“Nothing ever lasts forever”

Everybody Wants to Rule the World, Tears for Fears

The calendar may have turned to 2026, but markets have wasted little time in reminding investors that apparent stability can prove deceptive. Any early year pause for reflection has been overtaken by a rapid succession of geopolitical alliances trying to rule the world.

These developments include US military action in Venezuela and the extradition of President Nicolás Maduro on 3rd January, tentative discussions around a potential Russia–Ukraine peace agreement, renewed civil unrest in Iran, and fresh rhetoric from China regarding Taiwan – all within the first days of 2026.

Against this backdrop, it is worth briefly reflecting on where markets ended last year. 2025 was defined by an “everything rally”. It was the first year since the pandemic in which all major asset classes delivered positive returns. This outcome was notable given persistent inflation concerns and restrictive monetary policy for much of the year.

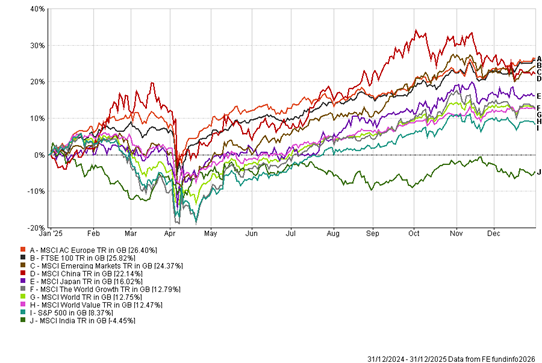

Despite heightened volatility in the latter part of 2025 – including the market impact of April’s “Liberation Day” tariff announcement – US equities still finished strongly in local terms. For international investors, however, returns were more muted as currency movements detracted from performance. The S&P 500 rose 16.4% in US dollar terms (8.4% in sterling terms), marking a third consecutive year of gains. Such runs are notably uncommon; since 1928, the index has achieved three consecutive positive years on only 12 occasions.

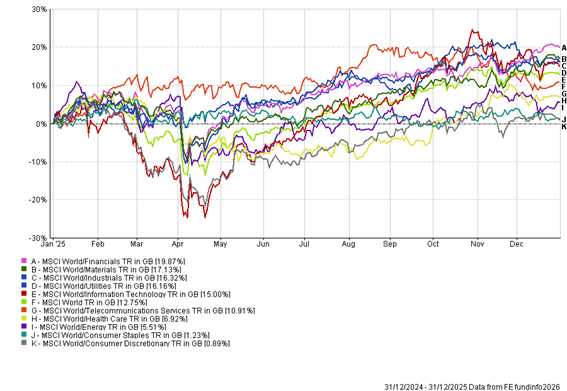

Elsewhere, precious metals were the standout asset class, reaching new records on multiple occasions. Emerging markets were the strongest-performing equity region, returning 34.4% in dollar terms; for sterling investors the leaders were “home base” regions with European and UK equities leading. Growth stocks outperformed in the US, while value stocks led returns across most other developed markets.

The transition into 2026 has already begun to test confidence in the breadth of last year’s rally. Despite rising geopolitical risk, regional equity markets have largely maintained early momentum. This resilience reflects a still-supportive macro backdrop. Global growth is slowing but remains positive. The Organisation for Economic Co-operation and Development (“OECD”) outlook projects global growth slowing from 3.2% in 2025 to 2.9% in 2026, before picking up to 3.1% in 2027 (Source: OECD).

Optimism around increased defence spending and efforts to expand energy supply has supported sentiment. The risk, however, is familiar. Markets are efficient at pricing in good news, but far less forgiving when expectations are disappointed.

Looking ahead to 2026, this environment argues against reliance on a single forecast. A range of plausible outcomes must be considered. While no crystal ball exists to predict asset-class or regional performance with precision, considering a range of scenarios, and their implications, remains an essential part of the investment process.

- Scenario 1 – Concentration persists

AI leadership remains narrowly concentrated in large-cap growth stocks. Speculative sentiment outpaces valuation discipline. Small-cap and value stocks continue to lag. - Scenario 2 – Broadening leadership

Growth remains resilient but uneven. Volatility persists as markets adjust expectations. Returns become more selective across regions and asset classes. The wider S&P 500 underperforms its largest constituents, while European equities and emerging markets continue to see relative strength. - Scenario 3 – Repricing risk

Geopolitical shocks, debt sustainability concerns, or a sharp reassessment of AI-related valuations trigger a broader repricing across assets. Volatility rises sharply. Commodities and defensive assets outperform.

While it is not possible to predict with certainty which scenario will unfold, towards the end of 2025 broader leadership across asset classes and sectors began to emerge – a trend that has continued into 2026 and forms part of our potential investment themes for the year ahead.

If the base-case environment persists, several themes could emerge as beneficiaries. Smaller-capitalisation equities may attract renewed interest as financial conditions ease, particularly where balance sheets are well positioned for lower borrowing costs. European equities and selective emerging markets also appear well placed, supported by more attractive valuations, improving earnings momentum and a gradual recovery in global trade.

Financials in both the US and Europe could benefit from a return towards more neutral interest-rate settings, alongside resilient consumer and corporate balance sheets. Commodities remain attractive, supported by infrastructure investment, energy-security priorities and ongoing supply constraints. Within this space, safe-haven assets such as gold may continue to play a role should geopolitical risks persist.

Clean energy and renewable infrastructure represent a longer-term structural opportunity. Despite shifting political rhetoric in some regions, the global transition continues, particularly outside the US where policy support remains firmly embedded. Improving economics as capacity scales are beginning to feed through into fundamentals, while valuations remain well below prior peaks.

Healthcare also stands out as a compelling theme for 2026. After a challenging period in 2023 and 2024, returns in 2025 were modest at around 6.9%, masking a notable improvement in momentum towards year-end. Stabilising earnings expectations, continued innovation and renewed activity in biotechnology offer an attractive balance of defensive qualities and long-term growth potential.

As the song by Tears for Fears reminds us, “Nothing ever lasts forever.” While none of these outcomes is guaranteed, the early weeks of 2026 serve as a timely reminder that diversification, discipline and a focus on risk management remain essential, particularly when markets appear comfortable and optimism risks running ahead of fundamentals. In line with this, our portfolios remain well diversified across sectors and geographies to help navigate the inevitably changing conditions.