“When the guns fire, gold is worth a fortune.” The old saying, attributed to the 18th century Welsh pirate Bartholomew “Black Bart” Roberts, reminds us that conflict and value are often intertwined. Throughout history, periods of tension and uncertainty have driven investors toward tangible assets and defence industries.

I have written about the investment case for gold and defence stocks previously in my updates titled Pax Europaea and A golden opportunity?, when spot gold was trading at around $2,400 an ounce. Since then, gold has almost doubled in value and entered a sustained bull run, maintaining the momentum that we first saw at the end of last year.

With gold recently breaking through $4,000 an ounce and aerospace and defence stocks performing remarkably well, it would be reasonable to think that taking profits would be a sound investment strategy. However, I would argue the investment case for both of these assets is still very much firmly in place. Indeed, the risk of deeper geopolitical fragmentation is rising.

Despite the recent ceasefire in the Middle Eastern conflict, the situation remains fragile and much still needs to be negotiated. By contrast, and concerningly, events in Ukraine have been escalating and a division between the East and West is accelerating, the implications of which are yet to be fully comprehended. Furthermore, an increase in internal political instability and the tilt toward a more radical electorate, particularly in Europe, is emerging, creating further uncertainty.

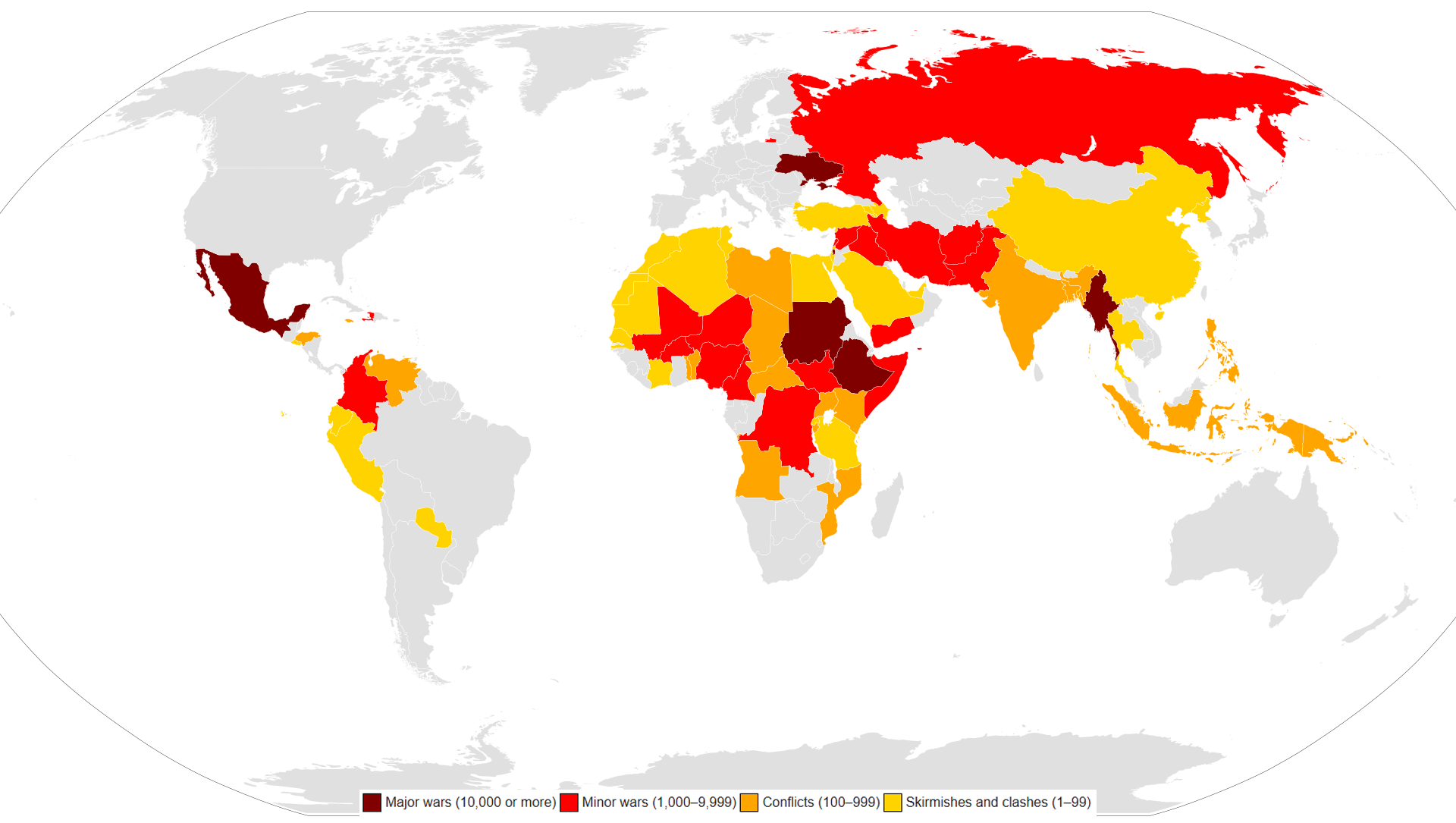

Global conflicts across the globe 2025

I was interested to see a recent interview with JP Morgan CEO Jamie Dimon, underscoring the risks of the current geopolitical environment and the remilitarisation of the world, referencing his letter to shareholders and his concerns should we see a continued escalation of global conflicts, stating “we should be stockpiling bullets, guns and bombs”.

“Buy guns and gold in times of stress”, a phrase often associated with Dimon, advocates investment into tangible assets, gold and defence infrastructure in times of economic and political instability. It’s a sentiment that echoes Bartholomew “Black Bart” Roberts’ old adage and this update’s title. Both, in their own eras, point to the same observation: when instability rises, investors turn to security and substance.

With global stock markets at or near all-time highs, though certainly not our base case, numerous risks are forming that have the potential to cause a correction in stock indices. One of the more credible of these risks, and one garnering increasing consideration, is that of a widespread breakdown in geopolitical relations.

With respect to our exposure to these areas, our direct equity strategy, Global Blue Chip, has exposure to both themes within the portfolio, owning AngloGold Ashanti, BAE Systems, L3 Harris, Lockheed Martin (a recent addition) and Raytheon (RTX). In addition, as a business, our precious metals service can facilitate the purchase and storage of gold, silver, platinum and palladium, in physical bar or coin form.

We appreciate that, at times like this, the investment market can be unnerving for investors but would like to assure you that your discretionary portfolios and holdings in the Titan Global Investment Funds are well-diversified to dampen any short-term volatility and, as active managers, we continue to take a long-term view. If you would like to discuss your portfolio or the most appropriate risk profile for your objectives, please don’t hesitate to get in touch.