As we start a new year, I would argue that many of us – whether we work in finance or not – find ourselves thinking a little more about money (or the lack of it!). The start of a new year often brings a moment to pause and take stock: reviewing the year just gone and considering what lies ahead. Whether we like it or not, our finances underpin our lifestyle: our holidays, hobbies, the food we eat, and the clothes we wear. While money is not necessarily the be-all and end-all, it can certainly act as either an enabler or a constraint.

With that in mind, it feels natural to also reflect on what happens to our money after we die. I appreciate that this may seem like a sombre topic to begin the year with; however, this is often a time when people think more deeply about planning, responsibility and perhaps the more mundane life-admin tasks they’ve been putting off. For many, this may already be a quiet thought at the back of their mind, and I am a firm believer in challenging traditional taboos and addressing these (sometimes uncomfortable) subjects head-on. Dad, if you’re reading this shall we discuss over the cheese course?!

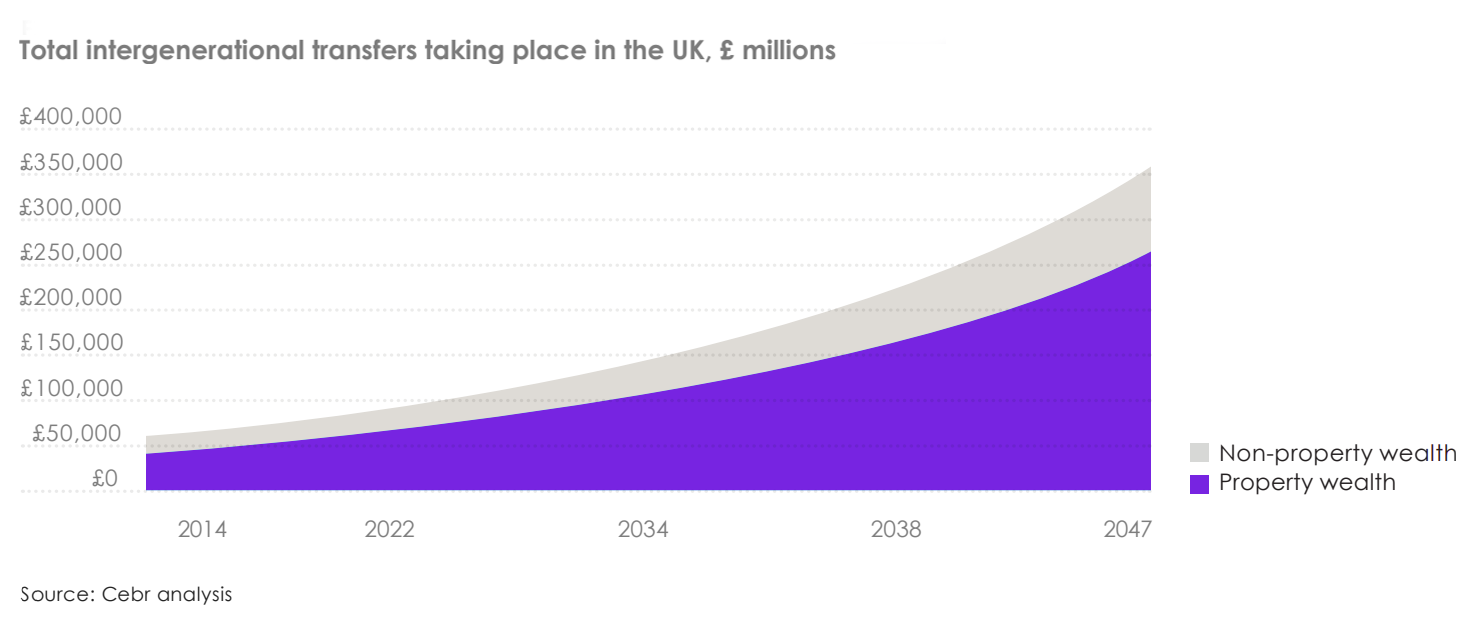

In the UK, it is estimated that more than £5.5 trillion¹ will pass between generations over the next 30 years. That is, even by Elon Musk’s standards, a significant sum. For our clients in the Channel Islands, we are fortunate not to have to contend with inheritance tax, but that does not mean we can afford to be complacent when it comes to planning where our wealth ultimately ends up.

It is also worth remembering that this conversation is not solely about cash. Property is expected to account for over 70% of the wealth transferred in the coming years, largely due to the substantial rise in house prices over recent decades. In the UK, average house prices increased by a remarkable 273% between 1996 and 2016 (equating to 7.2% per annum)¹.

The obvious answer to the question of who inherits this wealth is next of kin. The vast majority of people will leave assets to their children, family, or chosen family, which brings me neatly to a second taboo: are your children (or other beneficiaries) financially equipped to manage that inheritance?

Anecdotally, I was speaking with a client recently about their plans to pass wealth on to their children and asked at what age they intended to make distributions. Without hesitation, they replied, “My oldest will receive it at 21; the youngest at 30.” This response not only made me laugh out loud, but also prompted me to reflect on which of my own children I would trust most with money (my son, without question… sorry to my daughter!).

Once my children are a little older, these are some of the questions I will be asking myself:

- Do my children or next of kin know where my money is held?

- Have they met the person responsible for managing it, and have they built a relationship?

- If not, should they?

- Will they understand how to manage the money in a way that is appropriate for them at that point in their lives, rather than for me now?

While I jest about my own children, who are currently just nine and seven, there is a serious point to be made. There is often a misconception about the typical age of inheritance. Many people imagine inheritors to be in their 20s, and while some certainly are, my experience suggests that wealth and property are more commonly inherited much later in life, often when individuals are in their 50s or 60s.

By this stage, many people have paid off their own mortgages, secured their own retirement and supported their children in establishing themselves. As a result, inherited funds can feel, for want of a better phrase, surplus to requirements. This is not meant to sound ungrateful; rather, it highlights that these funds are often investable and should be managed in a way that reflects the recipient’s circumstances at that moment, rather than those of the person from whom they originated.

At Titan Wealth, we spend a lot of time talking to our clients about what comes next. This is underpinned by a strong commitment to financial education and ensuring that individuals and families have the knowledge and tools they need to make informed decisions. If you would like to talk to us about your own plans for the future, please feel free to contact us and one of the team will be happy to help.

Sources: