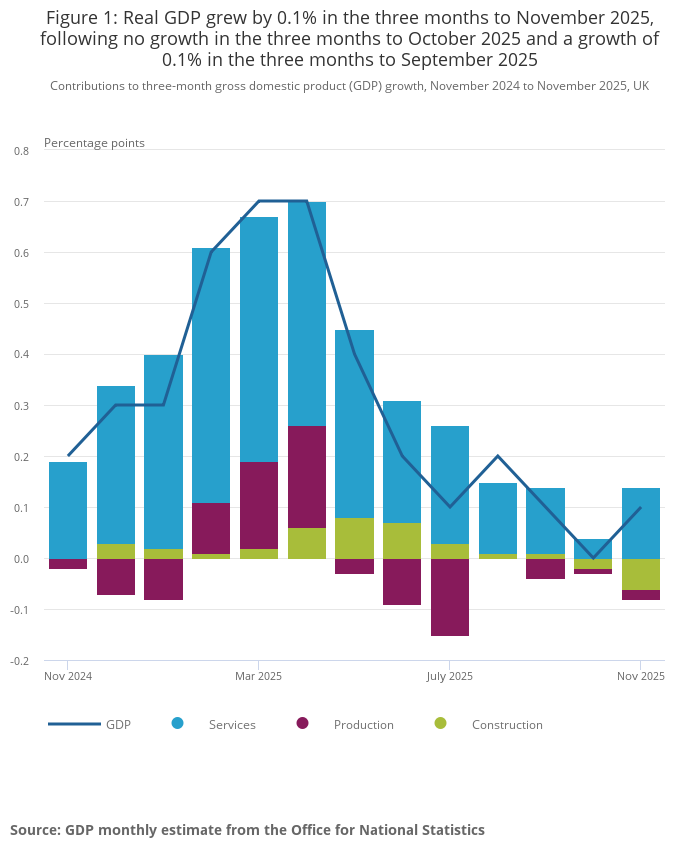

We are pleased to begin the year on a positive note for the cash team’s first weekly note. Figures published last week showed that UK GDP growth rose by 0.3% in November 2025 (Source: ONS). This was a better result than virtually all had forecast; the average expectation was an improvement of 0.1%.

The better-than-expected figure has been attributed to exceptional items, such as a rebound in production at Jaguar Land Rover following a cyber attack. The cyber attack is worth mentioning as an example of the unprecedented and exceptional threats that Western corporates are facing. The attack closed production at all of Jaguar Land Rover’s factories for six weeks, and the restarting of production saw UK car manufacturing increase by 26% month-on-month in November.

Assuming that December GDP posts another positive figure, the better-than-expected November result will offset October’s negative number, meaning that the quarterly figure will be positive.

Looking ahead to 2026, the outlook should remain positive. A number of uncertainties have been removed from the picture; there was much nervousness about the UK Budget and continued industrial action also dented GDP expectations. The main question will be whether consumers are now confident enough to increase spending. One of the keys to this could be the housing market. Again, there are some signs of optimism here. According to the December survey from the Royal Institution of Chartered Surveyors, there are signs that confidence is returning. A net balance of 34% of professionals expect the number of sales to increase over the next year. This is tentative at present and the UK housing market is still in a ‘soft patch’ but the removal of uncertainty following the Autumn Budget and lower borrowing costs should be positive.

Further good news for the Monetary Policy Committee (“MPC”) is that the latest inflation number was weaker than forecast. Consumer prices rose by 3.2% in November, following an increase of 3.6% the previous month. The rate of inflation in the UK is expected to fall in 2026, with some commentators suggesting it might fall to the 2% target by April. Within the headline figure there are still areas that will concern the MPC. Food price inflation rose last month for the first time since August 2025 and wage growth, given the size and make up of the UK labour market, will be closely watched.

The outlook for 2026 currently seems reasonably positive. Inflation appears on a downward trajectory and whilst economic growth is anaemic, most think it will at least stay positive. Markets therefore expect this outlook to be sufficient for the MPC to cut interest rates once, or perhaps even twice, this year. If UK rates reach the 3.25 to 3.5% level, then that, for many, would represent the neutral level for UK base rates. This is defined at the level at which interest rates have little impact on the growth, or otherwise, of the economy. Given that we are not forecasting recession and inflation is still expected to remain at or slightly above target then this feels an appropriate forecast on current expectations.

These projections are, of course, based on current forecasts. While the global environment remains subject to change, markets and policymakers alike continue to adapt to evolving conditions.