All underlying fund performance is GBP Total Return 31/12/2024 to 31/12/2025. Collated 12/01/2026. Source: FEfundinfo.