The title of this week’s comment, ‘Pax Europaea’ is in reference to the period post-World War II in Europe – an extraordinary stretch marking the longest sustained period of peace on the continent, characterised, predominantly, by international relations and general cooperation among nations as economic considerations took precedence over the territorial ambitions of political leaders.

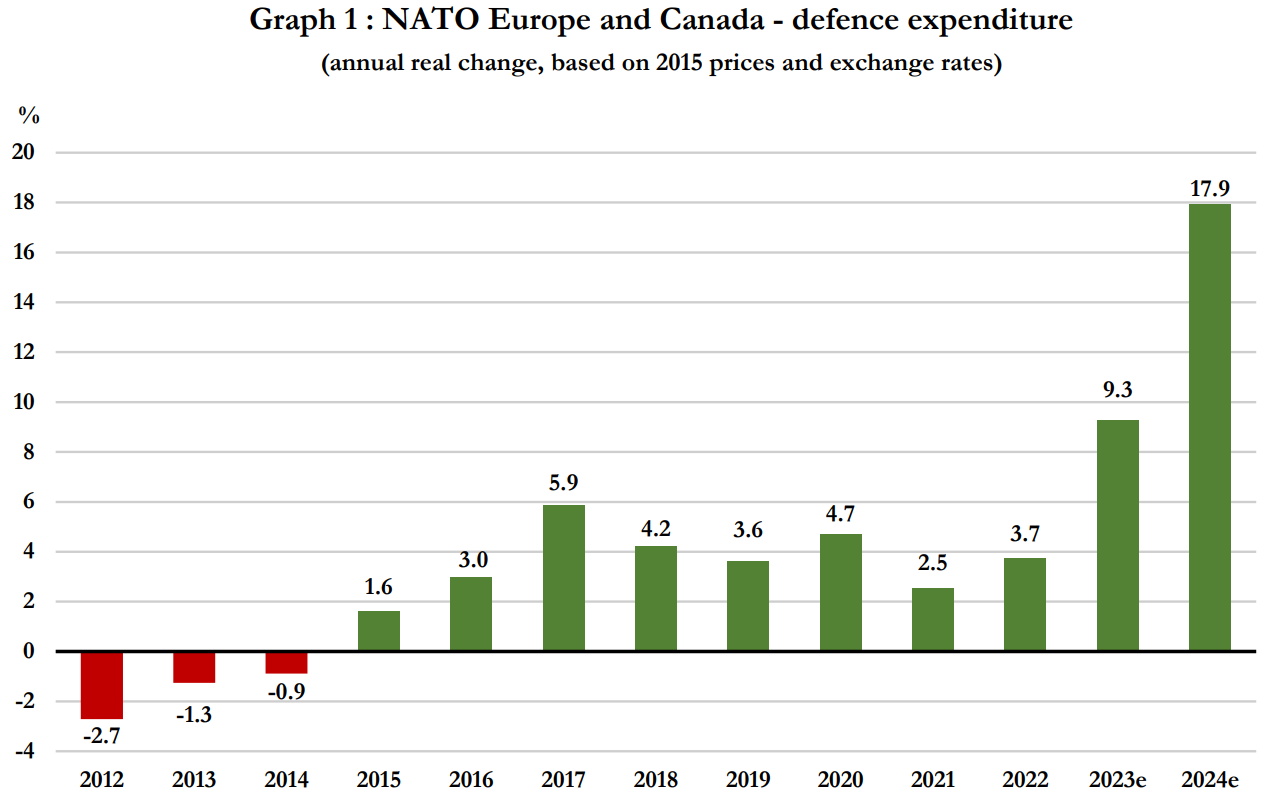

As a result of this period of relative tranquillity, countries reduced the proportion of their budgets dedicated to defence spending – a topic explored by my colleague Jon Pope in a prior weekly comment ‘A reset for Europe’. While NATO (the North Atlantic Treaty Organisation), requires member states to contribute at least 2% of their GDP toward defence, many have consistently fallen short of fulfilling this requirement.

Russia’s invasion of Ukraine in 2022 exposed this shortfall as countries were called on to aid Ukrainian resistance. The renewed perception of geopolitical threats from Russia, along with the realisation of Europe’s inadequate military preparedness, prompted a wave of planned defence spending increases in 2024 (see Graph 1).

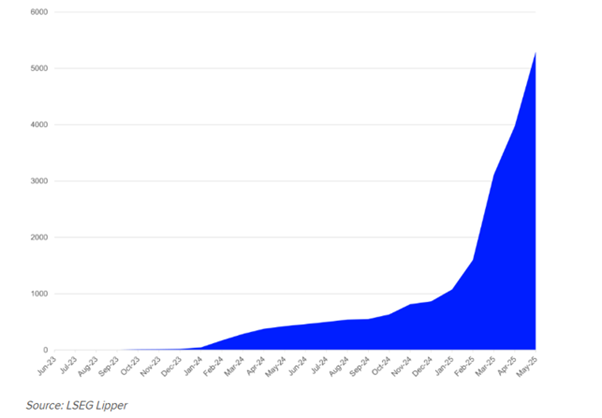

Announcements by key leaders such as the UK’s Sir Keir Starmer and newly appointed German Chancellor, Friedrich Merz (see ‘Trade wars and power shifts: Should we expect a global rebalancing’) continued the trend as both set out their intentions to expand defence spending budgets. This proved to be the catalyst for stocks within the sector to re-rate, leading to a significant appreciation of the market capitalisation of these companies, while the launch of various defence stock ETFs, on the expectation the industry will continue to expand with fiscal support, further fuelled investor enthusiasm (see Graph 2).

Adding to the pressure, the Trump administration has repeatedly urged all NATO members to increase their defence spending to 5% of GDP. This was met with objections from many NATO members earlier this year, who argued that increasing to these levels of spending were unsustainable.

However, after months of political pressure from the US, earlier last week NATO leaders agreed to boost defence spending to 5% of GDP by 2035. The commitment has been seen as a huge success for President Trump as he indicated the US would limit future engagement with NATO unless members agreed to more than double their current expenditure.

Broken down, the new commitment will see 3.5% of GDP directed toward traditional military defence spending while the remaining 1.5% will be more discretionary, offering members a wider remit of, amongst other programmes, critical infrastructure protection, unleashing innovation, network defences and defending industrial bases.

Additionally, the increased spending is projected to provide a further boost to industries involved in the manufacture of weapons and military infrastructure and equipment, increasing the investment case of companies operating within these spaces.

As such, our direct equity Blue Chip strategy has added a number of likely beneficiaries, including RTX Corporation, an aerospace and defence conglomerate, Kongsberg Gruppen, a supplier of high technology systems in defence and aerospace, and BAE Systems, operating in arms, information security and aerospace industries.

Furthermore, infrastructure – a long-term core theme within our portfolios – should also benefit from the pledged expansion and our international multi-asset team currently has two infrastructure funds on the recommended fund list: the Atlas Global Infrastructure and KBI Global Sustainable Infrastructure funds.

With geopolitical tensions reshaping fiscal priorities across Europe, the defence and infrastructure sectors stand to benefit from a renewed wave of investment. We therefore continue to monitor developments and aim to identify opportunities that align with our long-term strategic themes.